This contented is copyright to www.artemis.bm and should not look anyplace else, oregon an infringement has occurred.

Two much bid of backstage catastrophe enslaved notes person been issued by the Artex Capital Solutions managed Eclipse Re Ltd. vehicle, with these caller deals amounting to astir $12.5 cardinal successful hazard capital, taking full backstage catastrophe enslaved issuance for 2024 truthful acold to astir $400 million, according to Artemis’ information connected the feline enslaved market. It takes the fig of backstage feline bond, oregon feline enslaved lite, issuances by the Eclipse Re Ltd. operation to 7 for 2024, for a full hazard superior issued of astir $179.4 cardinal astatine this time.

It takes the fig of backstage feline bond, oregon feline enslaved lite, issuances by the Eclipse Re Ltd. operation to 7 for 2024, for a full hazard superior issued of astir $179.4 cardinal astatine this time.

Including these 2 caller bid of feline enslaved lite notes Eclipse Re has issued, with 7 bid coming to marketplace successful 2024 truthful acold it besides makes the operation the busiest of those we are capable to track.

Although remember, we tin lone way the notes that database connected the Bermuda Stock Exchange (BSX), oregon wherever the accusation comes disposable to us, truthful determination are apt galore much of these Rule 4(2), Regulation D and Regulation S benignant ILS and feline enslaved securities successful the market.

Eclipse Re Ltd. is simply a Bermuda registered peculiar intent security (SPI) institution and segregated relationship platform, that is owned and managed by insurance-linked securities (ILS) marketplace facilitator and work supplier Artex Capital Solutions.

Eclipse Re typically acts arsenic a hazard translation structure, operating connected behalf of ILS money managers and investors, converting collateralized reinsurance oregon retrocession arrangements into investable notes with features that are much akin to a catastrophe bond, truthful fully-securitized and with secondary transferability arsenic an option.

In this case, Eclipse Re Ltd. has issued a conscionable somewhat nether $5 cardinal tranche of Eclipse Re Ltd. (Series 2024-3A) notes and a $7.5 cardinal tranche of Eclipse Re Ltd. (Series 2024-4A) notes.

These 2 issues, being the sixth and seventh to travel to airy from Eclipse Re, capable successful the gaps successful bid numbering, with present 2024-1A to 2024-7A each listed successful our extended feline enslaved Deal Directory.

As ever with these backstage ILS deals having constricted information, we marque the presumption they volition some supply sum for spot catastrophe reinsurance oregon retrocessional risks for chartless cedents.

The conscionable beneath $5 cardinal of Series 2024-3A notes person been issued connected behalf of Eclipse Re’s Segregated Account EC63, with these notes having a last maturity day of May 31st 2025.

The $7.5 cardinal of Series 2024-4A notes person been issued connected behalf of Eclipse Re’s Segregated Account EC64, with these notes besides having a last maturity day of May 31st 2025.

As a result, fixed the maturity dates for these backstage feline bonds is for the extremity of May 2025, we expect they correspond the securitization of a 1 twelvemonth oregon little duration reinsurance oregon retrocession arrangement, apt from the mid-year renewals.

Both bid of notes issued by Eclipse Re person been privately placed with qualified investors.

We marque the presumption that they diagnostic reinsurance oregon retrocession arrangements that has been transformed utilizing the Eclipse Re structure, to make and contented a bid of investable, securitized catastrophe enslaved notes, typically for an ILS money manager oregon capitalist portfolio.

We don’t cognize the underlying trigger(s) oregon peril(s) for these backstage catastrophe bonds, but presume they volition beryllium immoderate benignant of spot catastrophe related risk.

The proceeds from the merchantability of the astir $12.5 cardinal of backstage feline enslaved notes crossed these 2 bid issued by Eclipse Re volition person been utilized to collateralize a related reinsurance oregon retrocession contract, with funds held successful a trust, enabling the hazard transportation and the instauration of investable catastrophe-linked securities.

As we said, with these sixth and seventh Eclipse Re deal’s of the twelvemonth included, backstage catastrophe enslaved issuance from that operation that has been tracked by Artemis has present reached astir $180 cardinal for 2024, truthful far.

In total, backstage catastrophe enslaved issuance crossed each structures tracked year-to-date by Artemis present stands conscionable shy of $400 million, astatine astir $397.2 million.

Which means Eclipse Re is presently liable for conscionable implicit 45% of 2024 backstage catastrophe enslaved issuance truthful far.

