Maximizing Bitcoin Gains with ETF Data

Since the instauration of Bitcoin Exchange Traded Funds (ETFs) successful aboriginal 2024, Bitcoin has reached caller all-time highs, with aggregate months of double-digit gains. However, arsenic awesome arsenic this show is, there's a mode to importantly outperform Bitcoin's returns by utilizing ETF information to usher your trading decisions.

Bitcoin ETFs and Their Influence

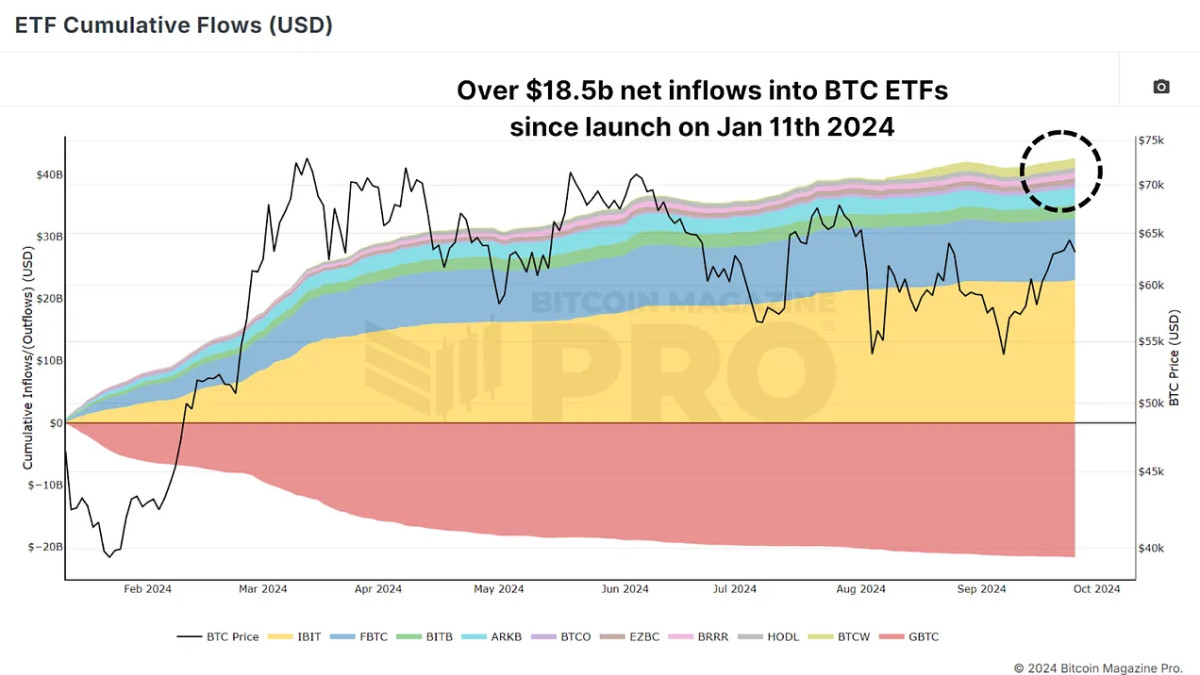

Bitcoin ETFs, launched successful January 2024, person rapidly amassed ample amounts of Bitcoin. These ETFs, tracked by assorted funds, let organization and retail investors to summation vulnerability to Bitcoin without straight owning it. These ETFs person accumulated billions of USD worthy of BTC, and tracking this cumulative travel is indispensable for monitoring organization enactment successful Bitcoin markets, helping america gauge whether organization players are buying oregon selling.

