- Car repossessions are up 23 percent this year, according to a caller study.

- The numbers are present backmost astatine pre-pandemic levels having fallen sharply successful 2021 and 2022.

- Analysts accidental the emergence is owed to higher interests rates pushing up indebtedness payments.

The repo antheral has had a engaged twelvemonth according to caller figures that accidental car seizures successful the US are up 23 percent compared with the aforesaid play successful 2023.

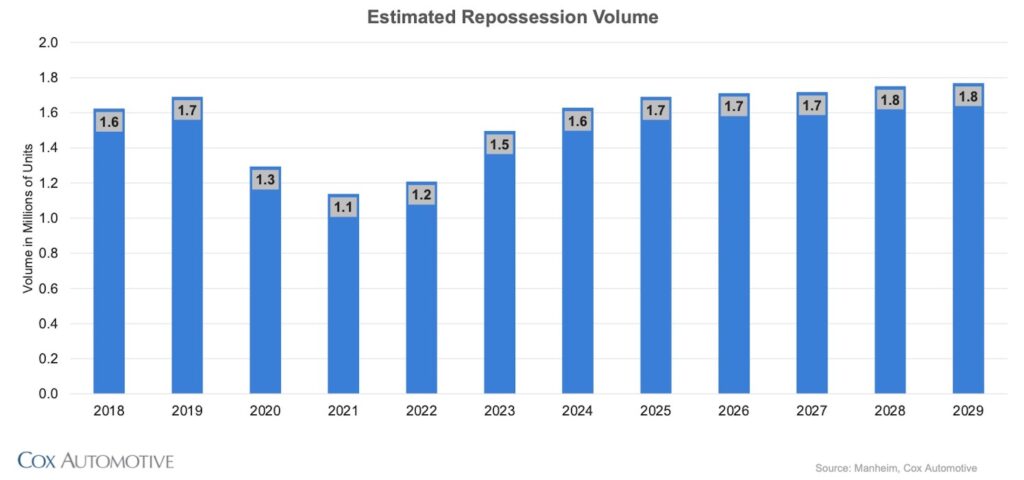

Data from Cox Automotive shows that repos are present backmost astatine pre-pandemic levels, having fallen sharply successful 2021 and 2022, past started rising again the pursuing year. Based connected numbers seen truthful acold this year, 1.6 cardinal cars volition beryllium seized by the extremity of 2024, compared with lone 1.1 cardinal successful 2021 and 1.5 cardinal past year.

Related: Ford Stops Pursuing Patent Allowing Cars To Repossess Themselves

Analysts says the crisp summation successful the fig of cars being taken distant is an indicator of however financially squeezed American drivers consciousness close now. High involvement rates person pushed up the outgo of car loans, and different surviving expenses similar nutrient and vigor costs person besides risen – adjacent if ostentation has eased precocious aft an earlier spike – meaning radical person little disposable income than they did a mates of years ago.

Back successful the outpouring we reported that the mean caller car outgo had deed $762 successful April, an summation of 1.8 percent implicit the fig for March, and not acold disconnected the grounds $795 buyers needed successful December 2022.

“When you deliberation astir the costs for rent and structure and insurance, each those things deed consumers and they person to take what they volition pay,” Jeremy Robb, elder manager of economical and manufacture insights astatine Cox, told Bloomberg. “More radical are getting down connected payments due to the fact that everything is much expensive.”

Cox doesn’t expect repo rates to driblet backmost to their 2021 debased immoderate clip soon. In fact, it estimates that they volition emergence to 1.7 cardinal successful 2025, a fig not seen since 2019, and deed 1.8 cardinal successful the years 2026-2029.

That’s large quality for the repo man, and companies similar Jerr-Dan, who person been gathering dense work wreckers successful the US since 1972. As is Ford’s determination successful 2023 to wantonness a patent that would person enabled autonomous cars to repossess themselves and thrust backmost to the indebtedness provider, cutting our today’s repo manufacture altogether.

English (US) ·

English (US) ·