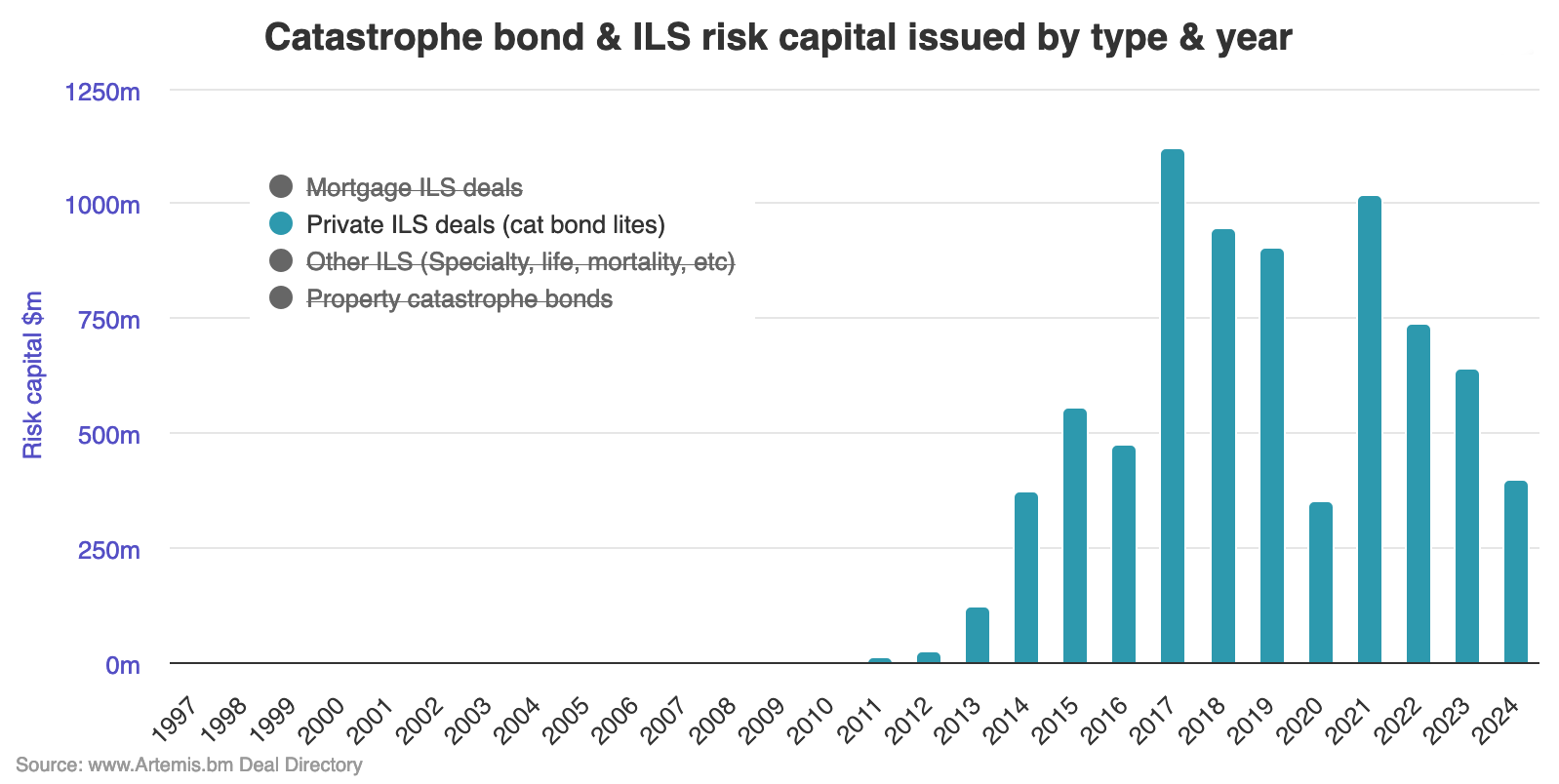

You tin analyse backstage feline enslaved issuance by twelvemonth done accessing this chart, wherever you tin divided our tracked catastrophe enslaved and related ILS issuance by benignant of arrangement, utilizing the key.

Analyse backstage catastrophe enslaved issuance by twelvemonth utilizing our interactive chart.

Eclipse Re issues $12.5m successful notes, backstage feline bonds adjacent $400m successful 2024 truthful far was published by: www.Artemis.bm

Our catastrophe enslaved woody directory

Sign up for our escaped play email newsletter here.

7 months ago

184

7 months ago

184

English (US) ·

English (US) ·