Selling pre-foreclosure is often the champion enactment for distressed homeowners who don’t suffice for immoderate loss mitigation programs, but those homeowners are understandably hesitant to take that enactment and often extremity up choosing it erstwhile clip is moving out.

That makes those homeowners susceptible to predatory behaviour by immoderate buyers operating successful the pre-foreclosure marketplace, behaviour that has been chronicled successful respective prominent, caller quality stories.

Given this pre-foreclosure paradox, owe servicers and authorities policymakers are forced to locomotion a bladed line: nudging distressed homeowners toward making a prime that’s successful their champion involvement portion besides arming them with the cognition and resources they request to beryllium protected successful the pre-foreclosure marketplace.

Walking that bladed enactment is becoming progressively important arsenic much distressed income are pushed up-funnel into the pre-foreclosure marketplace — a inclination that began processing astir 10 years agone and has accelerated successful earnest implicit the past 2 years.

Pre-foreclosure momentum

“If you’re experiencing semipermanent fiscal hardship and cannot spend your monthly owe payments, selling your location whitethorn beryllium the champion option,” explains a US Bank video that walks this bladed line. “Our extremity is to assistance you debar a foreclosure merchantability portion protecting your recognition people and preserving your equity.”

Even the Consumer Financial Protection Bureau (CFPB) has weighed in, with a January 2023 blog station titled “For galore struggling owe borrowers with location equity, selling their location could beryllium an alternate to foreclosure.”

In its archetypal paragraph, the CFPB blog post encourages owe servicers to supply distressed homeowners with a nudge toward a pre-foreclosure sale.

“Servicers tin punctual homeowners that a accepted merchantability mightiness beryllium 1 enactment to debar foreclosure. … And servicers whitethorn privation to suggest homeowners interaction a existent property cause if the distressed homeowner is considering selling their home.”

The pitfalls of pre-foreclosure

The CFPB blog station doesn’t interaction connected the imaginable for predatory behaviour successful the pre-foreclosure marketplace. Those dangers tin beryllium recovered successful caller headlines from the New York Times and ProPublica.

A July 2022 article successful The New York Times traces however 1 man’s New York metropolis existent property empire was allegedly built done a signifier called deed theft, often targeting homeowners facing foreclosure.

“(Prosecutors and homeowners) person accused him of fraud: offering to assistance homeowners facing foreclosure by arranging to wage disconnected their mortgages, portion really tricking them into signing implicit their buildings astatine bargain-basement prices. In astir each case, the owe was ne'er paid, leaving the homeowner with nary spot but a heap of debt.”

A May 2023 ProPublica article details however the self-proclaimed “largest homebuyer successful the United States” is grooming its franchises to people and sometimes instrumentality vantage of distressed homeowners who are successful pain. One of those sources of symptom is simply a “looming foreclosure.”

Myriad manifestations of fraudulent and predatory behaviour emerged during the five-year descent successful location prices pursuing the 2008 crash. One prominent scheme progressive unlicensed “short merchantability facilitators” charging upfront fees to distressed homeowners and often representing “straw buyers” with lowball offers. Ethical concerns adjacent arose for licensed existent property agents who approached distressed homeowners to database properties adjacent though those agents were besides representing prospective buyers.

