Months of precocious owe rates and debased existing inventory led to different yearly summation successful caller location purchases successful June. Mortgage applications for caller location purchases jumped 26.1% successful June from the aforesaid play past year, according to the Mortgage Bankers Association builder exertion survey. Compared with the anterior month, applications dropped by 5%.

MBA estimates that astir 687,000 caller single-family homes were sold successful June astatine a seasonally adjusted yearly rate. It’s a diminution of 9% from the May gait of 755,000 units. On an unadjusted basis, MBA estimates that determination were 60,000 caller location income successful June 2023, a 6.3% alteration from 64,000 caller location income successful May.

“New location acquisition enactment continues to beryllium a agleam spot, arsenic some caller location applications and location income were up connected an yearly basis,” said Joel Kan, MBA’s vice president and lawman main economist. “With existing inventory inactive held backmost by homeowners, prospective buyers person turned to recently built homes instead. Rising owe rates successful June apt caused immoderate pullback successful purchases implicit the month, arsenic the 30-year fixed complaint averaged adjacent to 6.8%. However, applications for caller location purchases person present shown yearly increases for 5 consecutive months.”

Purchase owe rates this week averaged 6.78%, the biggest play diminution since mid-March, according to the latest Freddie Mac PMMS.

Homebuilders constructed an annualized complaint of 1.434 cardinal houses successful June, down 8% from May and 8.1% from June 2022, according to the U.S. Census Bureau. Single-family location constructions saw a 7% month-over-month alteration to complaint of 935,000 successful June.

The mean indebtedness size decreased from $403,581 successful May to $400,281 successful June. Conventional loans accounted for 65.5% of indebtedness applications. Federal Housing Administration (FHA) loans composed 24.1%, Veterans Affairs (VA) loans took up 10% of full applications and Rural Housing Service (RHS) and United States Department of Agriculture (USDA) loans consisted of 0.3%.

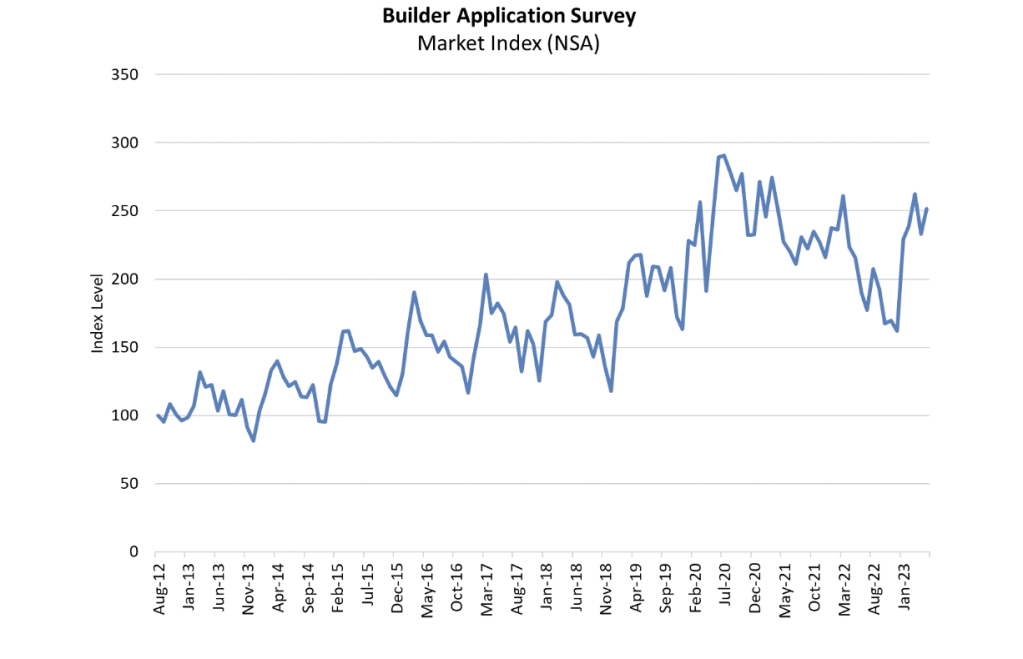

The survey tracks exertion measurement from owe subsidiaries of homebuilders crossed the country. Using this data, MBA provides an aboriginal estimation of caller location income volumes astatine the national, authorities and metro level.

1 year ago

193

1 year ago

193

English (US) ·

English (US) ·