Life embodies evolution, change, adaptation, and the willingness to thrive. Throughout history, we person experienced galore changes that person forced nine to evolve, adapt, and grow. From the inception of trading to the COVID-19 pandemic and beyond, we person witnessed events that person transformed the world. One of the astir important and influential sectors successful the satellite is finance. The satellite of concern has been shaped by pivotal events that person impacted economies, influenced policies, and altered the people of planetary markets. One of the astir exceptional developments successful the past 15 years is the invention of Bitcoin and the emergence of the crypto industry.

The crypto industry, portion not yet accessible to everyone, has witnessed singular maturation and improvement since Bitcoin's motorboat successful 2009. In the pursuing years, the manufacture became a dynamic and influential force, drafting the attraction of investors and enthusiasts worldwide. In this article, I volition stock my sentiment connected wherefore crypto volition go a precise unchangeable market, perchance replacing existent fiscal oregon banking methods. This treatment volition interaction connected cardinal topics specified arsenic safety, circular economy, and sustainability, which combined with existent precocious imaginable businesses similar Data Centers, volition signifier the caller future.

Crypto Infrastructure and Energy Consumption

The servers supporting the cryptocurrency infrastructure are chiefly utilized for cryptocurrency mining, transaction verification, astute declaration execution, and decentralized applications (DApps) hosting. These servers typically person the pursuing specifications:

• High-performance CPUs and GPUs

• Large representation and retention capableness

• Advanced networking capabilities

• Robust information features

These characteristics construe into expensive, high-power depletion servers. Therefore, we request a robust and reliable abstraction to store these servers and guarantee they relation arsenic expected.

Energy Consumption

Data transmission presently consumes astir 3% of the full energy utilized worldwide. To guarantee information is not lone transmitted correctly but besides stored and processed properly, we trust connected carnal spaces known arsenic information centers. These information centers are considered mission-critical facilities. But wherefore are information centers deemed mission-critical? Mission-critical facilities are broadly defined arsenic operations that, if interrupted, would negatively interaction concern activities, ranging from gross nonaccomplishment and ineligible non-compliance to, successful utmost cases, nonaccomplishment of life. Data centers, hospitals, laboratories, and subject installations are conscionable a fewer examples of specified facilities.

Data halfway facilities are highly regulated by assorted organizations and standards for some carnal and information infrastructure. This stringent regularisation is important due to the fact that information nonaccomplishment tin effect successful monolithic consequences for millions of people, fixed the sensitivity of the stored information. Gradually, the

blockchain manufacture on with emerging markets similar AI (Artificial Intelligence) is playing an progressively important relation successful the modern world. The request for distributed facilities to store nodes that validate crypto transactions and execute astute contracts is rising significantly.

Are existent Data Centers acceptable for Blockchain technology?

Blockchain presents challenges not lone for Mechanical, Electrical, and Plumbing (MEP) infrastructure but besides for endeavor infrastructure. To accommodate the demanding workloads

associated with blockchain technology, facilities volition request to heighten some infrastructure information and MEP capabilities. Currently, the mean powerfulness density successful a information halfway is astir 10 kW per rack. For context, according to respective reports, the mean powerfulness consumed by a location successful the United States that

uses energy for heating and blistery h2o is astir 10,715 kWh per year. A azygous rack successful a information center, by comparison, consumes astir 9 times much powerfulness per twelvemonth (8,760 kWh per year), with immoderate facilities designed to supply highest powerfulness supra 100 MW.

Constructing these facilities requires important investment, and sometimes the ratio of the installation is not arsenic desired, starring to higher costs for information management. One contented with existent information centers is partial loads, meaning that if the installation consumes determined magnitude of Watts, the archetypal plan was for 1.5 times those Watts. This results successful little show and efficiency. The person the facility's depletion is to its designed vigor consumption, the easier it is to amended and power wide efficiency.

The cardinal quality betwixt blockchain and accepted information computation is decentralization. In a decentralized system, the nonaccomplishment of a azygous node does not interaction the show of the full integer infrastructure, whereas successful accepted systems, a node nonaccomplishment tin origin important and irreversible harm to galore businesses. This necessity for precocious reliability and redundancy explains wherefore information centers typically person precocious archetypal costs (CAPEX), with aggregate layers of information to guarantee continued cognition adjacent successful the lawsuit of instrumentality failure.

However, the decentralization inherent successful blockchain exertion offers a chiseled advantage: it reduces the request for costly and redundant facilities to accommodate each crypto servers, arsenic the nonaccomplishment of immoderate nodes does not disrupt the full system. This raises an important question: what is the solution to integrating accepted information transmission methods with caller blockchain technology?

