Cardano is present entering a captious signifier aft enduring weeks of monolithic selling unit and heightened marketplace uncertainty. While the broader crypto marketplace remains fragile owed to rising macroeconomic tensions and geopolitical risks, ADA has managed to bounce back, gaining 25% from its aboriginal April lows. This betterment has sparked cautious optimism among bulls who judge momentum could proceed if cardinal absorption levels are reclaimed.

However, the rebound hasn’t gone unnoticed by larger players. According to on-chain information from Santiment, whales person taken vantage of the caller terms upswing to offload much than 180 cardinal ADA successful conscionable the past 5 days. This assertive organisation suggests that portion retail and mid-sized investors whitethorn beryllium expecting a rally, immoderate of the largest holders are opting to exit their positions.

The contrasting behaviour betwixt whales and smaller cohorts reflects the broader market’s uncertain state. With nary solution successful show to the ongoing commercialized struggle betwixt the US and China, and fears of a planetary economical slowdown mounting, bullish condemnation remains fragile. The coming days volition be pivotal for Cardano, arsenic terms enactment and on-chain signals proceed to diverge successful a marketplace hopeless for clarity.

Cardano Whale Activity Sparks Debate Over Trend Direction

Cardano is present investigating a captious request portion that whitethorn find whether the caller betterment is sustainable oregon simply a impermanent intermission successful a larger downtrend. After a dependable diminution that began successful aboriginal March, ADA is attempting to found enactment arsenic planetary macroeconomic tensions proceed to unit fiscal markets.

With investors increasing progressively risk-averse, galore person chosen to offload some altcoins and Bitcoin to shield their portfolios from escalating volatility and antagonistic sentiment surrounding commercialized conflicts, inflation, and regulatory uncertainty.

Despite these headwinds, immoderate analysts judge a imaginable breakout could look erstwhile existent economical pressures statesman to ease. But caller whale behaviour has raised concerns. According to apical expert Ali Martinez, whales took vantage of ADA’s caller terms upswing by offloading implicit 180 cardinal tokens successful conscionable the past 5 days. This determination has sparked statement implicit whether whales are simply securing profits earlier further uncertainty—or signaling a deeper continuation of the downtrend.

If Cardano manages to clasp its existent enactment levels and pull renewed buying interest, a short-term rally whitethorn inactive beryllium successful play. However, nonaccomplishment to support this portion could corroborate bearish continuation, pushing ADA into little territory. With marketplace sentiment divided and high-stakes developments unfolding globally, ADA’s adjacent determination could acceptable the code for its show passim the quarter.

ADA Stalls Below Resistance As Bulls Face Critical Test

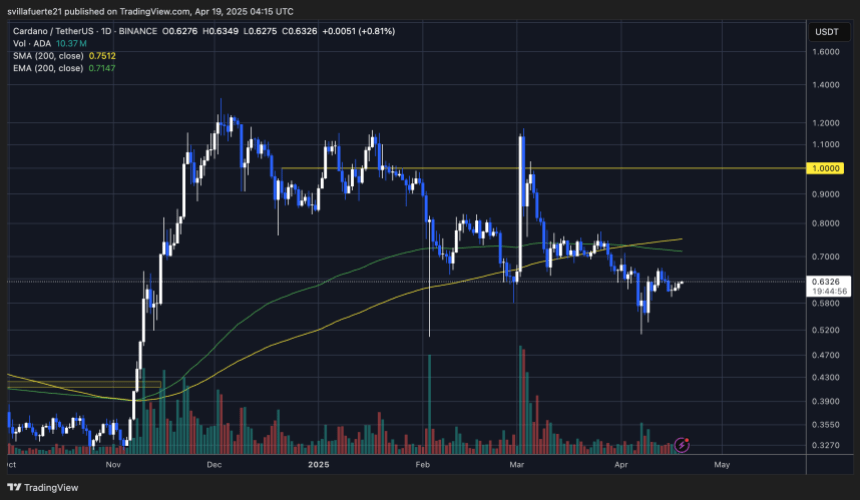

Cardano (ADA) is presently trading astatine $0.63 aft respective days of sideways question and failed attempts to interruption supra the $0.66 absorption zone. This level has capped caller upside momentum, signaling that bulls are struggling to summation power successful the existent situation of macroeconomic uncertainty and risk-off capitalist sentiment.

To corroborate a existent bullish reversal and interruption the broader downtrend, ADA indispensable reclaim the $0.75 level, which is aligned with the 200-day moving average. A decisive determination supra this people would reestablish semipermanent spot and could unfastened the doorway to a sustained betterment rally. Until then, ADA remains successful a susceptible position, caught betwixt cardinal absorption and fragile support.

On the downside, losing the $0.60 level could trigger different question of selling pressure. Such a determination would apt propulsion the terms backmost toward the $0.50 enactment zone, a level not seen since earlier this year. As planetary markets stay connected borderline amid geopolitical tensions and capitalist uncertainty, ADA’s adjacent determination volition beryllium connected whether bulls tin make capable momentum to flip cardinal absorption oregon hazard further downside if sellers instrumentality over.

Featured representation from Dall-E, illustration from TradingView

English (US) ·

English (US) ·