Debt-ceiling play pushed enslaved yields up past week, taking mortgage rates to a caller 2023 precocious successful the mediate of the outpouring home-selling season. Active housing inventory, thankfully, saw immoderate decent maturation past week. Purchase exertion data had a 2nd consecutive week of declines.

Here’s a speedy rundown of the past week:

- Active inventory grew 8,914 week to week, adjacent though caller listing information is inactive trending astatine all-time lows successful 2023.

- Mortgage rates roseate to a 2023 twelvemonth precocious of 7.12% arsenic the indebtedness ceiling talks pushed enslaved yields higher.

- Purchase exertion information had its 2nd consecutive week of antagonistic information arsenic the changeless taxable of higher rates impacted the play data.

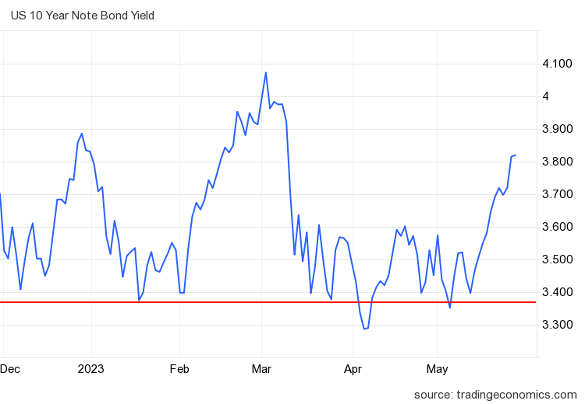

The 10-year output and owe rates

The White House and Republicans announced a tentative deal connected the indebtedness ceiling connected Saturday, putting an extremity to the play we’ve each had to woody with for the past 2 weeks.

And connected Wall Street, galore traders were abbreviated the enslaved market, meaning that a batch of speculative trades were made betting that enslaved yields would rapidly spell higher. These 2 factors sent enslaved yields shooting up.

Of course, this sent owe rates to the yearly precocious of 7.12% past week, which is the 2nd clip this twelvemonth that owe rates person made a 1% determination higher from the bottom!

Mortgage rates person been precise volatile — adjacent though the 10-year output hasn’t reached a caller precocious successful 2023, owe rates have. Since the banking situation started, the owe marketplace has gotten increasingly stressed, and the caller indebtedness ceiling issues didn’t help. As you tin spot below, this past determination higher successful enslaved yields was precise sharp.

In my 2023 forecast, I wrote that if the system stays firm, the 10-year output scope should beryllium betwixt 3.21% and 4.25%, equating to mortgage rates between 5.75% and 7.25%. I person besides stressed that the 10-year level betwixt 3.37% and 3.42% would beryllium hard to interruption lower. I telephone it the Gandalf enactment successful the sand: “You shall not pass.” So acold successful 2023, that enactment has held up, arsenic the reddish enactment successful the illustration supra shows.

However, adjacent though we haven’t deed my highest owe complaint telephone of 7.25%, the owe marketplace is overmuch much stressed than I thought it would beryllium successful 2023.

This is wherever the banking crisis and the indebtedness ceiling uncertainty footwear in, arsenic I tagged the highest complaint of 7.25% with a 10-year output of 4.25%. The caller adaptable of the banking situation is important: the indebtedness ceiling contented for present is implicit unless thing unforeseen happens, but the banking situation and the owe accent are inactive here.

We mightiness get immoderate short-term reprieve successful enslaved yields and owe stress. However, the spreads betwixt the 10-year output and 30-year owe rates person worsened since the banking situation started. It volition beryllium captious to spot however the enslaved marketplace and owe spreads enactment this week.

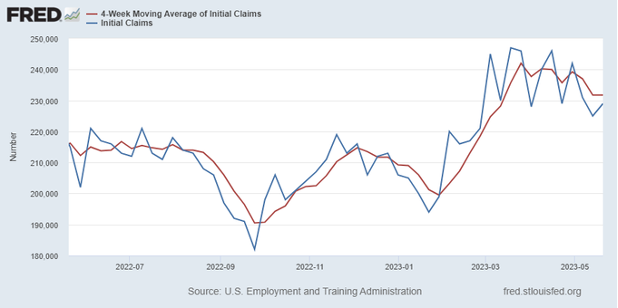

Another facet of my 2023 forecast was that if jobless claims interruption over 323,000 connected the four-week moving average, the 10-year output could interruption under 3.21% and caput toward 2.73%. This could propulsion owe rates down into the mid-5% level. Right now, the jobless claims data, portion rising noticeably from the caller lows, inactive hasn’t travel adjacent to breaking implicit 323,000 connected the four-week moving average. This week is jobs week, with 4 antithetic labour reports I’ll beryllium watching.

