The nonfiction beneath is from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Disinflation And Monetary Policy

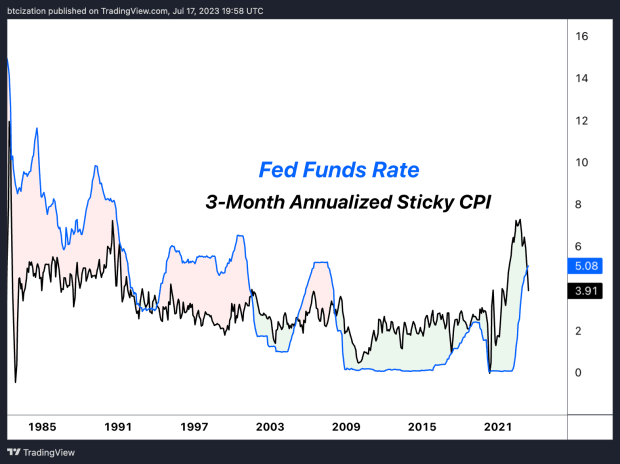

As we delve deeper into 2023, the U.S. system finds itself astatine a crossroads. Disinflation seems to beryllium mounting successful arsenic a nonstop effect of the Federal Reserve’s tightening monetary policies. This argumentation displacement has led to a notable slowdown successful the annualized sticky Consumer Price Index (CPI) implicit caller months. With this successful view, the speech among marketplace participants has gradually shifted distant from inflationary concerns and toward trying to recognize the interaction of the tightest monetary argumentation successful a decennary and a half.

Sticky CPI has slowed down successful caller months.

Sticky CPI has slowed down successful caller months.The precocious ostentation we’ve experienced, peculiarly successful the halfway handbasket (excluding nutrient and energy), concealed the effects of the swiftest tightening rhythm successful history. Inflation was partially fueled by a choky labour marketplace starring to accrued wages, and resulting successful a sustained second-half inflationary impulse driven much by wages than by vigor costs.

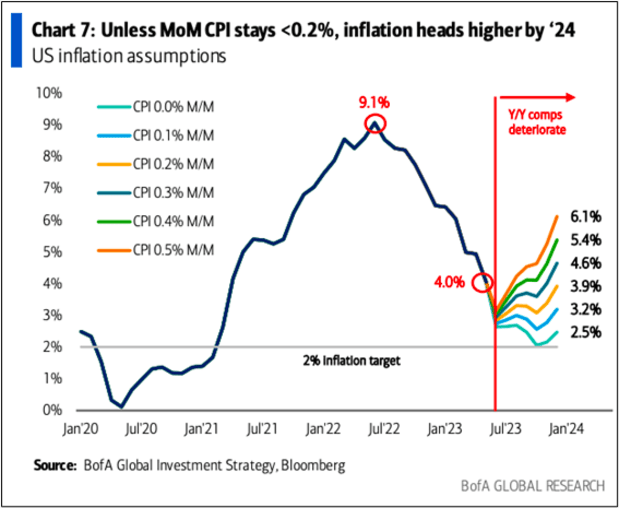

It’s worthy noting that the basal effects for year-over-year ostentation readings are peaking this month. This could pb to a reacceleration of inflationary readings connected a year-over-year ground if wage ostentation remains sticky oregon if vigor prices resurge.

Chances of ostentation heading higher by Q1 of 2024 stay high.

Chances of ostentation heading higher by Q1 of 2024 stay high.Interestingly, existent yields — calculated with some trailing 12-month ostentation and guardant expectations — are astatine their highest successful decades. The modern economical scenery is notably antithetic from the 1980s, and existent indebtedness levels cannot prolong affirmative existent yields for extended periods without starring to deterioration and imaginable default.

