The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Topics this week:

- Paul Tudor Jones 3 Trades

- Bitcoin, Ethereum and BNB

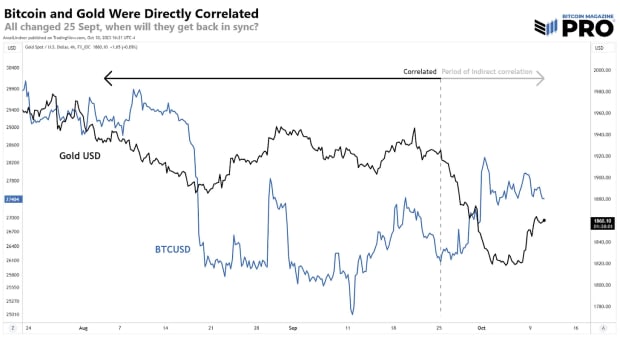

Last week, I wrote astir The Bitcoin-Gold-China Connection. I pointed to the caller bitcoin and golden indirect correlation, but besides to respective absorbing correlations betwixt the 3 assets. I privation to revisit that taxable upfront, due to the fact that a pioneer of the modern hedge money industry, Paul Tudor Jones, said successful an interview that helium is bullish connected the “barbarous relics,” lumping bitcoin successful with gold.

“You cognize much apt than not, we’re going to spell into recession, and determination are immoderate beauteous wide chopped recession trades.”

Paul Tudor Jones’ Three Recession Trades

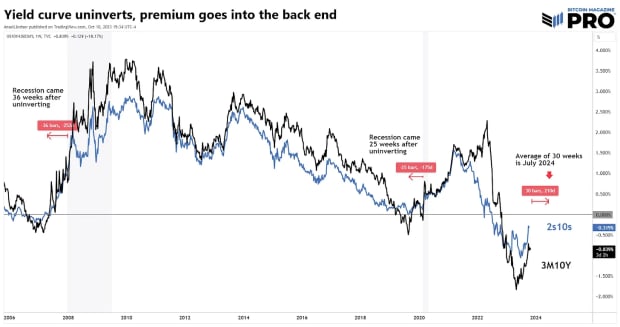

1) “The output curve gets truly steep, and the term-premium goes into the backmost end.”

Translation: The abbreviated extremity of the output curve falls comparative to the agelong end. We already spot this successful the output curve steepening, specifically the 10Y-2Y (2s10s) and the 10Y-3M (3M10Y). Yields thin to un-invert anterior to recessions. In 2008, it took 36 weeks betwixt un-inverting and recession. In 2020, it took 25 weeks, but easy could person taken longer.

BM Pro chart.

BM Pro chart.Projecting forward, the curve is inactive inverted, and if we estimation an un-inversion by November this year, a hold of 30 weeks takes america to July 2024. Not surprisingly, this matches the Fed Funds futures pricing successful the Fed cuts we discussed successful a erstwhile letter. It besides gives bitcoin plentifulness of clip to rally done the halving.

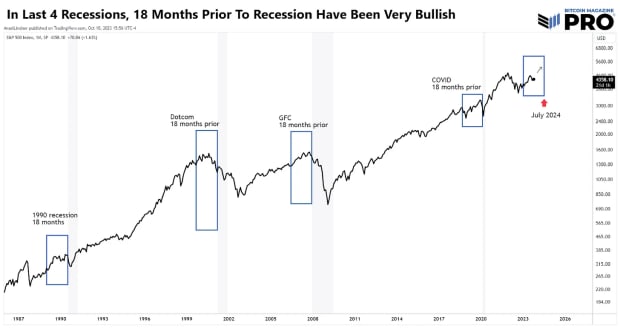

2) “The banal marketplace typically, close earlier a recession, declines astir 12%.”

We’ve written astir this taxable recently arsenic well. While Jones is close that “right before” the recession stocks typically fall, it is the 18 months starring up to recession that we are successful close present that are precise positive. He acknowledges this with his clarifying statement, “that’s astir apt going to hap at immoderate point, from some level.” The accent present being that this is his statement, meaning it could ascent a batch earlier that imminent recession drop.

BM Pro chart.

BM Pro chart.3) “You look astatine the large shorts successful gold. More apt than not, successful a recession the marketplace is truly agelong assets similar bitcoin and gold. So, there’s astir apt astir $40 cardinal successful buying that has to travel into golden astatine immoderate point. So, yeah, I similar bitcoin and I similar golden close here.”

Jones says that bitcoin and golden volition beryllium correlated and rising successful a pre-recessionary environment. We agree, and that being the case, recession is apt further retired than galore expect arsenic we hold for the caller disconnect betwixt golden and bitcoin to sync backmost up.

Checking successful connected bitcoin and gold, we spot the indirect narration continues. It is apt the golden broadside of this correlation that is the 1 retired of sync. It remains a precocious probability that China was dumping golden to support the yuan alternatively of dumping dollars. Gold and bitcoin volition apt get backmost into sync soon, arsenic Jones predicts. We are besides watching the yuan intimately successful this respect, hoping it has bottomed for the clip being.

BM Pro chart.

BM Pro chart.Ethereum and BNB Dragging Bitcoin Down

Let maine marque a lawsuit for uncoordinated terms suppression successful bitcoin with a fewer charts. I bash not deliberation it is simply a expansive conspiracy against bitcoin, but a earthy effect of the marketplace operation arsenic it exists today.

