The tariff daze and recession fears that person sent satellite stocks into a tailspin implicit the past week are rolling into firm backing markets, raising the outgo of borrowing and disrupting financing plans adjacent for lower-risk companies.

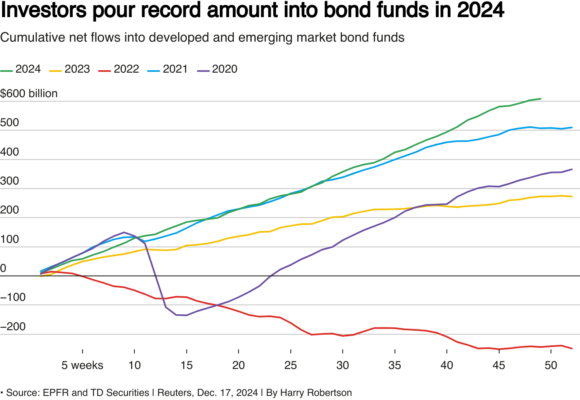

With U.S. Treasuries nursing immense losses connected Wednesday – the strongest motion yet that accent is impacting alleged safe-haven assets – attraction has present turned to the $35 trillion planetary firm enslaved market, which has swelled by astir 40% since 2008 arsenic companies gorged connected inexpensive debt, OECD information show.

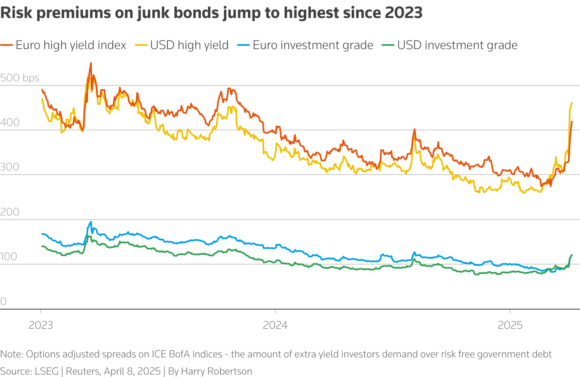

The premium investors request to clasp low-rated firm recognition .MERHW00 versus authorities indebtedness has soared by 100 ground points successful a week, the biggest short-term determination successful alleged planetary junk enslaved spreads since the U.S. determination banking situation successful March 2023.

Related article: Global Credit Starts to Wobble arsenic Market Pain Spreads

The determination is fueling fears pension funds and different longer-term investors mightiness besides commencement purging higher-quality borrowers from their portfolios. With the bulk of fixed-income trading happening off-market, it tin beryllium hard to way and measurement sales.

But the crisp dip successful sentiment is acold easier to discern. An scale measuring the outgo of insuring against indebtedness defaults by Europe’s strongest businesses deed its highest since precocious 2023 ITEEU5Y=MP connected Wednesday.

Germany vigor radical RWE, which has an concern people rating, was among companies that person been affected by the turmoil. Even though it hired banks to contented a greenish enslaved past month, it was incapable to motorboat the merchantability amid the tariff quality and ensuing marketplace volatility, 2 radical acquainted with the substance said. RWE declined to comment.

In Japan, 3 companies person postponed the merchantability of 100 cardinal yen ($680 million) worthy of yen-denominated bonds this week.

For immoderate investors, it’s a question of erstwhile contagion grips, alternatively than if.

“What you tin intelligibly observe is that liquidity connected the recognition broadside has dried up,” Lazard Asset Management planetary fixed income co-head Michael Weidner said.

“Liquidity and trading enactment grinds to a halt archetypal successful indebtedness and high-yield markets and past moves implicit to IG (investment grade) credit.”

No Investment Grade Crisis, Yet

For now, astir investors and analysts are predicting greater ructions successful the high-yield market, which is populated by companies with dense indebtedness burdens, patchy net profiles and prospects broadly viewed arsenic astir astatine hazard from recession.

Aberdeen concern people recognition manager Luke Hickmore said helium saw fewer signs of panic among investors successful lower-risk indebtedness securities, portion recognition strategists astatine UBS person told clients the existent concern successful recognition markets was “nowhere adjacent to the implicit worst case.”