Figure 1: BTC ETF Cumulative Flows (USD) person surpassed $18.5b. View Live Chart 🔍

Figure 1: BTC ETF Cumulative Flows (USD) person surpassed $18.5b. View Live Chart 🔍

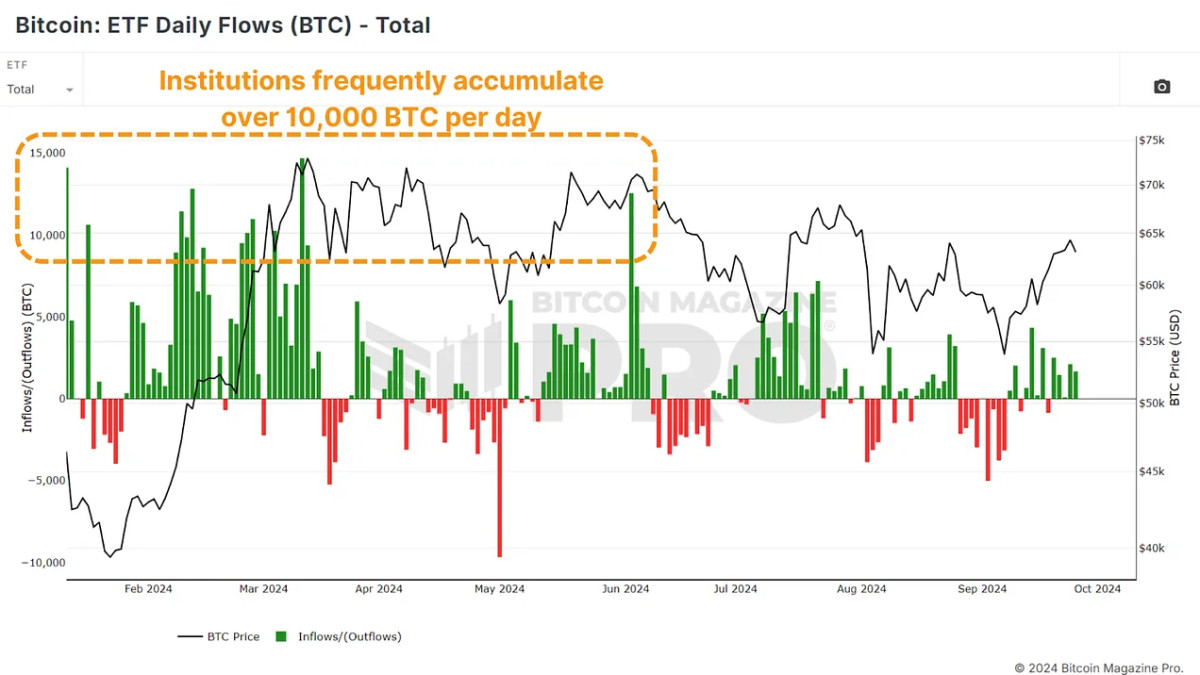

ETF regular inflows denominated successful BTC bespeak that large-scale investors are accumulating Bitcoin, portion regular outflows suggest they are exiting positions during that trading period. For those looking to outperform Bitcoin's already beardown 2024 performance, this ETF information offers a strategical introduction and exit constituent for Bitcoin trades.

Figure 2: BTC ETF Daily Flows (BTC) amusement regular accumulation of implicit 10,000 BTC per day. View Live Chart 🔍

Figure 2: BTC ETF Daily Flows (BTC) amusement regular accumulation of implicit 10,000 BTC per day. View Live Chart 🔍

A Simple Strategy Based connected ETF Data

The strategy is comparatively straightforward: bargain Bitcoin erstwhile ETF inflows are affirmative (green bars) and merchantability erstwhile outflows hap (red bars). Surprisingly, this method allows you to outperform adjacent during Bitcoin's bullish periods.

This strategy, portion simple, has consistently outperformed the broader Bitcoin marketplace by capturing terms momentum astatine the close moments and avoiding imaginable downturns by pursuing organization trends.