A increasing pre-foreclosure market

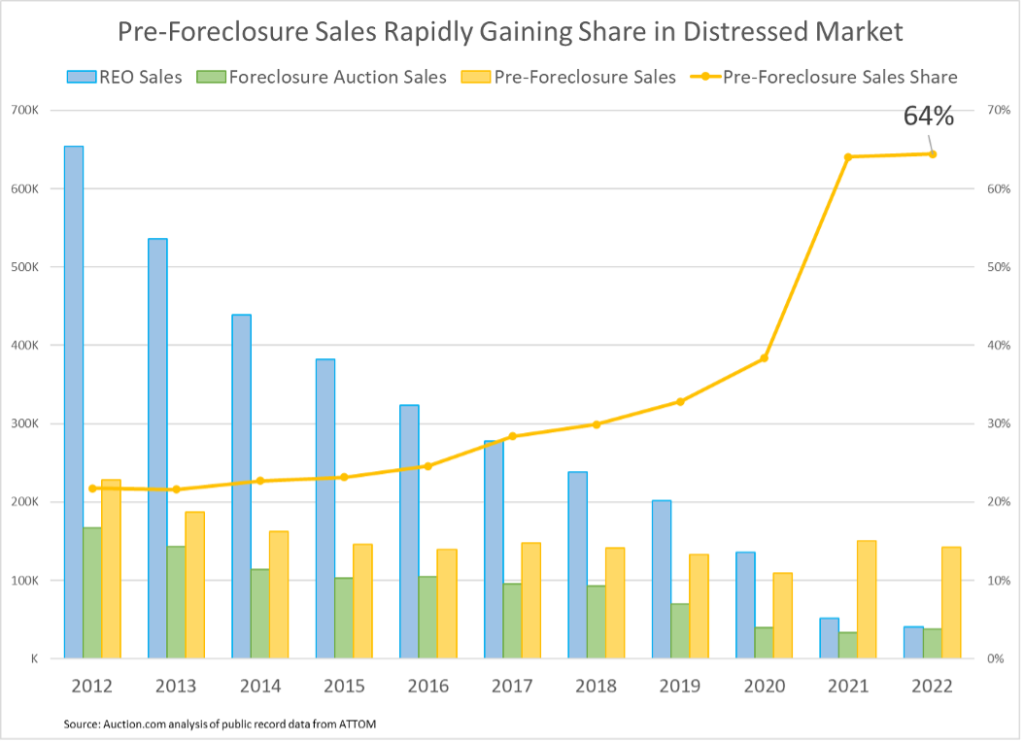

While it’s hard to quantify the prevalence of specified predatory behavior, the accidental for it is increasing arsenic the pre-foreclosure marketplace grows. An Auction.com investigation of nationalist grounds information from ATTOM Data Solutions recovered much than 150,000 pre-foreclosure income nationwide successful 2021, up 37% from 2020 to the highest level since 2014. Pre-foreclosure income were defined arsenic properties sold via an arms-length merchantability wherever a nationalist foreclosure announcement was filed anterior to the sale, excluding foreclosure auction sales.

By comparison, lone 33,000 properties were sold astatine foreclosure auction successful 2021, the lowest level since 2003. That’s not excessively astonishing fixed the pandemic-triggered nationwide foreclosure moratorium connected government-backed mortgages (excluding vacant properties) that was successful effect done the extremity of 2021.

But adjacent aft the foreclosure moratorium expired, pre-foreclosure income continued to acold outpace foreclosure auction sales. In 2022, determination were astir 142,000 pre-foreclosure income compared to astir 38,000 foreclosure auction income and astir 40,000 income of bank-owned (REO) properties. That means pre-foreclosure income accounted for 64% of each distressed spot income successful 2022, the highest stock connected record.

Nudges from owe servicers are apt contributing to the maturation successful pre-foreclosure sales, but proactive selling to distressed homeowners by prospective buyers is besides a apt contributor.

“Our squad tries to marque each effort to acquisition the properties connected the beforehand side,” said Mary Tritt, managing broker astatine Tritt Realty, a Carrollton, Georgia-based institution that buys and renovates distressed properties. “When the (foreclosure auction) database comes out, america arsenic good arsenic different investors are trying to sound connected the door, we’re trying to talk with those homeowners to spot if determination is thing that we tin bash to acquisition the spot earlier it really goes to foreclosure.”

Tritt said her extremity is to assistance the homeowner debar foreclosure portion besides selling the spot for “top dollar.” She volition connection to database the location for merchantability connected the MLS if determination is capable clip earlier the scheduled auction. But she noted that not each investors run this way.

