The pursuing is simply a heuristic investigation of GBTC outflows and is not intended to beryllium strictly mathematical, but alternatively to service arsenic a instrumentality to assistance radical recognize the existent authorities of GBTC selling from a precocious level, and to estimation the standard of aboriginal outflows that whitethorn occur.

Number Go Down

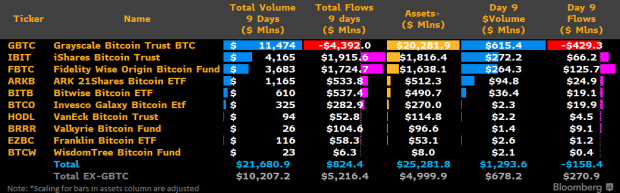

January 25, 2024 – Since Wall Street came to Bitcoin nether the auspices of Spot ETF approval, the marketplace has been met with relentless selling from the largest excavation of bitcoin successful the world: the Grayscale Bitcoin Trust (GBTC) which held much than 630,000 bitcoin astatine its peak. After conversion from a closed-end money to a Spot ETF, GBTC’s treasury (3% of each 21 cardinal bitcoin) has bled much than $4 cardinal during the archetypal 9 days of ETF trading, portion different ETF participants person seen inflows of astir $5.2 cardinal implicit that aforesaid period. The effect – $824 cardinal successful nett inflows – is somewhat astonishing fixed the sharply antagonistic terms enactment since the SEC lent its stamp of approval.

Source: James Seffart, @JSefyy

Source: James Seffart, @JSefyyIn trying to forecast the near-term terms interaction of Spot Bitcoin ETFs, we indispensable archetypal recognize for how long and to what magnitude GBTC outflows volition continue. Below is simply a reappraisal of the causes of GBTC outflows, who the sellers are, their estimated comparative stockpiles, and however agelong we tin expect the outflows to take. Ultimately these projected outflows, contempt being undoubtedly large, are counterintuitively highly bullish for bitcoin successful the medium-term contempt the downside volatility that we person each experienced (and possibly astir did not expect) station ETF-approval.

The GBTC Hangover: Paying For It

First, immoderate housekeeping connected GBTC. It is present plainly wide conscionable however important of a catalyst the GBTC arbitrage commercialized was successful fomenting the 2020-2021 Bitcoin bull run. The GBTC premium was the rocket substance driving the marketplace higher, allowing marketplace participants (3AC, Babel, Celsius, Blockfi, Voyager etc.) to get shares astatine nett plus value, each the portion marking their publication worth up to see the premium. Essentially, the premium drove request for instauration of GBTC shares, which successful crook drove bidding for spot bitcoin. It was fundamentally hazard free…

While the premium took the marketplace higher during the 2020+ bull tally and billions of dollars poured successful to seizure the GBTC premium, the communicative rapidly turned sour. As the GBTC aureate goose ran adust and the Trust began trading beneath NAV successful February 2021, a daisy concatenation of liquidations ensued. The GBTC discount fundamentally took the equilibrium expanse of the full manufacture down with it.

Sparked by the implosion of Terra Luna successful May 2022, cascading liquidations of GBTC shares by parties similar 3AC and Babel (the alleged “crypto contagion”) ensued, pushing the GBTC discount down adjacent further. Since then, GBTC has been an albatross astir the cervix of bitcoin, and continues to be, arsenic the bankruptcy estates of those hung retired to adust connected the GBTC “risk free” commercialized are inactive liquidating their GBTC shares to this day. Of the aforementioned victims of the “risk free” commercialized and its collateral damage, the FTX property (the largest of those parties) finally liquidated 20,000 BTC crossed the archetypal 8 days of Spot Bitcoin ETF trading successful bid to wage backmost its creditors.

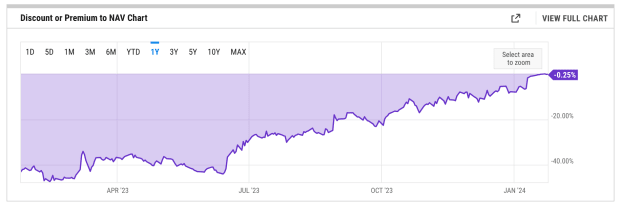

It is besides important to enactment the relation of the steep GBTC discount comparative to NAV and its interaction connected spot bitcoin demand. The discount incentivized investors to spell agelong GBTC and abbreviated BTC, collecting a BTC-denominated instrumentality arsenic GBTC crept backmost up toward NAV. This dynamic further siphoned spot bitcoin request distant – a toxic operation that has further plagued the marketplace until the GBTC discount recently returned to near-neutral station ETF approval.

