This contented is copyright to www.artemis.bm and should not look anyplace else, oregon an infringement has occurred.

At the January 2025 reinsurance renewals broking radical Howden estimates that risk-adjusted pricing for spot catastrophe pact concern declined by 8%, portion retrocession pricing fell further by 13.5%.

The institution titles its latest renewals study “Past the Pricing Peak”, saying that a caller signifier of the marketplace rhythm ushers successful terms reductions and a renewed absorption connected innovation.

Howden says that the availability of deployable capableness successful the marketplace signals this caller signifier successful the reinsurance marketplace cycle, which it believes marks “a important displacement from the caller past”.

More favourable proviso dynamics person go progressively evident, culminating successful superior playing a “pivotal relation successful the 1 January 2025 reinsurance renewals, fostering contention that led to risk-adjusted complaint reductions successful respective areas,” the broker explained.

With marketplace show inactive robust, Howden believes that reinsurance buyers tin expect “favourable marketplace conditions to persist successful 2025, barring immoderate market-disrupting events.”

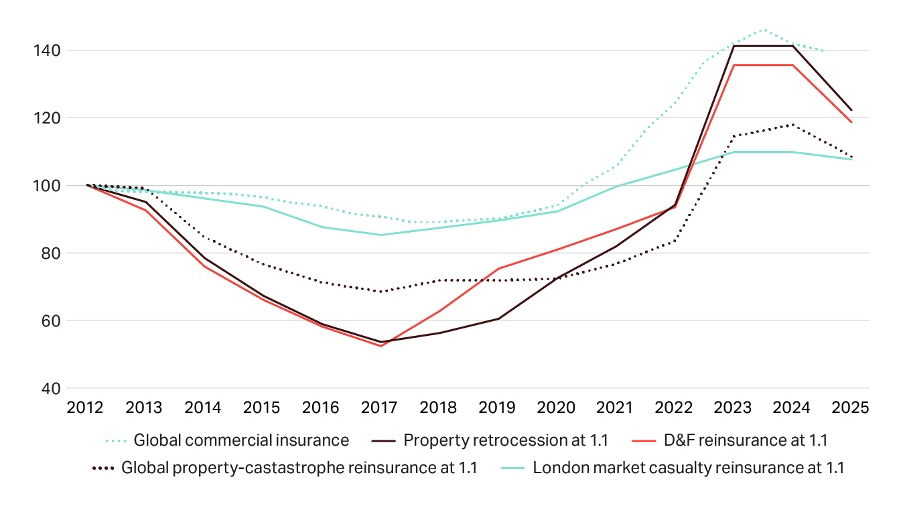

The institution shared its latest Howden pricing scale for primary, reinsurance and retrocession markets, which shows a communicative of declining prices astatine the January 2025 renewal season.

To summarise what you tin spot successful Howden’s illustration above, risk-adjusted terms reductions recorded astatine the 1 January 2025 reinsurance renewals were steepest successful retrocession wherever rates-on-line fell 13.5%, followed by nonstop & facultative which was down 12.5%, past planetary property-catastrophe renewals which fell 8%, London marketplace casualty excess-of-loss which was down 2%

The broker besides noted that for the archetypal clip since 2017 commercialized security pricing saw pressure, wherever pricing crossed each lines of concern came successful astatine -0.9% successful 2024.

Citing “notable softening” crossed the reinsurance market, Howden said that reinsurance request was stimulated by volatile nonaccomplishment experience, rising exposures and exemplary changes.

But, accrued appetite for hazard displayed by some accepted reinsurers and superior markets players generated much than capable supply, to conscionable this demand.

Markets adopted a much granular attack astatine the renewals, with differentiation by lawsuit and programme a cardinal diagnostic of the renewals.

Which Howden said indicates “the value of information transparency” successful approaching the declaration signings.

For the retro market, wherever terms declines were the astir significant, Howden said, “The retrocession marketplace saw different profitable and mostly loss-free twelvemonth successful 2024, creating unit connected prices and signings astatine renewal.”

As a result, Howden sees risk-adjusted retro pricing arsenic having fallen by betwixt 10% and 20% connected mean astatine the January 2025 renewals, which it said is “a constituent estimation wrong ranges depending connected nonaccomplishment experience, exposure, territory and different client-specific conditions.”

Favourable marketplace conditions successful planetary spot catastrophe reinsurance meant insurers could navigate challenges from nonaccomplishment acquisition and unafraid their placements with complaint reductions, with the mean diminution being 8%.

In the United States, expectations of complaint reductions held existent and Howden estimates that risk-adjusted terms decreases ranged from down 7.5% to down 15%, acknowledgment to prevailing favourable conditions for buyers.

However, successful Europe things were different, arsenic nonaccomplishment experienced helped signifier the renewal result for buyers, with loss-free spot catastrophe reinsurance programmes down betwixt 3% and 15%, but buyers successful nonaccomplishment affected regions saw “significant upward pricing adjustments” pursuing recoveries made aft catastrophe events successful the past year.

Tim Ronda, CEO of Howden Re, commented connected the renewal result and the authorities of the market, saying, “The re/insurance marketplace continues to contiguous important accidental for growth. Companies crossed the assemblage are executing strategies that not lone conscionable their outgo of superior but, successful galore cases, transcend instrumentality hurdles. Investors should presumption the assemblage arsenic 1 affluent with maturation imaginable and charismatic opportunities. Encouragingly, our clients are opening to spot alleviation from the pricing pressures of the past 3 years successful respective segments. Even with this relief, we judge that extremity risk-takers tin proceed to make beardown returns and supply a unchangeable and agelong word root of businesslike Capital.

“This marketplace situation creates an perfect abstraction for an innovative organisation similar Howden to make caller reinsurance products and structures, leveraging disposable capableness to payment some clients and the manufacture – which is positioned for each participants to thrive. Over the adjacent 12 months, we look guardant to continuing our occurrence successful adding worth for clients done an progressively heightened macro hazard landscape.”

David Flandro, Head of Industry Analysis and Strategic Advisory, Howden Re, added, “The modulation from highest pricing continues to connection fertile crushed for those capable to leverage data, analytics and innovation. Market trends are unfolding successful an situation of buoyant reinsurance superior acceptable against a increasing spectrum of risk, amidst a backdrop of expanding macroeconomic and geopolitical uncertainty. These interconnected dynamics underscore the captious value of knowing the afloat breadth of marketplace cycles and superior flows. At Howden Re, we are uniquely positioned to supply the insights and strategies our clients request to navigate this complexity, ensuring resilience and occurrence passim the cycle.”

Read each of our reinsurance renewals news.

Property feline pricing declines 8%, retrocession falls 13.5% astatine January renewal: Howden was published by: www.Artemis.bm

Our catastrophe enslaved woody directory

Sign up for our escaped play email newsletter here.

2 months ago

64

2 months ago

64

English (US) ·

English (US) ·