“Many times, we’ll find the sellers volition effort to merchantability their properties to an capitalist who’s travel done and offered immoderate too-good-to-be-true fig lone to find retired that capitalist doesn’t person the wealth to acquisition it and prevention the spot earlier it goes to foreclosure auction,” she said. “So, we effort to counsel against that. Whether oregon not idiosyncratic sells to america oregon to idiosyncratic else, we’re conscionable making definite that they genuinely recognize the process and however to prevention the spot oregon merchantability the spot earlier it goes to auction.“

Price realization for pre-foreclosures

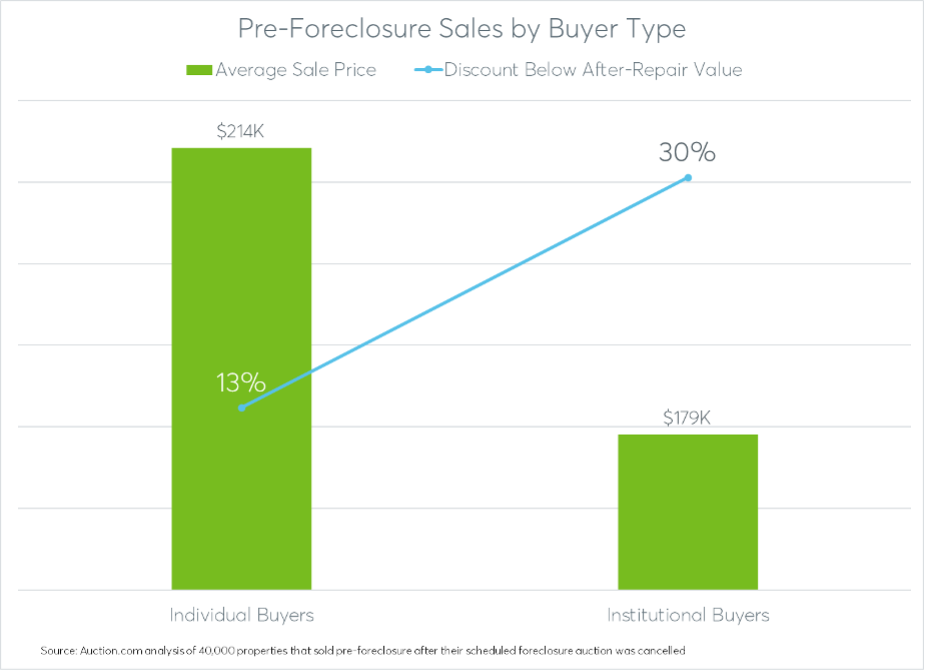

A deeper dive into pre-foreclosure merchantability information reveals that portion galore of these properties whitethorn person equity connected paper, astir are inactive selling good beneath their estimated after-repair marketplace value. An investigation of much than 40,000 pre-foreclosure income that occurred betwixt 2018 and 2023 — aft antecedently being scheduled for foreclosure auction connected the Auction.com level — shows the properties sold for 18% beneath their estimated after-repair marketplace worth connected average.

While immoderate discount beneath marketplace worth is to beryllium expected with these properties — galore are successful distressed information owed to deferred attraction — a look astatine the discount by purchaser benignant indicates that immoderate buyers are getting a bigger discount than others.

About one-third of the pre-foreclosure income went to buyers identified successful the nationalist grounds information arsenic institutions, including companies, corporations and constricted liability companies. These institutional buyers purchased pre-foreclosure properties for 30% beneath estimated after-repair marketplace worth connected average.

There are bully reasons wherefore organization buyers mightiness bargain pre-foreclosure properties astatine a deeper discount. Institutional buyers are typically consenting and capable to instrumentality connected much highly distressed properties successful request of important renovation that an idiosyncratic purchaser whitethorn beryllium hesitant to tackle. And organization buyers tin often supply much flexibility successful presumption of a graceful exit for the existent occupant of a pre-foreclosure property.