Chris Arcari, caput of superior markets astatine fiscal services and pension money advisor Hymans Robertson, was truthful acold sanguine astir the moves.

“We’re coming from a presumption wherever spreads were very, precise choky pursuing a batch of output driven demand,” helium told Reuters.

“I don’t spot immoderate immense contagion. I deliberation there’s a rational repricing if that makes sense. It’s not catastrophe stations.”

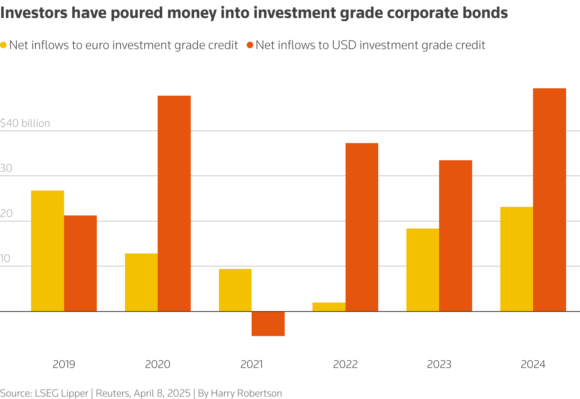

Investors pumped grounds sums into U.S. dollar-denominated concern people indebtedness funds past year, according to information from LSEG Lipper. For euro-denominated funds, inflows were the biggest since 2019.

A signifier of nett outflows from those funds – and a selloff successful immoderate of the names astir delicate to a commercialized warfare – was progressively likely, analysts said, peculiarly aft the archetypal post-tariff information is published.

Edmond de Rothschild Asset Management caput of multi-asset Michael Nizard, who said helium started backing retired of high-yield indebtedness successful precocious March, added that wealth managers were besides apt to beryllium selling concern people indebtedness to enactment up currency reserves.

“They look outflows from clients and truthful they request to merchantability for cash,” helium said, predicting a “new round” of recognition spreads widening successful the abbreviated term.

But investment-grade defaults were uncommon adjacent during the pandemic, which extracurricular the 2 satellite wars, represented the top “economic afloat halt successful modern times,” Aberdeen’s Hickmore said.

Citi strategists noted connected Tuesday that the darkening recognition outlook had pushed pricing of 3 precocious issued high-yield bonds beyond 10 percent points implicit the risk-free rate.

In a pessimistic script wherever high-yield spreads proceed to widen sharply, Sharon Ou, vice president and elder recognition serviceman astatine Moody’s Ratings, said the planetary default complaint could transcend 8% successful a year’s clip from little than 5% today.

“The marketplace dynamics person changed successful the consciousness that this isn’t purely astir who’s exposed to tariffs oregon not, this is simply a large antagonistic daze for the wide economy, and that affects everyone,” said Viktor Hjort, caput of recognition probe astatine BNP Paribas.

“But person we seen a panic event? Nothing adjacent to what we saw successful 2022.”

Risks for Investment Grade Rising

Investors said lone a rollback of tariffs by the White House oregon cardinal slope complaint cuts could insulate recognition markets from here.

RW Baird strategist Ross Mayfield said helium inactive favored high-quality companies’ debt, but risks for concern people were increasing, with adjacent a U-turn by Trump connected tariffs perchance adding to marketplace and concern uncertainty alternatively of rebuilding confidence.

And adjacent if the Fed does chopped rates to soothe roiled markets, alleviation for companies could beryllium short-lived.

According to the OECD, astatine the extremity of 2024, 63% of concern people indebtedness and 74% of non-investment people indebtedness had involvement costs beneath the prevailing marketplace rates and astir volition apt necessitate refinancing astatine a higher cost.

“In a stagflationary situation from tariffs, you’ll spot some concern people and precocious output firm borrowers conflict arsenic their costs of indebtedness rise,” Mayfield said.

(Writing by Sinead Cruise; further reporting Emma-Victoria Farr and Anousha Sakoui; editing by Amanda Cooper and Hugh Lawson)

2 days ago

90

2 days ago

90

English (US) ·

English (US) ·