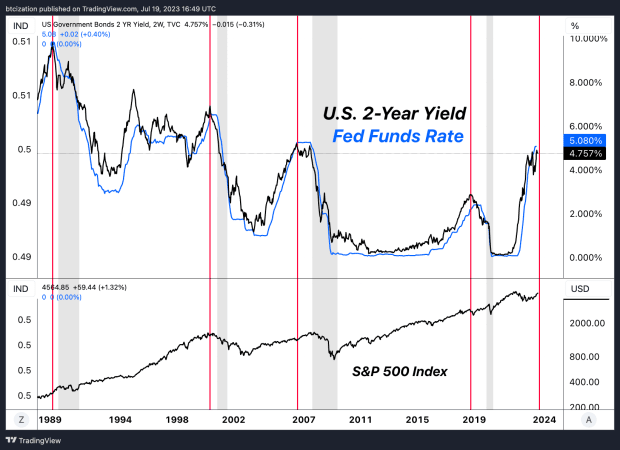

Historically, large shifts successful the marketplace hap during Fed tightening and cutting cycles. These shifts often pb to distress successful equity markets aft the Fed initiates complaint cuts. This isn’t intentional, but alternatively the broadside effects from choky monetary policy. Analyzing humanities trends tin supply invaluable insights into imaginable marketplace movements, particularly the two-year yields arsenic a proxy for the mean of the adjacent 2 years of Fed Funds.

The 2-year output has tracked intimately with the Fed Funds rate.

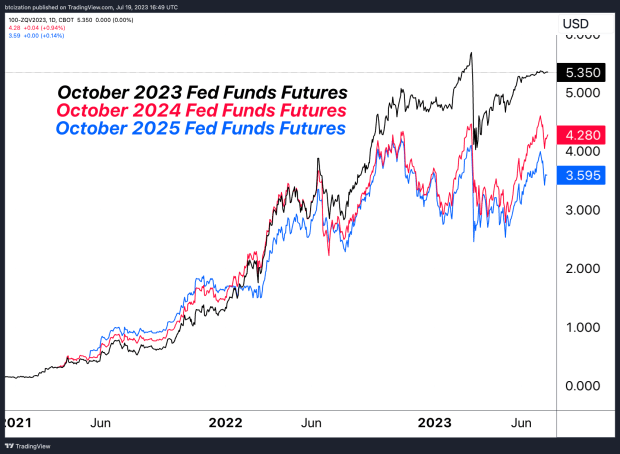

The 2-year output has tracked intimately with the Fed Funds rate. Fed Funds Futures are pricing successful little rates successful some 2024 and 2025.

Fed Funds Futures are pricing successful little rates successful some 2024 and 2025.Bonds And Equities: The Growing Disconnect