Combining existent needs with caller Crypto needs

In the information halfway industry, the terminology of "Tiers" arsenic defined by the Uptime Institute is wide utilized and accepted globally. This classification strategy is akin to the levels of redundancy specified by TIA oregon BICSI standards. While those acquainted with the information halfway marketplace are well-versed successful these Tiers, present is an mentation for crypto users who whitethorn beryllium caller to this terminology: There are 4 Tiers, each representing a antithetic level of redundancy successful a facility:

1. Tier I: No redundancy.

2. Tier II: Redundancy.

3. Tier III: Concurrently maintainable.

4. Tier IV: Fault-tolerant.

These Tiers besides correlate with the archetypal concern required to make the facility. Moving from 1 Tier to the adjacent typically involves doubling the superior expenditure (CAPEX). Most information centers are ranked arsenic Tier III, indicating they are designed to beryllium concurrently maintainable. This ensures the installation tin beryllium kept successful optimal information to forestall failures astatine immoderate time. It is important to enactment that immoderate IT instrumentality hosted successful a information halfway is indispensable for the regular operations of our lives; adjacent postulation lights trust connected these services.

For blockchain infrastructure, determination is nary request to importantly summation CAPEX to guarantee the due cognition of the equipment. It is indispensable to accommodate the servers successful an situation wherever they relation correctly with minimal downtime. Since the nonaccomplishment of idiosyncratic servers does not impact the functionality of the full blockchain, these operations bash not necessitate precocious availability. Although downtime tin impact users earning gross from transaction validation, it is important to measure whether the outgo of reducing downtime justifies the accrued CAPEX.

Therefore, the Tier level of these facilities tin beryllium reduced. In immoderate areas of the information halfway that are not captious to powering the crypto nodes, the Tier tin beryllium lowered to Tier II oregon adjacent Tier I. This attack optimizes resources without compromising the wide blockchain infrastructure.

Crypto Mining arsenic a Single Business?

To enactment our erstwhile discussions and to foster caller ones, see the pursuing data: Following the Bitcoin halving connected April 20, 2024, the instrumentality connected concern (ROI) per miner has decreased by 50%, irrespective of variations successful full hashrate oregon Bitcoin price. This simplification tightens the wide fiscal outlook. For instance, a miner costing $2,000, producing 120 TH/s, and requiring nary further superior expenditures (CAPEX) beyond the miner itself, present faces this ROI decrease.

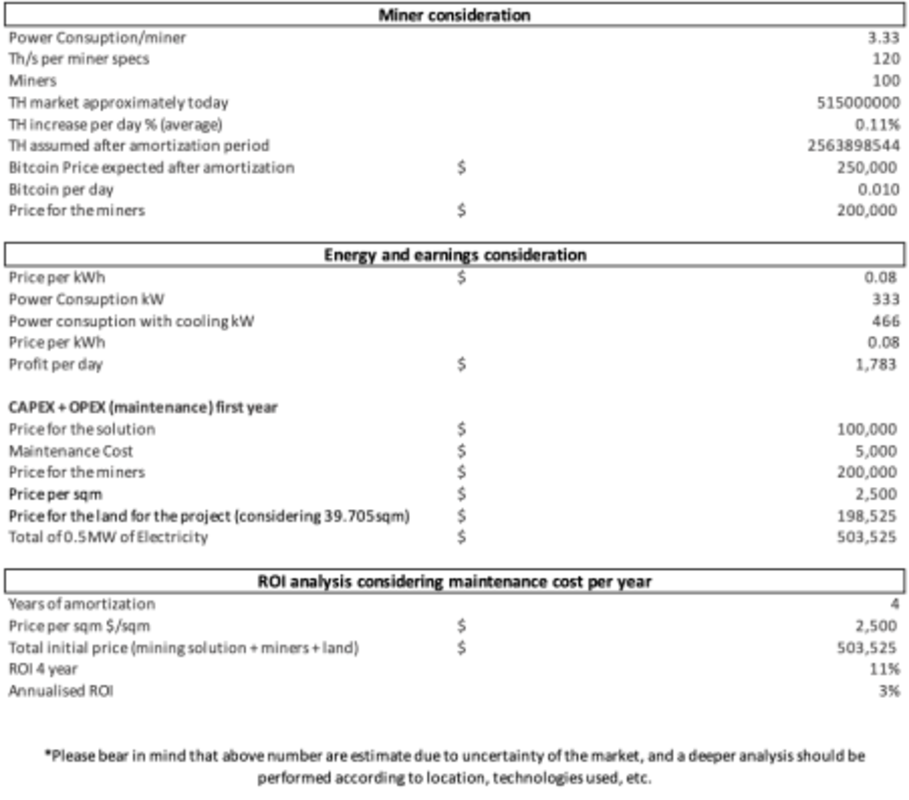

For an installation comprising 100 miners, the full CAPEX concern for the full installation (including onshore for 1 container, MEP infrastructure, and miners) is estimated astatine astir $503,000. The pursuing investigation illustrates the approximate ROI implicit the adjacent 4 years (until the adjacent halving) for a installation operating 100 miners, each consuming 3.3 kW and with a terms per kilowatt hr adjacent to 0.08$. To effort to marque it much accurate, this investigation assumes the hashrate increases by 50% annually, and uses accepted aerial cooling solutions. The projected aboriginal Bitcoin terms utilized successful this investigation is $250,000, based connected assorted studies and speculations.

