On-chain information shows that immoderate enactment metrics related to Polygon person surged recently, which could beryllium affirmative for the asset’s price.

Polygon Active Addresses & Age Consumed Have Spiked Recently

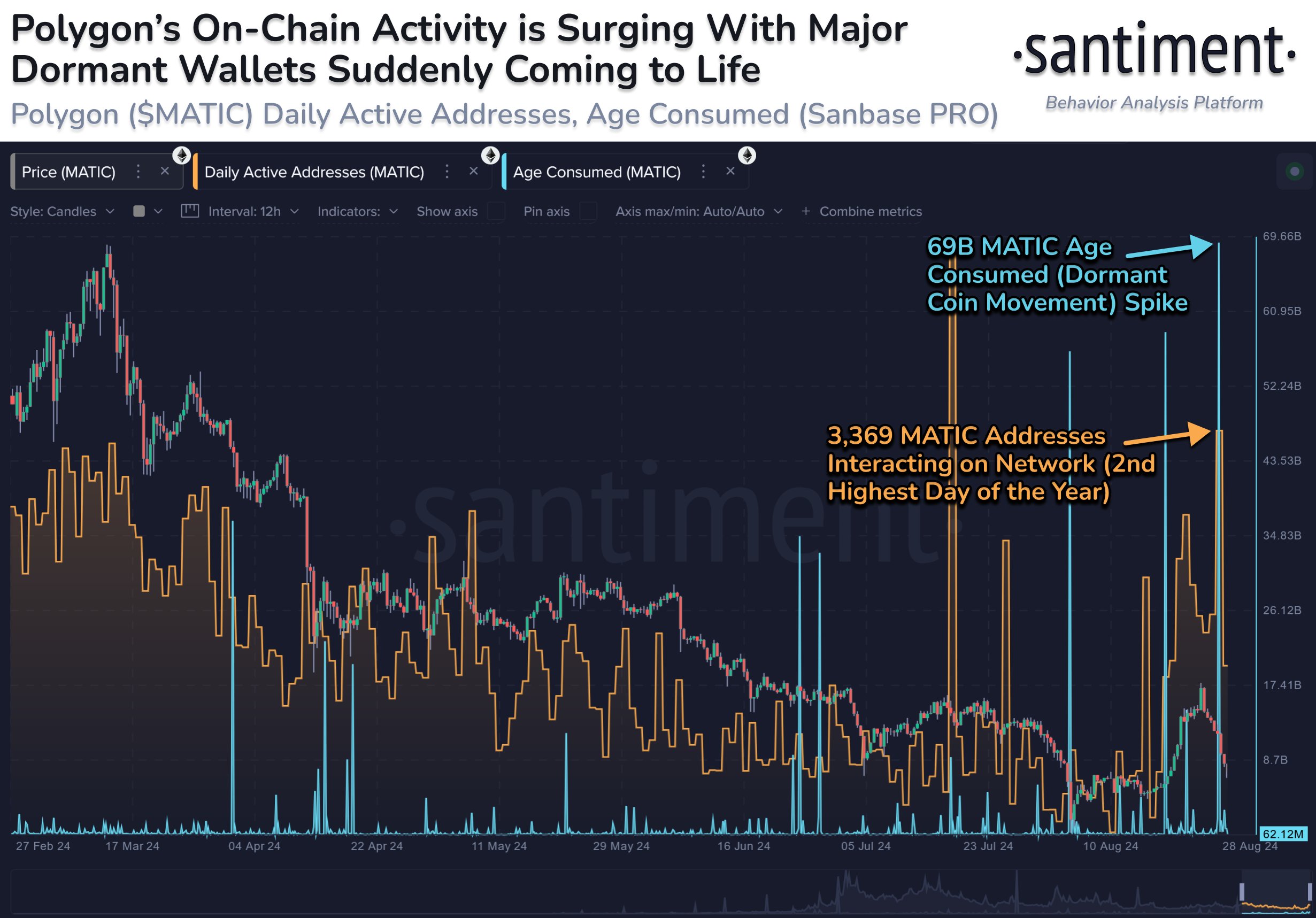

In a caller post connected X, the on-chain analytics steadfast Santiment discussed the latest inclination successful 2 MATIC indicators. The first is the “Daily Active Addresses,” which tracks the full fig of addresses participating successful immoderate benignant of transaction enactment connected the web each day.

The unsocial fig of progressive addresses tin beryllium considered the aforesaid arsenic the unsocial fig of users participating successful web activities, truthful the worth of this metric tells america astir the magnitude of postulation that the blockchain is observing close now.

When the indicator’s worth rises, much users are becoming progressive connected the network. Such a inclination implies that cryptocurrency is charismatic to investors.

On the different hand, the metric registering a diminution suggests capitalist involvement successful the plus could beryllium declining arsenic less users marque transfers connected the blockchain.

Now, present is simply a illustration that shows the inclination successful the Daily Active Addresses for Polygon implicit the past fewer months:

The supra graph shows that the Polygon Daily Active Addresses has precocious experienced a surge. At the highest of the latest spike, 3,369 MATIC addresses made transactions connected the network, the second-highest worth for the year.

Thus, investors look to person been actively engaged connected the web recently. It tin mostly beryllium hard to accidental what the consequences of specified enactment whitethorn beryllium for the asset, arsenic some selling and buying enactment would beryllium flagged up successful the indicator.

One happening that tin mostly beryllium said is that precocious idiosyncratic enactment whitethorn pb to cryptocurrency volatility. In the existent case, though, determination whitethorn beryllium 1 different hint: the surrounding terms action.

Interestingly, the largest spike successful the indicator lone came conscionable aft MATIC’s latest terms decline, which could connote that investors whitethorn beryllium rushing to bargain the dip. If this is the case, past Polygon could payment from a turnaround successful the activity.

The 2nd indicator successful the illustration is the “Age Consumed,” which tells america whether dormant coins are connected the move. From the chart, it’s disposable that a ample fig of aged tokens look to person moved connected the web during the latest enactment rush.

This tin beryllium a mixed signal, arsenic it could suggest that the asset’s diamond hands are selling. It’s besides imaginable that these investors person lone shifted the coins for immoderate different activity, arsenic the past Age Consumed spike of a akin standard proved bullish for Polygon.

Given the spikes these on-chain indicators person witnessed, however the coin develops from present remains to beryllium seen.

MATIC Price

Polygon’s terms has plunged astir 17% implicit the past week to $0.43.

English (US) ·

English (US) ·