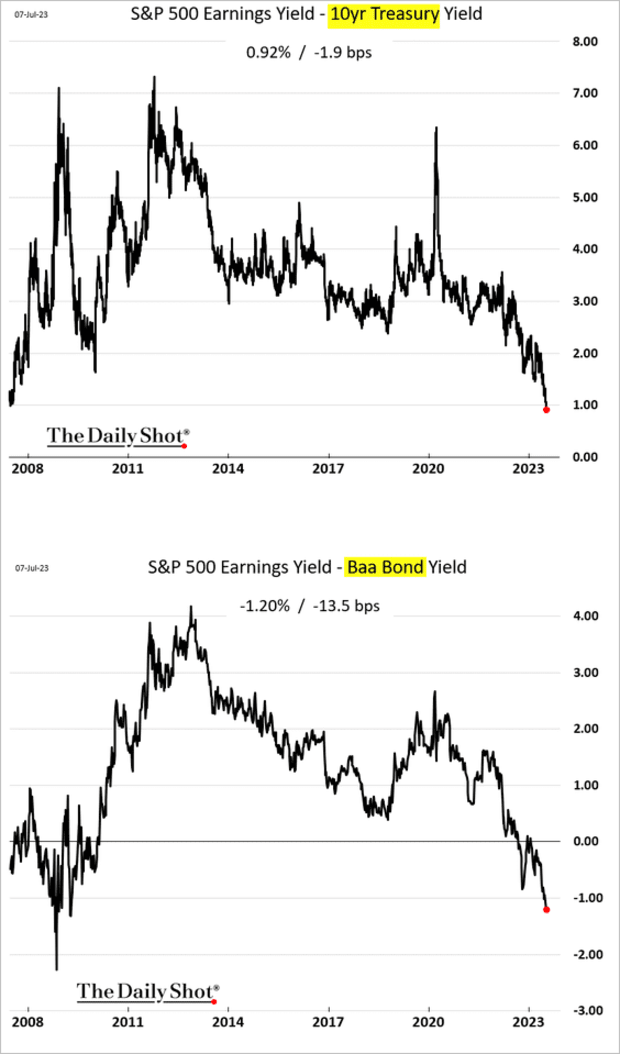

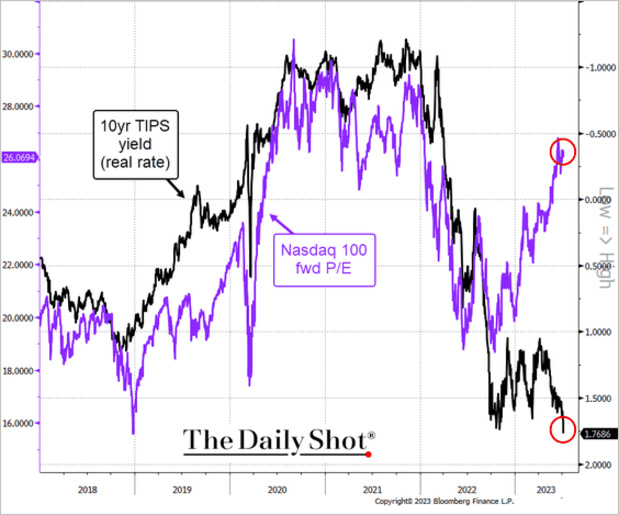

Currently, there’s a sizable and increasing disconnect betwixt enslaved and equity markets. It’s not antithetic for equity net to outperform bonds during an inflationary authorities owed to equities’ superior pricing power. However, with disinflation successful motion, the increasing divergence betwixt equity multiples and existent yields becomes a captious concern. This divergence tin besides beryllium observed done the equity hazard premium — equity yields minus enslaved yields.

The growing divergence betwixt equity multiples and existent yields is becoming a captious concern.

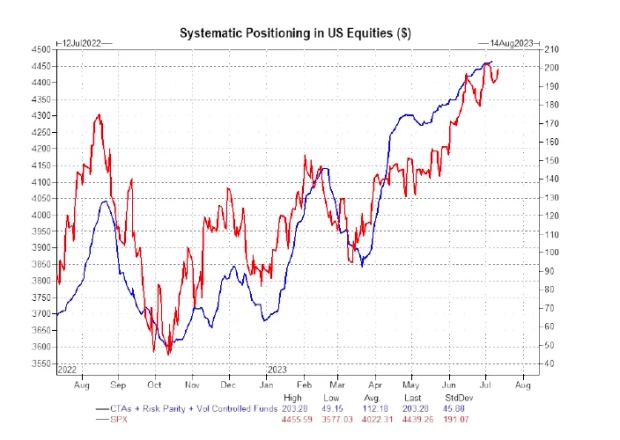

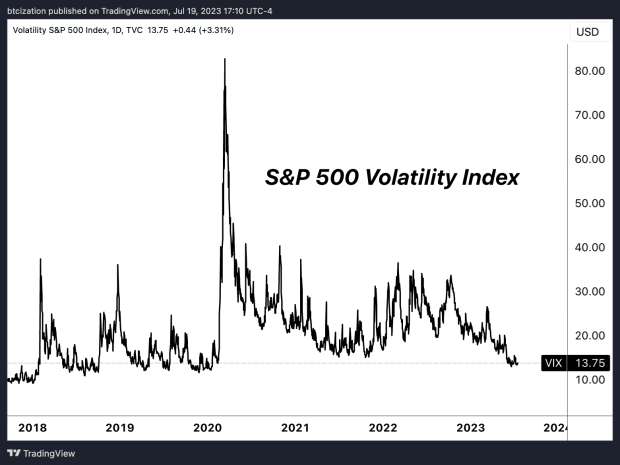

The growing divergence betwixt equity multiples and existent yields is becoming a captious concern.Research from Goldman Sachs shows systematic concern strategies, namely Commodity Trading Advisors (CTA), volatility power and risk-parity strategies, person been progressively utilizing leverage to amplify their concern exposure. This ramp-up successful leveraging has travel successful tandem with a affirmative show successful equity indices, which would beryllium forced to unwind during immoderate moves to the downside and/or spikes successful volatility.