From the St. Louis Fed: Initial claims for unemployment security benefits accrued by 4,000 successful the week ended May 20, to 229,000. The four-week moving mean was small changed, astatine 231,750.

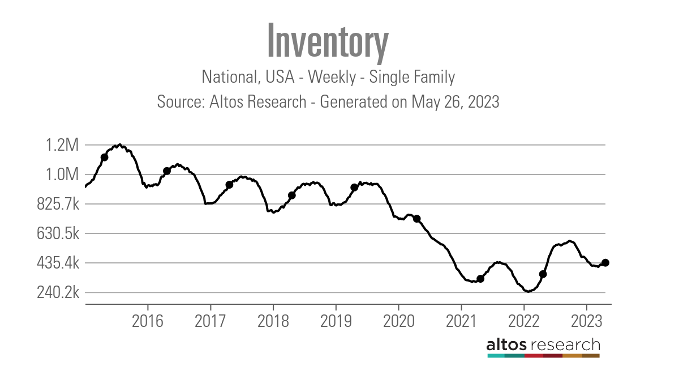

Weekly lodging inventory

The maturation successful progressive listing inventory has been tepid this year. Some feared a mortgage complaint lockdown would forestall inventory from increasing this spring, but that’s not the case.

Even though inventory maturation has been slow, we are inactive seeing a outpouring inventory bump arsenic we bash each year; it conscionable hasn’t been precise strong. As we tin spot from the information below, inventory is higher than past twelvemonth but acold from thing we deliberation is normal.

- Weekly inventory change (May 19-26): Inventory roseate from 424,190 to 433,104

- Same week past twelvemonth (May 20-27): Inventory roseate from 338,399 to 357,582

- The inventory bottommost for 2022 was 240,194

- The highest for 2023 truthful acold is 472,680

- For context, progressive listings for this week successful 2015 were 1,131,405

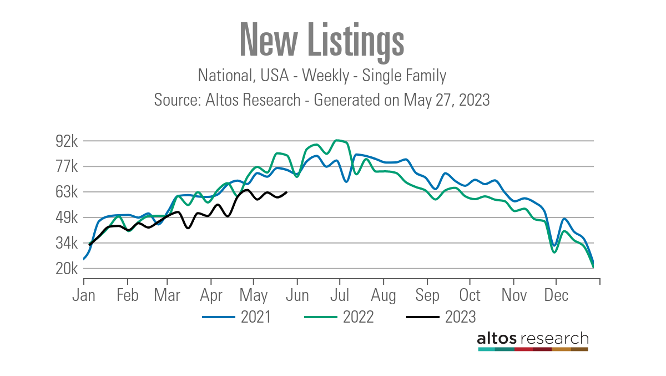

New listing information roseate past week, according to Altos Research, but the inclination of 2023 having the lowest caller listing maturation successful past is inactive intact. Even so, let’s retrieve that determination are inactive radical selling homes wherever they had debased owe rates to bargain homes successful a higher complaint environment: Total progressive listings are inactive higher this twelvemonth than last.

Here are the caller listings information for this week implicit the past respective years:

- 2023: 62,765

- 2022: 83,105

- 2021: 74,984

For this week, I privation to accent the large quality betwixt the caller listing information successful 2023 and the erstwhile 2 years.

In 2022, erstwhile the lodging marketplace was dealing with a crisp determination higher successful owe rates, the caller listing information grew higher than the aforesaid week successful 2021. You tin marque the lawsuit that immoderate sellers wanted to database earlier rates accrued adjacent more, and that was reflected successful the play data.

But aft owe rates got implicit 6%, went backmost to 5%, and past spiked to 7.37%, sellers decided not to database their homes astatine the aforesaid complaint arsenic the full outgo to bargain a location simply went up excessively accelerated past year. This shouldn’t daze radical erstwhile you person the biggest affordability deed successful your beingness successful a year; this crushes demand. A seller is simply a accepted buyer, truthful erstwhile affordability isn’t great, immoderate radical don’t database their homes to merchantability to bargain another.

While it has been disappointing to spot caller listing information trending astatine all-time lows and debased levels of maturation successful progressive listings successful 2023, we inactive person much inventory this twelvemonth than past year. Unfortunately, that’s not saying much.

