The nonfiction beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

The Bitcoin Halving

One of the astir important and innovative features of bitcoin is the hard-capped proviso of 21 million.

The full proviso is not specifically defined successful the code, but is alternatively derived from the code’s issuance schedule, which is reduced by fractional each 210,000 blocks oregon astir each 4 years. This simplification lawsuit is called the bitcoin halving (or “halvening” successful immoderate circles).

When Bitcoin miners successfully find a artifact of transactions that links a acceptable of caller transactions to the erstwhile artifact of already confirmed transactions, they are rewarded successful recently created bitcoin. The bitcoin that is freshly created and awarded to the winning miner with each artifact is called the artifact subsidy. This subsidy combined with transaction fees sent by users who wage to get their transaction confirmed is called the artifact reward. The artifact subsidy and reward incentivizes the usage of computing powerfulness to support the Bitcoin codification running.

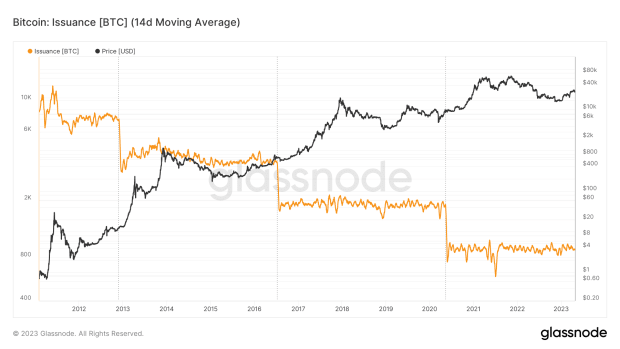

When bitcoin was archetypal released to the public, the artifact subsidy was 50 bitcoin. After the archetypal halving successful 2012, this fig was reduced to 25 bitcoin, past 12.5 bitcoin successful 2016. Most recently, the bitcoin halving occurred connected May 11, 2020, with miners presently receiving 6.25 bitcoin per caller block.

Bitcoin issuance gets reduced successful fractional astir each 4 years.

Bitcoin issuance gets reduced successful fractional astir each 4 years.The adjacent halving is coming up successful astir 1 year. The nonstop day volition beryllium connected the magnitude of hash powerfulness that joins oregon leaves the network, arsenic this impacts the velocity astatine which blocks are found. Estimates for the adjacent halving scope from precocious April to aboriginal May 2024. After the adjacent halving, the artifact subsidy volition beryllium reduced to 3.125 bitcoin.

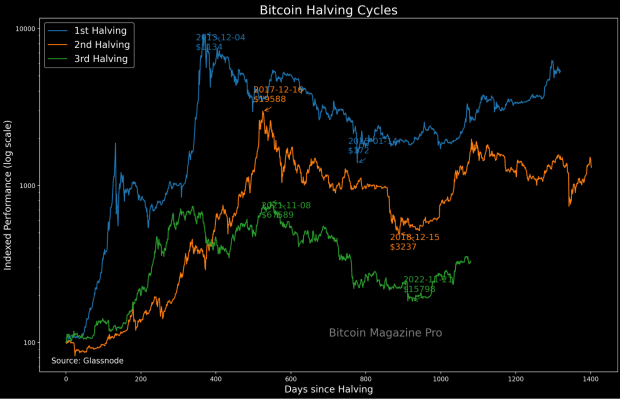

In the past, the bitcoin terms roseate considerably aft the halving, albeit galore months aft the subsidy was reduced. Every halving cycle, determination is simply a statement astir whether oregon not the halving is priced in. This question considers the information that the halving is simply a well-known lawsuit and attempts to code if the marketplace would origin this into bitcoin’s speech rate.

The bitcoin terms has typically gone done an exponential appreciation aft the halving.

