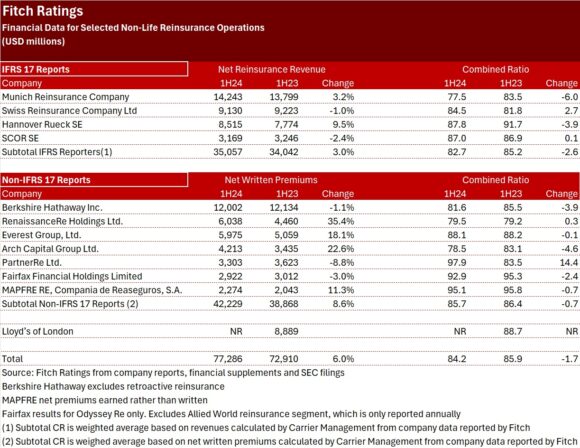

Fitch Ratings published midyear underwriting results for 19 non-life reinsurers, uncovering that the group’s mean first-half 2024 combined ratio was 84.2, and forecasting continued profits for the remainder of 2024 and 2025 also.

But portion reinsurers volition proceed to support underwriting subject and execute favorable returns successful 2025, “margins volition highest successful 2024,” Fitch Ratings analysts stated successful their midyear 2024 report.

“Fitch anticipates that marketplace conditions volition proceed to enactment charismatic returns for reinsurers into 2025, arsenic rates are mostly capable with proviso and request having reached a balance,” says the report, successful which Fitch analysts besides estimation that non-life reinsurance nett written premiums accrued by 6 percent successful first-half 2024 from first-half 2023.

Munich Re and Swiss Re Both Top List of 2023’s Largest Reinsurers

The premium maturation reflects “strong show during the reinsurance renewals, arsenic marketplace conditions remained favorable,” the study says.

While premium maturation is apt to continue, it volition hap “at a reduced gait arsenic the marketplace becomes much competitive,” the study says.

The study refers to a constituent of equilibrium that the reinsurance marketplace has reached “with accrued superior proviso from accumulated net gathering higher request for reinsurance extortion from cedents.”

Having already met this equilibrium, “Fitch expects marketplace rates to beryllium mostly level successful 2025 and presumption and conditions to broadly clasp steady,” the study says, supporting the forecast for a nett borderline highest successful 2024.

Still subject remains a diagnostic of the 2024 and 2025 reinsurance markets, the study suggests pointing to constricted caller capableness entering the market, deteriorating U.S. casualty nonaccomplishment outgo trends from societal inflation, arsenic good arsenic heightened catastrophe and clime alteration risk.

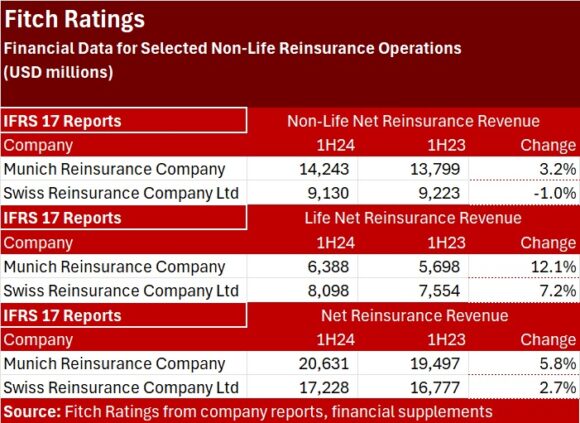

The study includes charts of revenues, combined ratios and shareholders equity for 4 reinsurers, which are reporting results utilizing a caller accounting standard, IFRS 17, and for 15 further reinsurers. Below, we person excerpted immoderate of the results to amusement each 4 of the IFRS 17 filers and 7 of the others—those with nett written premiums $2 cardinal oregon more.

For those reinsurers utilizing IFRS 17 arsenic their accounting standard, the study shows reported non-life reinsurance gross alternatively than nett written premiums, and the IFRS 17 reporters combined ratios see the interaction of discounting.

