NEW YORK/OAKLAND, Calif., October 11 (Reuters) - According to persons familiar with the situation, the U.S. is rushing to address unforeseen implications of its new export restrictions on China's chip industry that could unintentionally affect the semiconductor supply chain.

The South Korean memory chipmaker SK Hynix Inc (000660.KS) claimed late Tuesday, hours before a new restriction went into effect, that it had obtained permission from the United States to import goods for its chip manufacturing facilities in China without having to obtain additional licensing as required by the new regulations.

United States tries to avert supply chain disruption caused by China's export restrictions on chips.

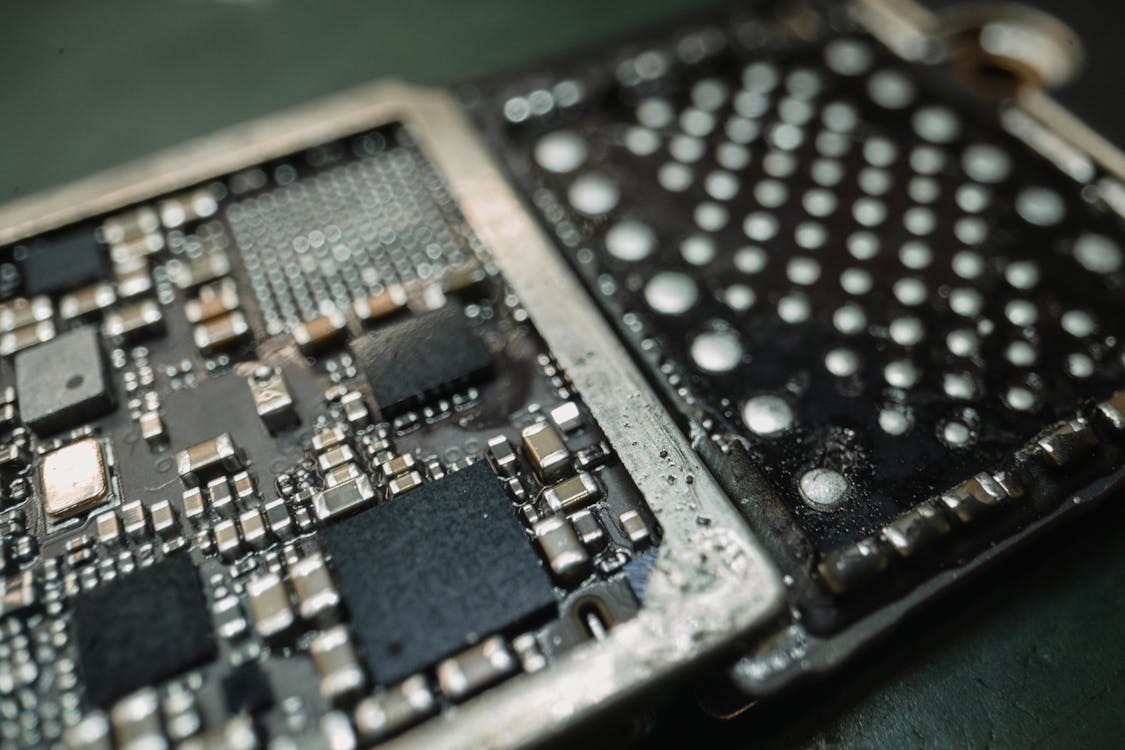

Semiconductor chips may be seen in the file photo. source: pexels.com

NEW YORK/OAKLAND, Calif., October 11 (Reuters) - According to persons familiar with the situation, the U.S. is rushing to address unforeseen implications of its new export restrictions on China's chip industry that could unintentionally affect the semiconductor supply chain.

The South Korean memory chipmaker SK Hynix Inc (000660.KS) claimed late Tuesday, hours before a new restriction went into effect, that it had obtained permission from the United States to import goods for its chip manufacturing facilities in China without having to obtain additional licensing as required by the new regulations.

The Biden administration had hoped to shield foreign businesses with operations in China, such SK Hynix and Samsung Electronics Co (005930.KS), from the worst effects of new regulations, but this was not the case with the regulations released on Friday.

The rules, which are part of an effort by the United States to halt China's scientific and military advancements, mandate licenses before U.S. exports may be sent to Chinese factories that produce advanced chips.

As of midnight on Tuesday, vendors cannot support, service, or send non-U.S. materials to the plants in China without licenses if American firms or individuals are engaged.

Therefore, until suppliers are granted licenses, even fundamental supplies like light bulbs, springs, and bolts that maintain tools in operation could not have been able to be sent. According to one insider, the foundries could start shutting down if they don't get the minute-by-minute support they require.

Our negotiations with the Department of Commerce resulted in the Department of Commerce's approval to provide the tools and materials required for development and According to a statement from SK Hynix, "Our discussions with the Department of Commerce led to an approval to supply equipment and goods needed for the development and production of DRAM semiconductors in Chinese facilities without the need for extra licensing."

The modification, according to the business, would help prevent supply chain delays, and the authorization is valid for a year.

A comment from Samsung Electronics was rejected.

According to a different source, a short-term repair was implemented while a more permanent one was being developed.

According to a third source, at least one other non-Chinese corporation also acquired a similar authorization.

Despite declining to comment directly on the authorizations in response to a request, a U.S. Commerce Government representative said the department intends to hear from stakeholders about the rule and may take that into consideration.

A request for response from a White House representative also went unanswered.

One of the insiders stated, "Without the authorization, a number of equipment and other suppliers would have had to remove their staff from the fabs in China.

The U.S. intended to examine permits for foreign firms in China affected by the new limitations on an individual basis; nevertheless, even if allowed, this could cause delays in shipments. The likelihood of denying licenses to Chinese semiconductor companies was high.

Chip factories are also run by Taiwan Semiconductor Manufacturing Co. (2330.TW) and Intel Corp (INTC.O) in China.

No reprieve is anticipated for the Chinese chip manufacturing facilities.

English (US) ·

English (US) ·