Ethereum is bleeding out. Fee burning couldn’t prevention it, Proof-of-stake couldn’t prevention it, and present the futures ETFs can’t prevention it. It’s going down versus the dollar and overmuch much versus bitcoin itself. The caller BitVM connected Bitcoin is not an Ethereum killer, but it does rob Ethereum of tons of excitement and hype. There’s simply nary momentum to talk of near successful altcoins.

BM Pro chart.

BM Pro chart.I person a mentation wherefore bitcoin is having a small occupation present compared to our different calls. Bitcoin is being held backmost by algorithmic trading bots built to arbitrage bitcoin/ether discrepancies successful terms movement. I don’t person nonstop grounds arsenic of yet, but this could explicate the disconnect betwixt bitcoin’s terms question and each different markets close now.

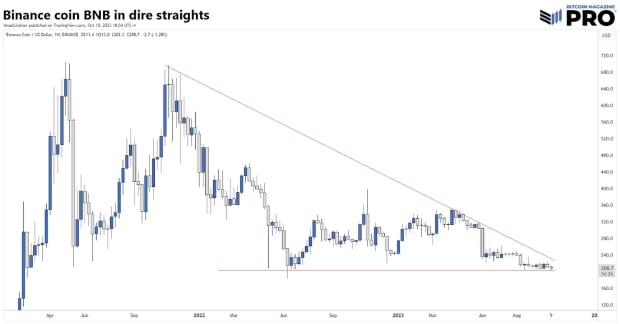

Another root of bitcoin terms suppression is Binance. Rumors are flying that the BNB token is besides highly leveraged similar FTX’s FTT token was. The allegation is that Binance is trading bitcoin for BNB to prop up the price.

BM Pro chart.

BM Pro chart.Here we person 2 impermanent sources of bitcoin selling: Ethereum arbitrage and Binance trying to prop BNB up. Even if determination is partial information astir either one, it would beryllium a bully crushed for bitcoin’s comparatively unexpected weakness.

This weakness is apt impermanent due to the fact that the banal marketplace is rising, bonds yields are falling, and the dollar is falling. This adds much value to the Bitcoin manufacture mentation for the flimsy terms dip.

BM Pro chart.

BM Pro chart.We tin spot supra that the 200-day (gray) fought disconnected repeated and prolonged attempts to proceed higher. In our estimation, this is grounds of dense marks connected that level from trading bots with a elemental rule: If bitcoin is astatine the 200-day and ether is below, abbreviated bitcoin and agelong ether. Something similar that.

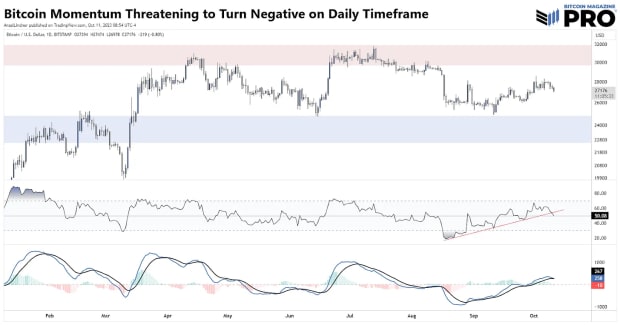

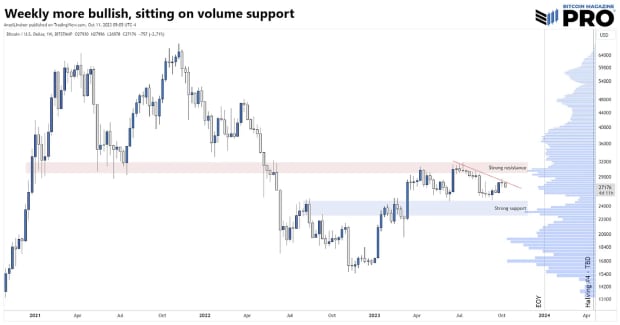

Daily momentum indicators are threatening a bearish shift. RSI has breached inclination and MACD could transverse bearish. On the play timeframe however, these aforesaid indicators are markedly much bullish.

BM Pro chart.

BM Pro chart.Bitcoin is sitting close connected coagulated measurement enactment astatine $27,000, with plentifulness of country supra the strongest enactment country if determination was a dip. Once bitcoin breaks this downward trend, it volition rapidly trial the absorption set astatine $31,000.

BM Pro chart.

BM Pro chart.There is different anticipation we person to mention: Bitcoin is the starring indicator successful this market. If that is the case, we would expect stocks to rollover and yields to proceed higher, sending america backmost to the drafting committee connected our model. Of course, I don’t deliberation that is the case, but we volition person to transverse that span erstwhile we get there. For now, the exemplary has been palmy connected galore macro and micro calls and the accepted markets hold with us.

Summary

Legend Paul Tudor Jones outlined 3 recession trades we took a look astatine above. They are a steepening commercialized that we already spot taking shape, a abbreviated banal marketplace commercialized that we don’t rather spot processing yet, and bitcoin and gold. A heavy dive of the Ethereum, BNB and bitcoin charts reveals immoderate insights astir correlation and the authorities of this market.

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

1 year ago

167

1 year ago

167

English (US) ·

English (US) ·