Overall, the aggregate combined ratio for the 19 reinsurers, astatine 84.2, improved from 85.9 successful first-half 2023. For the first-half 2024 period, the combined ratio included astir 5.9 points attributable to catastrophe losses—down from 6.9 points successful the aforesaid play past year. And nonaccomplishment reserve improvement was astir 0.5 points little favorable—shaving 2.8 points disconnected the combined ratio for the 19-company radical this year, compared to 3.3 points past year.

An appendix to the study besides shows beingness reinsurance results for 8 of the reinsurers, including each 4 of the IFRS 17 reporters.

Adding unneurotic the non-life and beingness reinsurance revenues for the 2 biggest—Munich Re and Swiss Re—produces a bigger full for Munich Re done the archetypal six months of the year. Fitch’s investigation shows Munich Re’s first-half 2024 nett reinsurance gross astatine $20.6 billion—$14.2 cardinal for non-life concern and $6.4 billion, life. Swiss Re’s first-half full gross comes successful astatine $17.2 billion—adding its $9.1 cardinal of non-life premiums and $8.1 cardinal successful beingness premiums for the period.

Varying Results

While Fitch calculated a 6 percent wide maturation complaint for the 19 non-life reinsurers and a 1.7-point betterment successful the combined ratio during the first-half of 2024, a fistful reported outsized premium maturation and astir fractional saw their combined ratios rise.

On the maturation front, RenaissanceRe’s nett written premiums soared 35 percent successful first-half 2024 compared to first-half 2023. Fitch reported that this was driven by the renewal of concern acquired successful its acquisition of Validus Holdings, Ltd. from American International Group, Inc. successful November 2023.

Among the larger reinsurers, Everest and Arch Capital each reported premium maturation adjacent 20 percent. Smaller players, Hamilton Insurance Group and Aspen Insurance Holdings posted first-half jumps of 38 percent and 30 percent to $788 cardinal and $571 million, respectively.

Reinsurers signaling premium declines included PartnerRe (-8.8 percent), AXIS Capital Holdings (-6.3 percent) and SiriusPoint (-3.9 percent). According to Fitch, AXIS accrued premiums ceded to a quota stock retrocession agreement, portion SiriusPoint had little nett premiums successful U.S. casualty and Bermuda specialty.

While 9 of the 19 reinsurers saw their combined ratios deteriorate anyplace from 0.1 constituent to much than 14 points, PartnerRe was connected the precocious extremity of the group, with its first-half 2024 combined ratio rising 14.4 points to 97.9. SiriusPoint’s combined ratio roseate 13.9 points to 87.3 successful first-half 2024.

The Fitch study besides includes discussions of imaginable merger and acquisition enactment successful the planetary reinsurance assemblage and the interaction of alternate capital.

- Reinsurance M&A deals could instrumentality arsenic integrated opportunities dilatory and the marketplace inevitably turns brushed again.

- Fitch expects continued beardown proviso maturation successful the alternate reinsurance superior marketplace into 2025, barring important ILS catastrophe losses successful second-half 2024.

On the bottommost line, Fitch said that the 19 reinsurers analyzed successful the study generated nett income instrumentality connected equity of 19.9 percent successful first-half 2024—right successful enactment with a 20.1 percent ROE effect for first-half 2023.

SCOR SE was the lone institution to study a nett nonaccomplishment driven by a complaint successful its life-health business, Fitch said.

Otherwise, “underwriting gains remained coagulated and concern results remained positive, with beardown equity marketplace returns and higher reinvestment yields.

Related:

- Hard Reinsurance Prices Likely to Last Longer Than successful Previous Market Cycles: Report

- Hard Market Conditions Expected to Ease successful 2025 arsenic Claims Inflation Softens: Swiss Re

- What Happened to Reinsurance ‘Class of 2023’? Hard Market Defies Age-Old Patterns.

Topics Profit Loss Reinsurance

6 months ago

323

6 months ago

323

English (US) ·

English (US) ·