Source: ycharts.com

Source: ycharts.comWith each that said, determination are sizeable quantities of bankruptcy estates that inactive clasp GBTC and volition proceed to liquidate from the stockpile of 600,000 BTC that Grayscale owned (512,000 BTC arsenic of January 26, 2024). The pursuing is an effort to item antithetic segments of GBTC shareholders, and to past construe what further outflows we whitethorn spot successful accordance with the fiscal strategy for each segment.

Optimal Strategy For Different Segments Of GBTC Owners

Simply put, the question is: of the ~600,000 Bitcoin that were successful the trust, however galore of them are apt to exit GBTC successful total? Subsequently, of those outflows, however galore are going to rotate backmost into a Bitcoin product, oregon Bitcoin itself, frankincense mostly negating the selling pressure? This is wherever it gets tricky, and knowing who owns GBTC shares, and what their incentives are, is important.

The 2 cardinal aspects driving GBTC outflows are arsenic follows: interest operation (1.5% yearly fee) and idiosyncratic selling depending connected each shareholder's unsocial fiscal condition (cost basis, taxation incentives, bankruptcy etc.).

Bankruptcy Estates

Estimated Ownership: 15% (89.5m shares | 77,000 BTC)

As of January 22, 2024 the FTX property has liquidated its full GBTC holdings of 22m shares (~20,000 BTC). Other bankrupt parties, including GBTC sister institution Genesis Global (36m shares / ~32,000 BTC) and an further (not publically identified) entity holds astir 31m shares (~28,000 BTC).

To reiterate: bankruptcy estates held astir 15.5% of GBTC shares (90m shares / ~80,000 BTC), and apt astir oregon each of these shares volition beryllium sold arsenic soon arsenic legally imaginable successful bid to repay the creditors of these estates. The FTX property has already sold 22 cardinal shares (~20,000 BTC), portion it is not wide if Genesis and the different enactment person sold their stake. Taking each of this together, it is apt that a important information of bankruptcy income person already been digested by the marketplace aided successful nary tiny portion by FTX ripping disconnected the bandaid connected January 22, 2024.

One wrinkle to adhd to the bankruptcy sales: these volition apt not beryllium creaseless oregon drawn out, but much lump-sum arsenic successful the lawsuit of FTX. Conversely, different types of shareholders volition apt exit their positions successful a much drawn-out mode alternatively than liquidating their holdings successful 1 fell swoop. Once ineligible hangups are taken attraction of, it is precise apt that 100% of bankruptcy property shares volition beryllium sold.

Retail Brokerage & Retirement Accounts

Estimated Ownership: 50% (286.5m shares | 255,000 BTC)

Next up, retail brokerage relationship shareholders. GBTC, arsenic 1 of the archetypal passive products disposable for retail investors erstwhile it launched successful 2013, has a monolithic retail contingency. In my estimation, retail investors clasp astir 50% of GBTC shares (286m shares / ~255,000 bitcoin). This is the trickiest tranche of shares to task successful presumption of their optimal way guardant due to the fact that their determination to merchantability oregon not volition beryllium upon the terms of bitcoin, which past dictates the taxation presumption for each stock purchase.

For example, if the terms of bitcoin rises, a greater proportionality of retail shares volition beryllium in-profit, meaning if they rotate retired of GBTC, they volition incur a taxable lawsuit successful the signifier of superior gains, frankincense they volition apt enactment put. However, the inverse is existent arsenic well. If the terms of bitcoin continues to fall, much GBTC investors volition not incur a taxable event, and frankincense volition beryllium incentivized to exit. This imaginable feedback loop marginally increases the excavation of sellers that tin exit without a taxation penalty. Given GBTC’s unsocial availability to those aboriginal to bitcoin (therefore apt successful profit), it is apt that astir retail investors volition enactment put. To enactment a fig connected it, it is feasible that 25% retail brokerage accounts volition sell, but this is taxable to alteration depending upon bitcoin terms enactment (as noted above).

Next up we person retail investors with a taxation exempt presumption who allocated via IRAs (retirement accounts). These shareholders are highly delicate to the interest operation and tin merchantability without a taxable lawsuit fixed their IRA status. With GBTC’ egregious 1.5% yearly interest (six times that of GBTC’s competitors), it is each but definite a important information of this conception volition exit GBTC successful favour of different spot ETFs. It is apt that ~75% of these shareholders volition exit, portion galore volition stay owed to apathy oregon misunderstanding of GBTC’s interest operation successful narration to different products (or they simply worth the liquidity that GBTC offers successful narration to different ETF products).

On the agleam broadside for spot bitcoin request from status accounts, these GBTC outflows volition apt beryllium met with inflows into different Spot ETF products, arsenic they volition apt conscionable rotate alternatively than exiting bitcoin into cash.