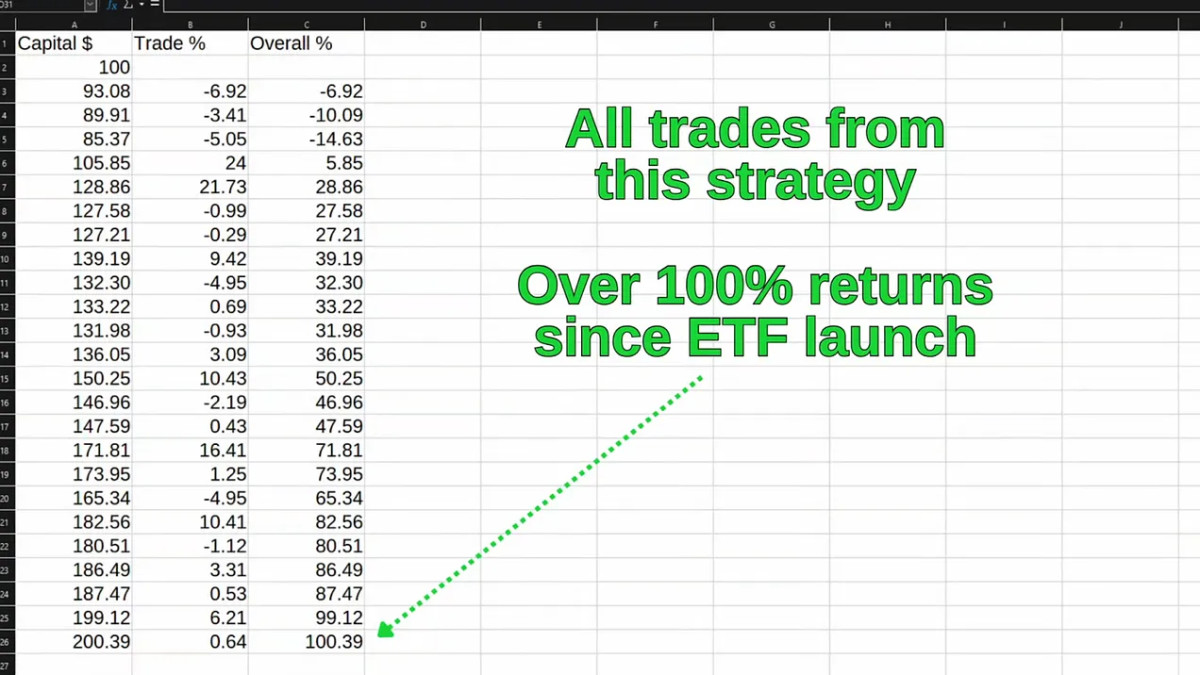

Figure 3: Each commercialized pursuing this organization inflow/outflow strategy.

Figure 3: Each commercialized pursuing this organization inflow/outflow strategy.

The Power of Compounding

The existent concealed to this strategy lies successful compounding. Compounding gains implicit clip importantly boosts your returns, adjacent during periods of consolidation oregon insignificant volatility. Imagine starting with $100 successful capital. If your archetypal commercialized yields a 10% return, you present person $110. On the adjacent trade, different 10% summation connected $110 brings your full to $121. Compounding these gains implicit time, adjacent humble wins, accumulate into important profits. Losses are inevitable, but compounding wins acold outweigh the occasional dip.

Since the motorboat of the Bitcoin ETFs, this strategy has provided implicit 100% returns during a play successful which conscionable holding BTC has returned astir 37%, oregon adjacent compared to buying Bitcoin connected the ETF motorboat time and selling astatine the nonstop all-time high, which would person returned astir 59%.

Figure 4: Over 100% compounded gains since ETF motorboat pursuing this strategy.

Figure 4: Over 100% compounded gains since ETF motorboat pursuing this strategy.

Can Further Upside Be Expected?