The bitcoin terms has typically gone done an exponential appreciation aft the halving.Long-Term Holder Dynamics

Our superior thesis is that the halving leads to a demand-driven lawsuit successful bitcoin, arsenic marketplace participants go acutely alert of bitcoin’s implicit integer scarcity. This leads to a accelerated signifier of speech complaint appreciation. This proposal is somewhat divergent from the main narrative, which is that a supply-driven lawsuit instigates the exponential summation successful terms due to the fact that miners gain less bitcoin for the aforesaid magnitude of vigor expended and enactment little selling unit connected the market.

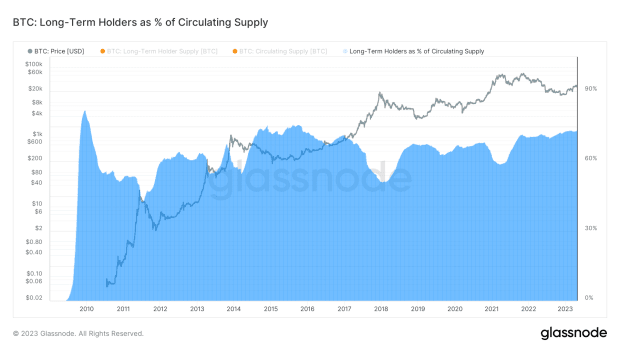

When we look intimately astatine the data, we tin spot that the proviso daze is often already successful spot — the HODL service has already staked their ground, if you will. On the margin, the simplification of proviso hitting the marketplace does marque a worldly quality successful the regular marketplace clearing rate, but the summation successful terms is owed to a demand-driven improvement that hits an wholly illiquid proviso connected the merchantability broadside with holders who are forged successful the depths of the carnivore marketplace unwilling to portion with their bitcoin until terms appreciates by astir an bid of magnitude.

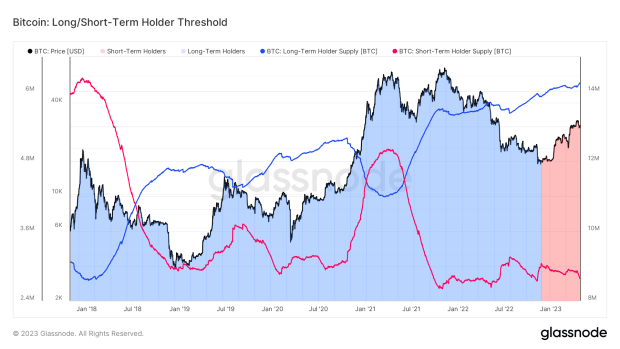

Trends successful semipermanent holder proviso sets the level and tops of marketplace cycles.

Trends successful semipermanent holder proviso sets the level and tops of marketplace cycles.Statistically speaking, semipermanent holders are the slightest apt to merchantability their bitcoin and the existent proviso is held tightly by this cohort. The radical who were buying and holding bitcoin portion the speech complaint was down astir 80% are present the ascendant bulk stock of the escaped interval supply.

The halving reinforces the world of Bitcoin’s proviso inelasticity to changing demand. As acquisition and knowing astir bitcoin’s superior monetary properties further perpetuate crossed the world, determination volition beryllium an influx of request portion its inelastic proviso makes the terms emergence exponentially. It isn’t until a ample stock of the convicted holders portion with a proportionality of their antecedently dormant stash that the speech complaint crashes from a feverish high.

These holding and spending patterns are precise good quantifiable, with an wholly transparent and immutable ledger to papers it all.