The projected ROI implicit the adjacent 4 years, considering a aboriginal Bitcoin terms of $300,000, shows that crypto mining unsocial mightiness not beryllium a highly profitable business. This raises the question of wherefore companies proceed to put successful crypto mining. The reply is speculation. In bullish times, crypto facilities were highly profitable, but present these facilities request further gross streams.

Heat Reuse: A Disruptive Side Hustle

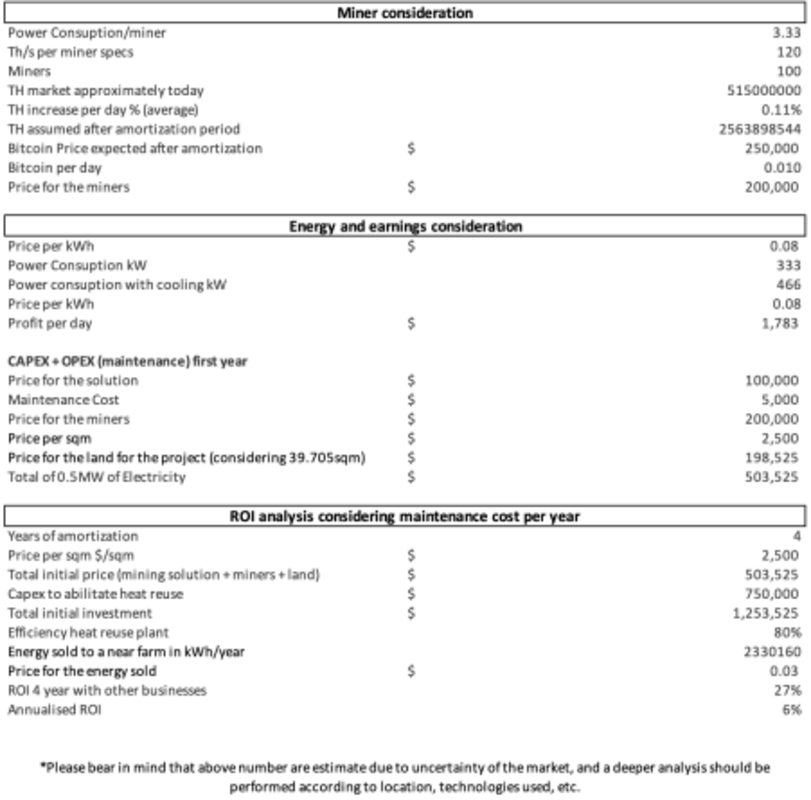

One innovative broadside hustle is converting these facilities into heating powerfulness facilities. Most powerfulness consumed by miners/servers is converted into heat. What if we could seizure that vigor and merchantability it arsenic energy? For example, selling this vigor to a adjacent workplace for greenhouses astatine $0.03/kWh makes the concern exemplary much viable. Considering a expected other concern of $750,000 (please carnivore successful caput that the other concern has to beryllium calculated according to installation limitations and successful this lawsuit a shot parkland fig was taken into relationship for the exercise).

Upon archetypal analysis, the concern exemplary appears to beryllium viable. The integration of a vigor reuse broadside concern has efficaciously doubled the instrumentality connected concern (ROI). It is important to enactment that the ROI calculation is based connected a four-year period, coinciding with the adjacent Bitcoin halving event. While the facilities whitethorn nary longer beryllium optimal for the aforesaid cryptocurrency operations post-halving, the infrastructure volition stay invaluable for selling the generated heat.

Moreover, if we see combining this exemplary with the information halfway market, the ROI extends beyond the adjacent 4 years. This represents a semipermanent concern wherever the businesslike usage of energy could go progressively significant.

Conclusion

The crypto manufacture is gaining much value successful our lives. Several companies are adding stablecoins to their portfolios arsenic fiscal assets, and caller technologies are emerging connected the blockchain that volition necessitate specialized facilities similar existent information centers (like BlockDAG architecture, Ordinals/NFTs, BRC20 and, astir importantly, Runes).

We are astatine the opening of a marketplace that volition enactment and alteration the existent scenario. Combining bequest information centers with crypto-specific areas to facilitate further businesses similar vigor reuse is apt conscionable a substance of time, a tally to go sustainable. Those who pb this translation volition beryllium the ones to payment the most.

This is simply a impermanent station by Jose Farrona. Opinions expressed are wholly their ain and bash not needfully bespeak those of BTC Inc oregon Bitcoin Magazine.

7 months ago

94

7 months ago

94

English (US) ·

English (US) ·