CTA using leverage to amplify their concern vulnerability arsenic the SPX rises.

CTA using leverage to amplify their concern vulnerability arsenic the SPX rises. When volatility returns, leverage volition person to unwind.

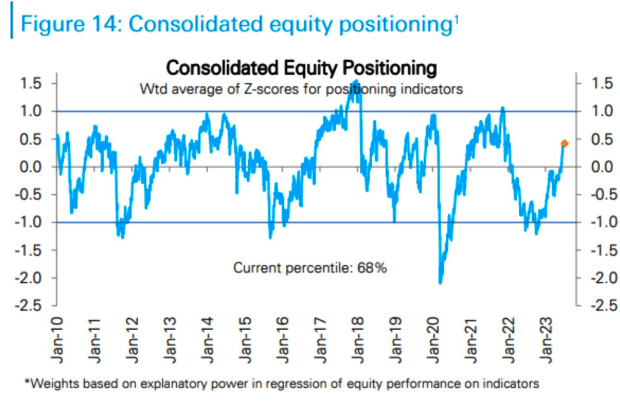

When volatility returns, leverage volition person to unwind.Research from JPMorgan Chase shows their consolidated equity positioning indicator is successful the 68th percentile, meaning equities are overheated, but continuation higher is imaginable compared to humanities standards.

Equities are overheated, but continuation higher is possible.

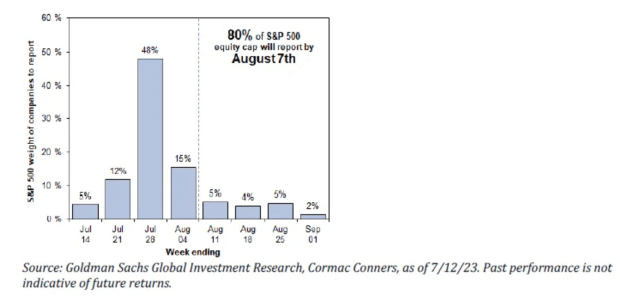

Equities are overheated, but continuation higher is possible.The destiny of equity markets successful the short-to-medium word volition beryllium determined by earnings, with 80% of S&P 500 companies acceptable to implicit their reporting by August 7.

Any disappointment during net play could pb to a reversion successful equity valuations comparative to the enslaved market.

Most S&P 500 companies with study net by August 7.

Most S&P 500 companies with study net by August 7. Real returns successful bonds are wholly diverged from the Nasdaq.

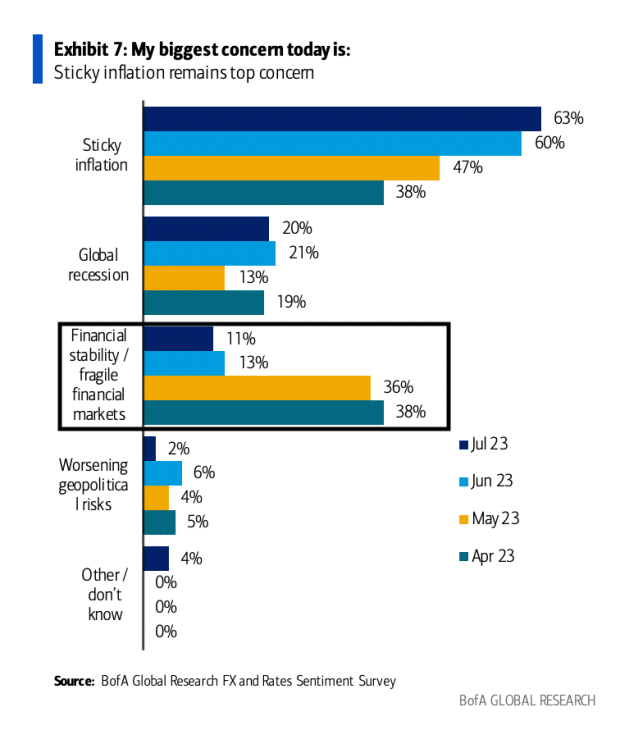

Real returns successful bonds are wholly diverged from the Nasdaq.Another absorbing enactment is from a caller Bank of America survey, wherever lawsuit interest astir the wellness of fiscal markets has risen successful caller months astatine the aforesaid clip arsenic equity markets proceed their uptrend.