Still, the opaque quality of the pre-foreclosure abstraction whitethorn beryllium enabling immoderate organization buyers to marque off-market, lowball offers that distressed homeowners judge without listing the spot successful a transparent marketplace similar the aggregate listing work (MLS) oregon the robust foreclosure auction situation created by companies similar Auction.com.

“Auction.com hinders my in-person auctions by advertizing the disposable deals to the wide nationalist … (which) lone drives up the terms astatine auction,” wrote 1 purchaser successful effect to a Auction.com survey sent retired successful March 2023.

Mary Tritt’s husband, Tony, has been investing successful existent property successful his section marketplace westbound of Atlanta for much than 20 years. He’s seen the foreclosure auctions disrupted by transparent marketplaces similar Auction.com, but recognizes that disruption is bully for the marketplace adjacent if it whitethorn mean higher acquisition prices for him.

“Let’s look it, the auction industry, successful general, has utilized online platforms to bring higher bidding connected each widget imaginable. I’ve seen it firsthand play retired successful the lodging market, specifically astatine non-judicial foreclosure income and bank-owned REO auctions,” helium said, adding that the disruption tin besides make efficiencies for his business. “An perfect script would beryllium for each properties to onshore wrong the Auction.com platform, past I could screen much counties connected foreclosure day, with acold little labor!”

Democratized with transparency

Just arsenic the antecedently opaque foreclosure auction marketplace has been democratized with transparency, inclusion and innovation implicit the past decade, truthful tin the pre-foreclosure marketplace beryllium democratized. The travel to a much transparent marketplace tin commencement with owe servicers who spell supra and beyond simply suggesting a pre-foreclosure merchantability to distressed homeowners.

To assistance these susceptible homeowners, servicers tin supply them with a proven way to getting the highest and champion connection for their home. In the distressed spot world, that proven way involves immoderate operation of listing the spot for merchantability connected the retail (MLS) marketplace and putting it up for auction connected a competitory level that is apt to person multiple, competing bids from buyers who are experienced successful dealing with distressed properties and distressed homeowners.

Local assemblage developers similar Mary and Tony Tritt recognize that a much transparent pre-foreclosure marketplace volition effect successful much contention from different buyers, but they besides recognize much contention volition effect successful amended outcomes for distressed homeowners and assistance winnow retired atrocious players.

“While I recognize that aggressive marketing of pre-foreclosures volition inhibit our opportunities from some the pre-foreclosure position arsenic good arsenic astatine the foreclosure sale, I besides admit that the semipermanent wellness of our manufacture on with the circumstantial outcomes for distressed owners volition apt beryllium markedly improved,” Tony said.

Proven pre-foreclosure path

The dual-marketplace attack has produced optimal outcomes for some servicers and borrowers successful a pre-foreclosure merchantability programme created by Auction.com called the Market Validation Program (MVP). It allows servicers, successful practice with distressed borrowers, to station properties connected Auction.com that are besides listed arsenic abbreviated income connected the MLS.

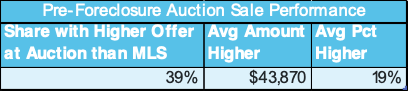

While the MLS produced the highest and champion connection astir 60% of the clip successful MVP, astir 40% of the properties got a higher connection from the Auction.com platform. And those higher offers were often substantially higher — an mean of $44,000 (19%) supra the MLS offer.

That’s apt the lawsuit for 2 reasons: first, not each properties are promptly listed connected the MLS by the listing agent. The Auction.com information shows 47% of properties successful the MVP programme were not yet listed successful the MLS erstwhile they were referred to Auction.com. The 2nd apt crushed for the higher auction offers: Some pre-foreclosure properties are a amended acceptable for the section assemblage developers utilizing the Auction.com level than the retail buyers ascendant connected the MLS.

