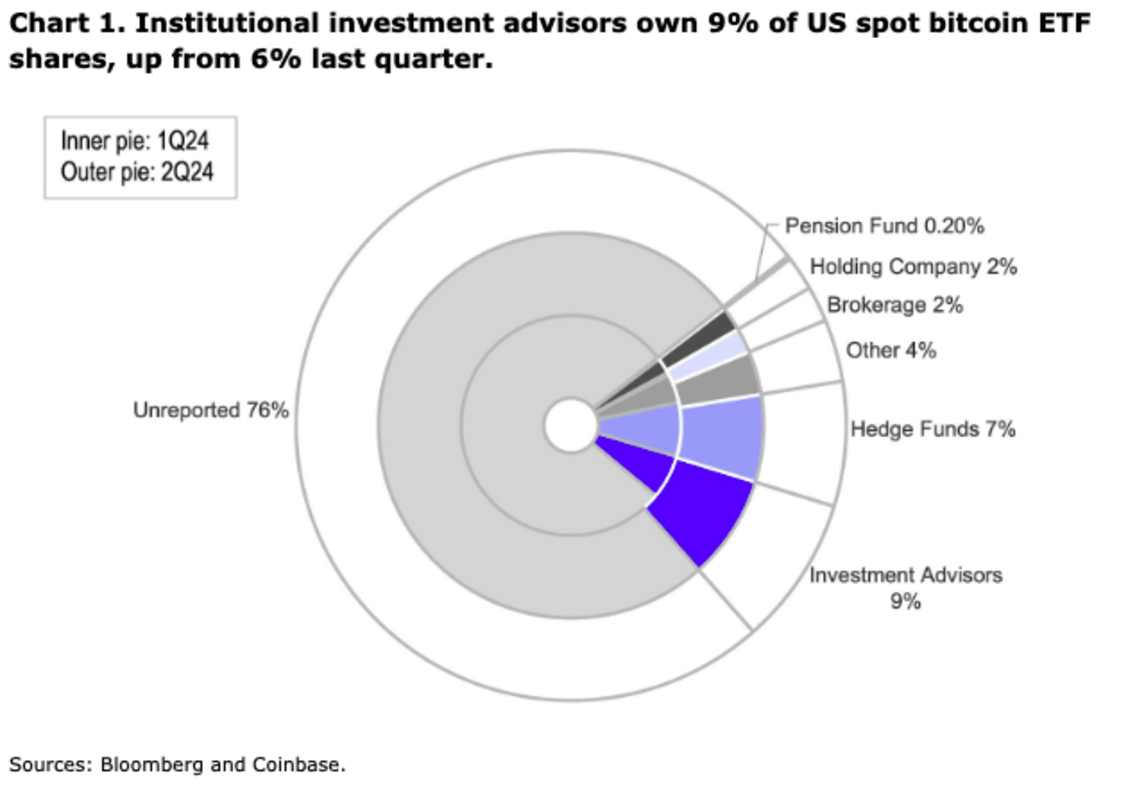

Coinbase has reported that updated 2Q 2024 13-F filings bespeak a notable summation successful organization inflows into U.S. spot Bitcoin ETFs, which the institution views arsenic a "promising indicator" for the Bitcoin market. The 13-F filings, released connected August 14, uncover that organization ownership of these ETFs grew from 21.4% to 24.0% betwixt Q1 and Q2 of 2024.

Significantly, the proportionality of ETF shares held by the "investment advisor" class roseate from 29.8% to 36.6%, signaling heightened involvement from wealthiness absorption firms. Notable caller holders see Goldman Sachs and Morgan Stanley, who added $412 cardinal and $188 cardinal worthy of shares, respectively. Despite Bitcoin's terms driblet during the quarter, nett inflows into spot Bitcoin ETFs reached $2.4 billion.

"The ETF analyzable saw nett inflows of $2.4B during this period, though the full AUM of spot bitcoin ETFs dropped from $59.3B to $51.8B (due to BTC dropping from $70,700 to $60,300)," Coinbase reported. "We deliberation that the continued ETF inflows during bitcoin’s underperformance whitethorn beryllium a promising indicator of sustained involvement successful crypto from the caller pools of superior that the ETFs springiness entree to."

Coinbase expects this maturation to proceed arsenic much brokerage houses implicit their owed diligence connected Bitcoin ETFs, peculiarly among registered concern advisors. However, the study besides notes that short-term inflows whitethorn beryllium tempered by seasonal factors and existent marketplace volatility.

"In our view, it’s apt that we volition spot the proportionality of concern advisor holdings proceed to summation arsenic much brokerage houses implicit their owed diligence connected these funds," the study stated. "We whitethorn not instantly spot ample inflows look successful the short-term, arsenic soliciting clients whitethorn beryllium harder to bash during the summer, erstwhile much radical are connected vacation, liquidity tends to beryllium thinner and the terms enactment mightiness beryllium choppy."

7 months ago

68

7 months ago

68

English (US) ·

English (US) ·