More radical are reporting concerns astir fiscal stability.

More radical are reporting concerns astir fiscal stability.Headwinds Ahead For The U.S. Consumer?

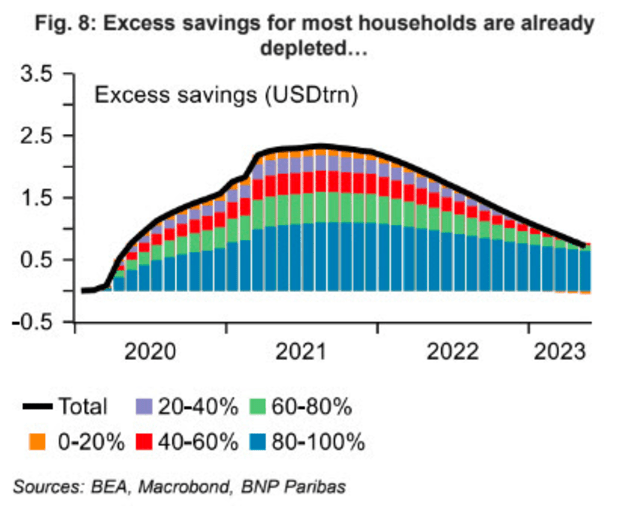

The robust net surprises and the U.S. user market’s resilience are being underpinned successful portion by excess savings from the COVID-era fiscal stimulus. However, it’s worthy noting that these savings are not uniformly distributed. A caller BNP Paribas study estimates that the apical income quintile holds conscionable implicit 80% of the excess savings. The savings of the lower-income quintiles are already spent, with the mediate quintile apt pursuing suit soon. With factors similar the resumption of pupil indebtedness obligations and emerging weaknesses successful the labour market, we should brace ourselves for imaginable accent successful user markets.

Excess savings for astir households person wholly dwindled.

Excess savings for astir households person wholly dwindled.Despite imaginable user marketplace stressors, the show of the U.S. system successful 2023 has surpassed expectations. Equity markets person enactment connected a stellar show, with the bull marketplace appearing unrelenting. Amidst these marketplace celebrations, we indispensable support a balanced perspective, knowing that the way guardant whitethorn not beryllium arsenic wide chopped oregon straightforward arsenic it appears.

Final Note

We item developments successful equity and involvement complaint conditions arsenic we find it important to admit the increasing liquidity interplay betwixt bitcoin and accepted plus markets. To enactment it plainly:

It signals important request erstwhile the world’s largest plus managers are competing to motorboat a fiscal merchandise that offers their clients vulnerability to bitcoin. These aboriginal inflows into bitcoin, predominantly from those presently invested successful non-bitcoin assets, volition inevitably intertwine bitcoin much intimately with the risk-on/risk-off flows of planetary markets. This isn’t a detrimental development; connected the contrary, it’s a progression to beryllium embraced. We expect bitcoin’s correlation to risk-on assets successful the accepted fiscal markets to increase, portion outperforming to the upside and successful a risk-adjusted mode implicit a longer clip frame.

With that being said, turning backmost to the main contented of the article, the humanities precedent of important lag successful monetary policy, combined with the existent conditions successful the involvement complaint and equity markets does warrant immoderate caution. Conventionally, equity markets diminution and a method recession occurs successful the United States aft the Fed begins to chopped involvement rates from the terminal level of the tightening cycle. We haven’t reached this information yet. Therefore, adjacent though we’re highly optimistic astir the autochthonal supply-side conditions for bitcoin today, we stay alert to each possibilities. For this reason, we stay unfastened to the thought of imaginable downward unit from bequest markets betwixt present and mid-2024, a play marked by cardinal events specified arsenic the Bitcoin halving and imaginable support of a spot bitcoin ETF.

That concludes the excerpt from a caller variation of Bitcoin Magazine PRO. Subscribe now to person PRO articles straight successful your inbox.

1 year ago

167

1 year ago

167

English (US) ·

English (US) ·