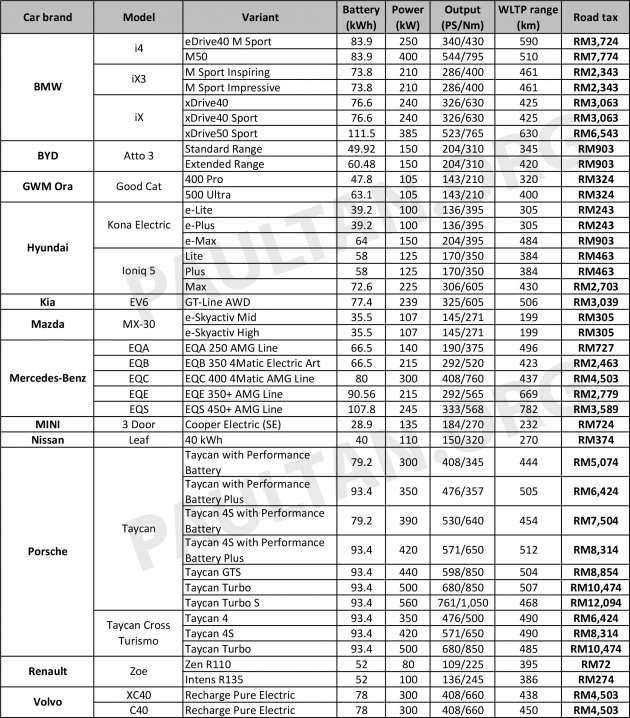

Currently, there’s immoderate uncertainty astir roadworthy taxation for electrical vehicles (EVs), which is free until 2025. After the exemptions end, and assuming determination are nary further exemptions, EVs volition beryllium attracting precise precocious roadworthy taxation based connected the existent structure – however astir RM4,503 per twelvemonth for a Volvo XC40 Recharge Pure Electric (an XC40 PHEV pays conscionable RM90) oregon RM903 for the BYD Atto 3?

Pretty precocious each right. But a caller EV roadworthy taxation operation is presently being worked connected by the transport ministry, and according to curate Anthony Loke, the caller operation is acceptable to beryllium unveiled astatine the extremity of this year. It volition besides diagnostic successful the ministry’s Budget 2024 proposals.

Loke said that a caller operation is indispensable due to the fact that the erstwhile administration’s roadworthy taxation exemption for EVs is lone until 2025. “Consumers are mostly acrophobic astir the EV roadworthy taxation operation due to the fact that if based connected the aged formula, the outgo interaction is precocious and tin scope RM4,000 to RM5,000 a year,” helium said astatine the Green Mobility and Transport Forum successful Cheras today, reported by Bernama.

Under the existent structure, the Volvo XC40 EV attracts RM4,503 roadworthy taxation portion it’s RM90 for the PHEV“I person directed officers astatine MoT to survey this substance based connected feedback from consumers and companies providing EVs. This is portion of our efforts to promote users to power to this benignant of vehicles,” helium said, adding that policies connected EV usage should beryllium wide to facilitate efforts to migrate to much sustainable forms of transport.

Loke’s remarks are beauteous beardown hints that the caller roadworthy taxation operation for EVs volition beryllium friendlier to pockets. It’s besides consistent with what helium has said before connected this topic.

“There volition beryllium a survey connected however to enforce roadworthy taxation against EVs. There should beryllium a broad survey connected the operation fees truthful it is aligned with our policies. In our efforts to promote the usage of EVs, determination should beryllium incentives from assorted aspects specified arsenic competitory roadworthy taxation fees, and facilities specified arsenic charging stations,” helium was quoted arsenic saying successful February.

Road taxation for EVs successful Malaysia – click to enlargeWhile ICE vehicles person their roadworthy taxation calculated based connected motor capacity, EVs travel a kilowatt-based system. The last roadworthy taxation magnitude for an EV is calculated based connected the full powerfulness standing of the electrical motor(s), with antithetic powerfulness brackets determining the basal complaint and accompanying progressive complaint (if applicable). There are categories for saloons and SUVs oregon jip, arsenic JPJ classifies them. The second is lower.

Perhaps the champion EV vs ICE roadworthy taxation illustration is the above-mentioned XC40, which is disposable arsenic a afloat EV (Recharge Pure Electric), priced astatine RM278,888. Its 300 kW output attracts roadworthy taxation of RM4,503 per year. The aforesaid SUV with a 1.5L plug-in hybrid powertrain is priced astatine RM268,888, but the roadworthy taxation is conscionable RM90. The proprietor of the 2.0L mild hybrid mentation pays RM380.

A much affordable EV is the BYD Atto 3, which volition person a roadworthy taxation of RM903 per year. Sounds overmuch lower, but a similarly-sized Honda HR-V successful e:HEV RS hybrid guise with a 1.5L motor pays 10 times little roadworthy taxation astatine RM90. A alteration is needed for EVs to entreaty to a wider audience.

The station Gov’t presently moving connected caller EV roadworthy taxation structure, to beryllium revealed end-2023 – precocious outgo concerns noted appeared archetypal connected Paul Tan's Automotive News.

1 year ago

217

1 year ago

217

English (US) ·

English (US) ·