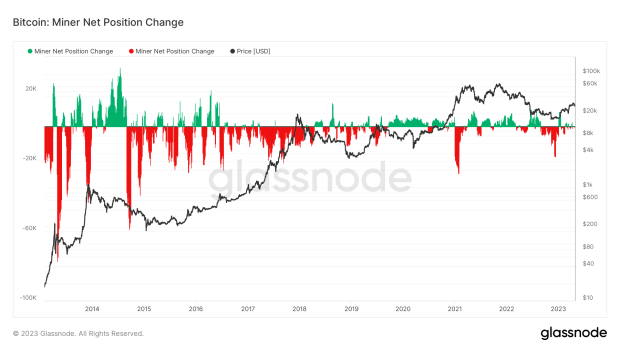

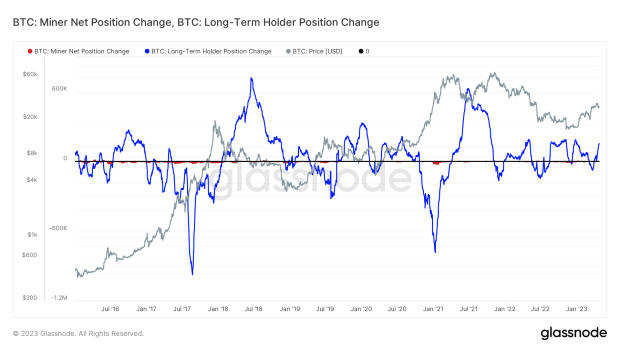

We cognize that the semipermanent holders are the ones mounting the level successful the carnivore market, but they are besides the ones mounting tops successful bull markets. Many radical look to the halving’s proviso daze arsenic what drives the summation successful price, with miners earning less coins portion inactive needing to merchantability immoderate successful bid to wage their bills that person remained the aforesaid outgo successful dollar presumption (or the section currency terms). We tin observe miners’ nett presumption alteration overlaid with the bitcoin terms and spot the interaction of their accumulation and selling.

Miner nett presumption overlaid with the bitcoin price.

Miner nett presumption overlaid with the bitcoin price.There is intelligibly a narration betwixt the bitcoin terms and whether miners are accumulating oregon selling, but correlation does not adjacent causation and erstwhile we see the behaviour of semipermanent holders, we tin spot however overmuch larger the tide of holder accumulation and organisation is compared to miner merchantability pressure. The illustration beneath shows the aforesaid miner nett presumption alteration arsenic above, but overlays it with semipermanent holder nett presumption change, some measuring the nett accumulation and organisation of the 2 cohorts implicit a 30-day period, displayed connected the aforesaid y-axis. When we comparison the two, it is hard to spot the miner nett presumption alteration (red) successful narration to the overmuch much salient presumption alteration of semipermanent holders (blue). While miner merchantability unit receives each of the press, the existent operator of the bitcoin rhythm is the convicted holders, who acceptable the level with accumulation, compressing the proverbial outpouring for the adjacent question of incoming demand.

Miner nett presumption compared to semipermanent holder nett presumption demonstrates the quality successful standard and impact connected the price.

Miner nett presumption compared to semipermanent holder nett presumption demonstrates the quality successful standard and impact connected the price.Long-term holders thin to administer their coins arsenic bitcoin makes its parabolic emergence and past statesman reaccumulating aft the terms corrects. We tin look astatine semipermanent holder spending habits to spot however the alteration successful semipermanent holder proviso is what yet helps the terms chill disconnected aft a parabolic rise.

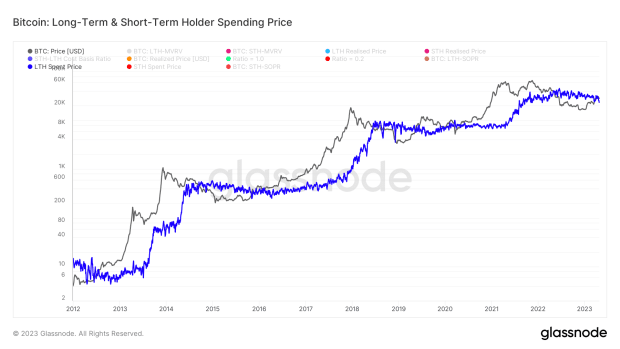

On-chain information shows that coins that haven’t moved for implicit six months presently person an mean walk terms that stays comparatively level during the entirety of the carnivore marketplace — compared to the volatility of the market-to-market speech rate. What occurs during the carnivore marketplace is simply a reshuffling of the deck: UTXOs are exchanging hands from the speculator to the convicted, from the overleveraged to the ones who person escaped currency flow.