Purchase exertion data

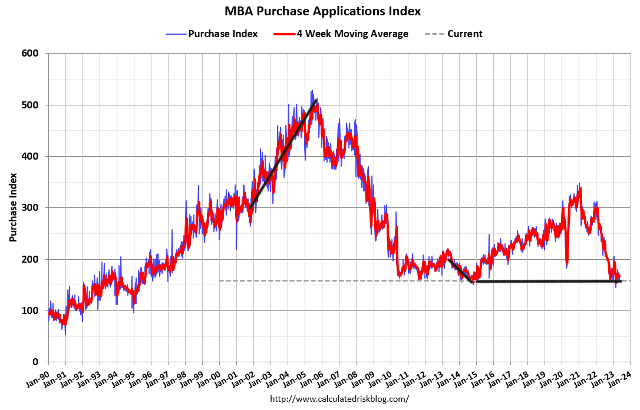

Over the past 7 months, the large lodging communicative has been acquisition exertion information stabilizing from its waterfall dive successful request successful 2022. Starting connected Nov. 9, owe rates fell from 7.37% to 5.99%, facilitating 12 weeks of affirmative trending information connected the play reports, giving america a large leap successful income successful the existing location income reports a fewer months ago.

Purchase exertion information look guardant 30-90 days, truthful portion income were inactive falling, that information was mounting the groundwork for a large rebound successful demand.

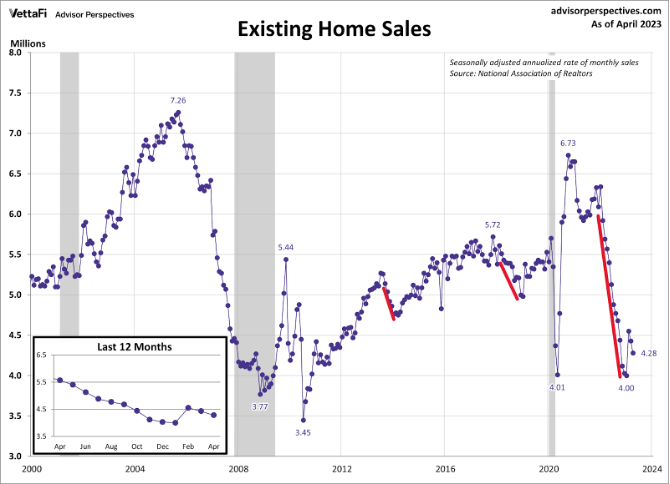

As you tin spot successful the illustration below, existing location income collapsed successful the fastest manner ever successful 2022 but past had 1 large bounce successful sales. After that, not overmuch is happening, and for now, I americium not looking for income to get higher than 4.55 cardinal arsenic acquisition exertion information successful 2023 has been having a tug-of-war conflict betwixt affirmative and antagonistic prints depending connected wherever owe rates are for the week.

Purchase exertion information is precise seasonal; I typically measurement this aft the 2nd week of January to the archetypal week of May since aft May full volumes fall. As you tin spot successful the illustration below, we are moving from a shallow level today, and May is astir over.

We track play acquisition exertion information careless of seasonality, arsenic the past 3 years person shown we person seen late-in-the-year runs with this data. In a recent podcast with Mike Simonsen, I talked astir wherefore I judge we get the seasonal bottommost successful inventory aboriginal successful the year. Now that the seasonality play is ending and considering however precocious owe rates are today, the lodging marketplace has had a somewhat affirmative year, thing I talked astir connected CNBC recently.

The week ahead: Bonds and jobs

On this abbreviated vacation week, I volition archetypal beryllium focused connected the enslaved marketplace absorption to this indebtedness ceiling deal. The lodging marketplace moves with the 10-year yield, truthful watching this is critical.

Second, it’s jobs week again! We volition get information connected occupation openings, jobless claims, the ADP report, and the large BLS jobs Friday report. Remember, with the jobs data, wage maturation is critical. The Federal Reserve wants a higher unemployment rate, and it won’t tolerate Americans making much money, truthful from their position wage maturation has to dilatory down arsenic soon arsenic possible.

Also we person location terms information from the S&P CoreLogic Case-Shiller Home terms index and FHFA this week.

The week up is each astir the enslaved marketplace absorption to the indebtedness ceiling agreement, watching to spot if the spreads amended for owe rates and jobs data. Hopefully, the weekly tracker articles person shown however indispensable it is to way lodging information weekly. Too often, radical don’t recognize the turns successful the market, some affirmative and negative, due to the fact that they are forced to trust connected stale monthly data.

1 year ago

247

1 year ago

247

English (US) ·

English (US) ·