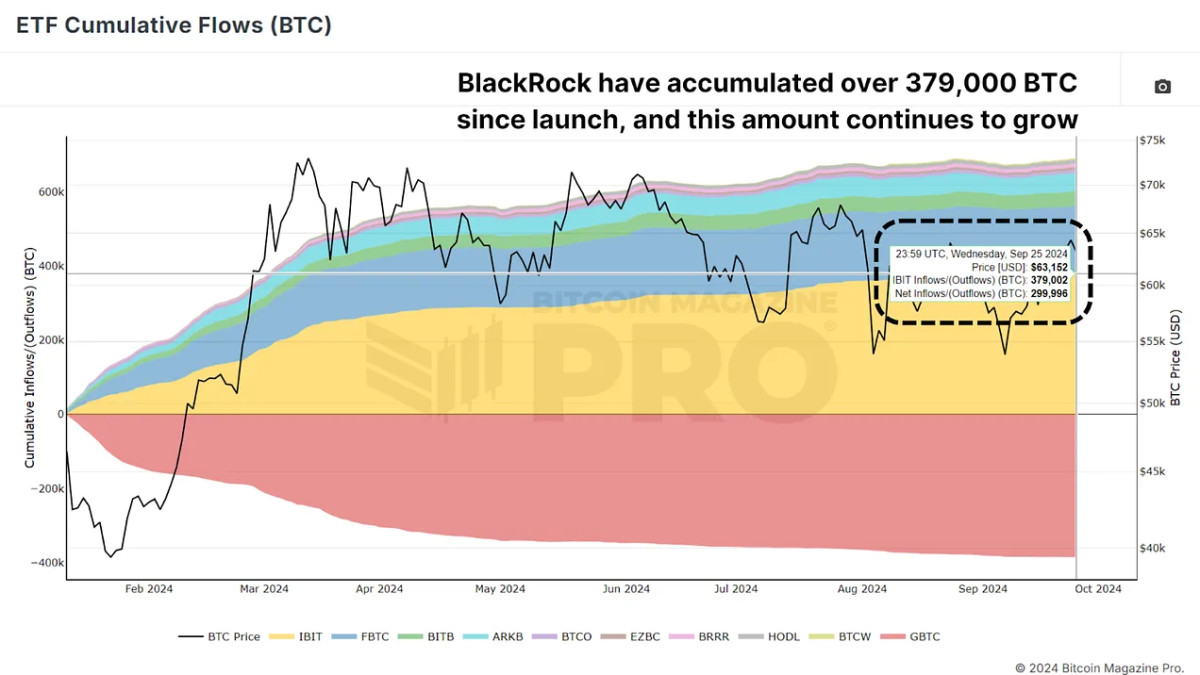

Recently, we’ve begun to spot a sustained inclination of affirmative ETF inflows, suggesting that institutions are erstwhile again heavy accumulating Bitcoin. Since September 19th, each time has seen affirmative inflows, which, arsenic we tin see, person often preceded terms rallies. BlackRock and their IBIT ETF unsocial person accumulated implicit 379,000 BTC since inception.

Figure 5: BlackRock unsocial has accumulated implicit 379,000 BTC successful conscionable a fewer months. View Live Chart 🔍

Figure 5: BlackRock unsocial has accumulated implicit 379,000 BTC successful conscionable a fewer months. View Live Chart 🔍

Conclusion

Market conditions tin change, and determination volition inevitably beryllium periods of volatility. However, the accordant humanities correlation betwixt ETF inflows and Bitcoin terms increases makes this a invaluable instrumentality for those looking to maximize their Bitcoin gains. If you’re looking for a low-effort, set-it-and-forget-it approach, buy-and-hold whitethorn inactive beryllium suitable. However, if you privation to effort and actively summation your returns by leveraging organization data, tracking Bitcoin ETF inflows and outflows could beryllium a game-changer.

For a much in-depth look into this topic, cheque retired a caller YouTube video here: Using ETF Data to Outperform Bitcoin [Must Watch]

6 months ago

100

6 months ago

100

English (US) ·

English (US) ·