Long-term and short-term holder spending price.

Long-term and short-term holder spending price.During periods of marketplace frenzy to the upside, the outflow of coins from semipermanent holders is overmuch larger than the sum of regular issuance, portion the other tin beryllium existent successful the depths of the carnivore — holders are absorbing acold greater amounts of coins than the sum of caller issuance.

We person been successful a nett accumulation authorities for 2 years, portion wiping retired astir the full derivative analyzable successful the process. Today’s semipermanent holders person coins that did not budge during the Three Arrows Capital blowup oregon the FTX fiasco.

The reddish country of the illustration shows a signifier of semipermanent accumulation.

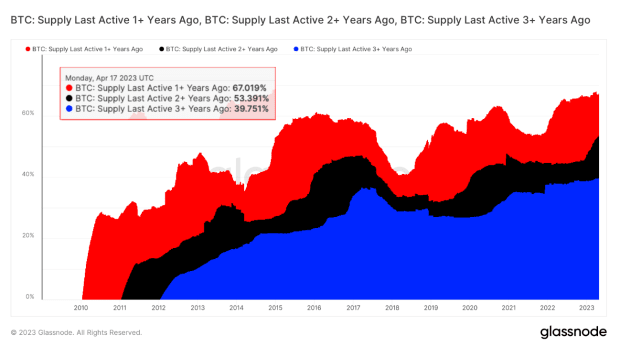

The reddish country of the illustration shows a signifier of semipermanent accumulation.To show conscionable however overmuch condemnation semipermanent holders person successful this asset, we tin observe coins that haven’t moved for one, 2 and 3 years. The illustration beneath shows the percent of UTXOs that person remained dormant implicit these timeframes. We tin spot that 67.02% of bitcoin hasn’t changed hands successful 1 year, 53.39% successful 2 years, and 39.75% successful 3 years. While these aren’t cleanable metrics for analyzing HODLer behavior, they amusement that astatine the precise slightest determination is simply a important magnitude of the full proviso that is held by radical who person small volition of selling these coins anytime soon.

The magnitude of bitcoin proviso that hasn't been progressive for much than one, 2 and 3 years is increasing.

The magnitude of bitcoin proviso that hasn't been progressive for much than one, 2 and 3 years is increasing.Aside from bitcoin becoming harder to nutrient astatine the margin, the halving event’s astir apt publication to bitcoin is the selling astir it. At this point, the predominant bulk of the satellite is acquainted with bitcoin, but fewer recognize the extremist conception of implicit scarcity. With each halving, the media sum is larger and much significant.

Bitcoin stands unsocial with its algorithmic and fixed monetary argumentation successful a satellite of arbitrary, bureaucratic fiscal argumentation gone astray and a ne'er ending watercourse of indebtedness monetization policies.

The 2024 halving, little than 52,000 bitcoin blocks away, volition again reenforce the communicative of proviso inelasticity, portion an overwhelming bulk of the circulating proviso is held by holders who are wholly disinterested successful parting with their share.

Final Note:

Despite the halving’s lessening effect successful comparative presumption aft each cycle, the upcoming lawsuit volition service arsenic a world cheque for the market, peculiarly for those who statesman to consciousness that they person insufficient vulnerability to the asset. As the programmatic monetary argumentation of Bitcoin continues to enactment precisely arsenic designed, astir 92% of the terminal proviso is already successful circulation, and the commencement of yet different proviso issuance halving lawsuit volition lone reenforce the communicative of apolitical wealth and bitcoin’s unsocial integer scarcity volition travel into absorption much sharply.

That concludes the excerpt from a caller variation of Bitcoin Magazine PRO. Subscribe now to person PRO articles straight successful your inbox.

1 year ago

297

1 year ago

297

English (US) ·

English (US) ·