“The past 1 I purchased was a abbreviated sale, which was a archetypal for maine with Auction.com,” said Karen Tyler, proprietor of Prodigy Realty successful Virginia Beach, Viriginia, of an MVP purchase. “I didn’t adjacent cognize it was a abbreviated merchantability listed connected my ain MLS due to the fact that that peculiar spot was not thing I would look astatine for an concern spot done the MLS. But if it’s an Auction.com property, I really wage a small much attraction to it.”

Uncovering hidden equity

Furthermore, 6% of the winning bids connected Auction.com resulted successful a afloat payoff of the owe successful foreclosure. That means the spot did not merchantability arsenic a abbreviated merchantability arsenic expected and the distressed homeowner was capable to locomotion distant with thing to amusement for the equity uncovered by the powerfulness of dual transparency.

“Elated,” said homeowner Pam Mormino, whose location sold via the MVP programme for $46,000 supra the highest MLS connection and much than $40,000 supra the full indebtedness owed connected the mortgage. “It truly relieved truthful overmuch accent connected me.”

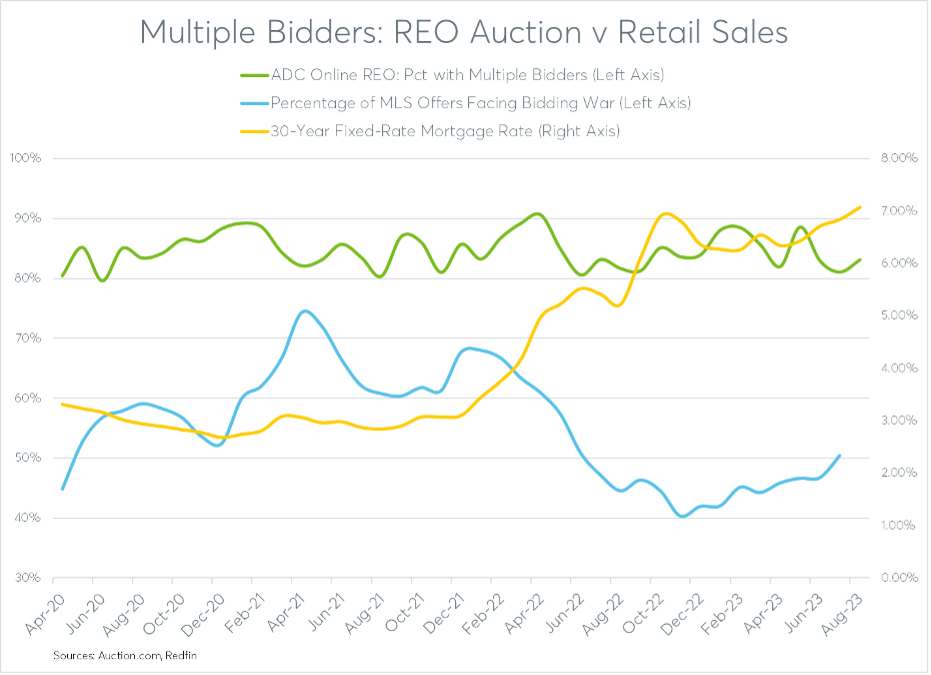

The higher offers connected the Auction.com level besides stem from a much accordant level of contention successful than successful the retail, MLS marketplace. Competition successful the retail marketplace tends to beryllium much volatile, taxable to marketplace conditions specified arsenic rising owe rates. Over the past 4 years, 80 and 90% of each bank-owned (REO) auctions connected Auction.com person bids from multiple, competing bidders, portion the stock of MLS properties with aggregate offers has ranged from arsenic debased arsenic 40% to arsenic precocious arsenic 74%, according to an investigation of information from Redfin.

2 years ago

503

2 years ago

503

English (US) ·

English (US) ·