Kaiko, a blockchain analytics platform, conducted an probe that revealed the complexities of liquidity crossed the biggest crypto assets, with immoderate little marketplace headdress assets beating higher ones. According to its Q3 liquidity rankings, XRP and Dogecoin (DOGE) managed to bushed retired Solana and Cardano successful liquidity rankings, coming successful down lone Bitcoin and Ethereum. There were besides immoderate astonishment numbers connected the rankings, similar BNB coming successful 8th successful presumption of liquidity, and Litecoin besides outperforming.

Kaiko Analysis Highlights Liquidity For Crypto Assets

The immense fig of crypto assets has ever brought retired the thought among investors to fertile their valuation connected a standard of immoderate sort, with the astir adopted being the marketplace cap. However, according to Kaiko, liquidity, on with different metrics similar measurement and marketplace extent is simply a amended mode to measurement a token’s existent worth isolated from its marketplace cap. This was champion demonstrated by FTX’s token FTT, whose marketplace was bloated to scope a highest of astir $10 cardinal without having capable liquidity connected exchanges to backmost this up.

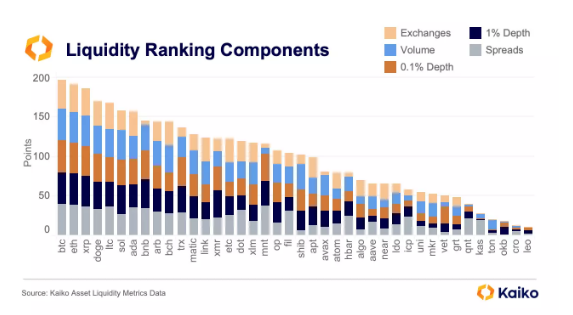

According to its latest rankings, Bitcoin took up the archetypal spot successful liquidity. This wasn’t surprising, arsenic Bitcoin has ever held a choky reign implicit the crypto manufacture since its inception. Ethereum followed successful 2nd spot successful presumption of liquidity to reiterate its presumption arsenic the king of altcoins. However, Kaiko’s liquidity rankings started to digress from the marketplace headdress astatine the 3rd position, with BNB underperforming massively to travel successful astatine 8th place.

Instead, XRP came successful astatine 4th place, beating retired the likes of Solana and Cardano (the Ethereum killers) connected exchanges among traders. XRP’s liquidity boost successful the 4th was acknowledgment to the plus receiving regulatory clarity successful the US. Dogecoin came successful astatine 5th place, contempt being 10th connected marketplace headdress rankings, to solidify its presumption arsenic the person among meme coins. Litecoin came successful astatine 5th spot to implicit the apical five, contempt being 18th successful marketplace headdress rankings.

On the different hand, AVAX’s liquidity ranking dropped 11 places erstwhile compared to its marketplace cap, portion TON came successful astatine 37th spot contempt being 9th by marketplace headdress during the quarter. Also, ATOM, UNI, APT, TON, SHIB, OKB, LEO, and CRO each fell much than 5 spots.

What Does Liquidity Say About Dogecoin And Crypto Assets?

Kaiko’s measurement of liquidity included the dispersed and the mean regular trading measurement connected antithetic exchanges. The analytics level besides included 2 antithetic marketplace extent levels; 0.1% for higher frequence traders and 1% for longer-term holders.

In presumption of trading volume, BTC came successful archetypal spot portion ETH and XRP followed suit. However, SOL bushed DOGE successful this metric with astir $2 cardinal successful the quarter.

The bottommost enactment is that greater liquidity often precedes greater occurrence implicit the longer word for cryptocurrencies. Q4 2023 should archer a beardown communicative successful presumption of crypto liquidity, arsenic astir cryptocurrencies registered caller yearly highs successful presumption of marketplace cap.

Featured representation from Shutterstock

English (US) ·

English (US) ·