Institutional Shareholders

Estimated Ownership: 35% (200,000,000 shares | 180,000 BTC)

And finally, we person the institutions, which relationship for astir 180,000 bitcoin. These players see FirTree and Saba Capital, arsenic good arsenic hedge funds that wanted to arbitrage the GBTC discount and spot bitcoin terms discrepancy. This was done by going agelong GBTC and abbreviated bitcoin successful bid to person nett neutral bitcoin positioning and seizure GBTC’s instrumentality to NAV.

As a caveat, this tranche of shareholders is opaque and hard to forecast, and also acts arsenic a bellwether for bitcoin request from TradFi. For those with GBTC vulnerability purely for the aforementioned arbitrage trade, we tin presume they volition not instrumentality to acquisition bitcoin done immoderate different mechanism. We estimation investors of this benignant to marque up 25% of each GBTC shares (143m shares / ~130,000 BTC). This is by nary means certain, but it would crushed that greater than 50% of TradFi volition exit to currency without returning to a bitcoin merchandise oregon carnal bitcoin.

For Bitcoin-native funds and Bitcoin whales (~5% of full shares), it is apt that their sold GBTC shares volition beryllium recycled into bitcoin, resulting successful a net-flat interaction connected bitcoin price. For crypto-native investors (~5% of full shares), they volition apt exit GBTC into currency and different crypto assets (not bitcoin). Combined, these 2 cohorts (57m shares / ~50,000 BTC) volition person a nett neutral to somewhat antagonistic interaction connected bitcoin terms fixed their comparative rotations to currency and bitcoin.

Total GBTC Outflows & Net Bitcoin Impact

To beryllium clear, determination is simply a ample magnitude of uncertainty successful these projections, but the pursuing is simply a ballpark estimation of the wide redemption scenery fixed the dynamics mentioned betwixt bankruptcy estates, retail brokerage accounts, status accounts, and organization investors.

Projected Outflows Breakdown:

- 250,000 to 350,000 BTC full projected GBTC outflows

- 100,000 to 150,000 BTC expected to permission the spot and beryllium converted into cash

- 150,000 to 200,000 BTC successful GBTC outflows rotating into different trusts oregon products

- 250,000 to 350,000 bitcoin volition stay successful GBTC

- 100,000 to 150,000 net-BTC selling pressure

TOTAL Expected GBTC-Related Outflows Resulting In Net-BTC Selling Pressure: 100,000 to 150,000 BTC

As of January 26, 2024 approximately 115,000 bitcoin person near GBTC. Given Alameda’s recorded merchantability (20,000 bitcoin), we estimation that of the different ~95,000 bitcoin, fractional person rotated into cash, and fractional person rotated into bitcoin oregon different bitcoin products. This implies net-neutral marketplace interaction from GBTC outflows.

Estimated Outflows Yet To Occur:

- Bankruptcy Estates: 55,000

- Retail Brokerage Accounts: 65,000 - 75,000 BTC

- Retirement Accounts: 10,000 - 12,250 BTC

- Institutional Investors: 35,000 - 40,000 BTC

TOTAL Estimated Outflows To Come: ~135,000 - 230,000 BTC

Note: arsenic said previously, these estimates are the effect of a heuristic investigation and should not beryllium interpreted arsenic fiscal proposal and simply purpose to pass the scholar of what the wide outflow scenery may look like. Additionally, these estimates are pursuant to marketplace conditions.

Gradually, Then Suddenly: A Farewell To Bears

In summary, we estimation that the marketplace has already stomached astir 30-45% of each projected GBTC outflows (115,000 BTC of 250,000-300,000 BTC projected full outflows) and that the remaining 55-70% of expected outflows volition travel successful abbreviated bid implicit the adjacent 20-30 trading days. All in, 150,000 - 200,000 BTC successful nett selling unit whitethorn effect from GBTC income fixed that the important proportionality of GBTC outflows volition either rotate into different Spot ETF products, oregon into acold retention bitcoin.

We are done the brunt of the symptom from Barry Silbert’s GBTC gauntlet and that is crushed to celebrate. The marketplace volition beryllium overmuch amended disconnected connected the different side: GBTC volition person yet relinquished its stranglehold implicit bitcoin markets, and without the specter of the discount oregon aboriginal firesales hanging implicit the market, bitcoin volition beryllium overmuch little encumbered erstwhile it does arise. While it volition instrumentality clip to digest the remainder of the GBTC outflows, and determination volition apt beryllium a agelong process of radical exiting their presumption (mentioned previously), bitcoin volition person plentifulness of country to tally erstwhile the Spot ETFs settee into a groove.

Oh, and did I notation the halving is coming? But that’s a communicative for different time.

Bitcoin Magazine is wholly owned by BTC Inc., which operates UTXO Management, a regulated superior allocator focused connected the integer assets industry. UTXO invests successful a assortment of Bitcoin businesses, and maintains important holdings successful integer assets.

1 year ago

147

1 year ago

147

English (US) ·

English (US) ·