Cardano (ADA), a Proof-of-Stake (PoS) Layer-1 (L1) astute declaration web launched successful 2017, experienced a mostly quiescent Q3 2023 successful the wide crypto market. However, the web faced challenges with a diminution successful ADA’s terms and revenue.

Despite these setbacks, Cardano showcased growth successful its treasury balance, stablecoin marketplace cap, and Total Value Locked (TVL) ranking. Furthermore, the network’s infrastructure and connections to different ecosystems person paved the mode for aboriginal decentralized concern (DeFi) assemblage developments.

Cardano Sees Decrease In Daily Active Addresses And Transactions

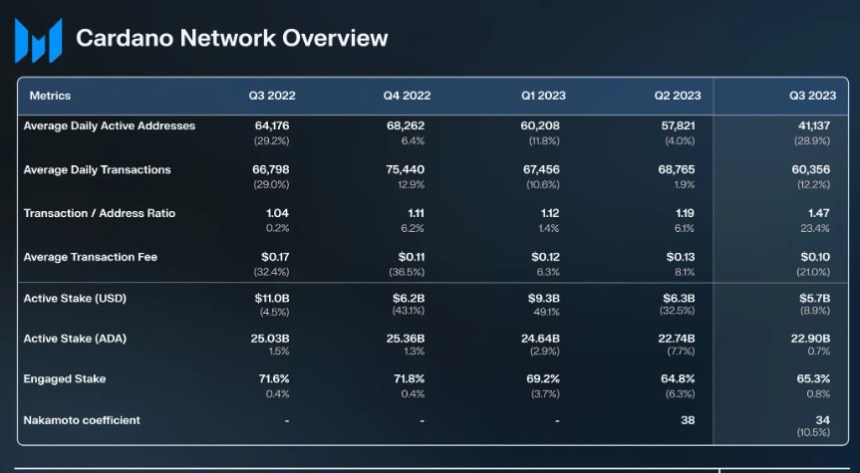

According to a caller report by Messari, ADA’s terms declined for the 2nd consecutive quarter, down 9.5% quarter-over-quarter (QoQ) to $0.25, successful enactment with the wide crypto market’s 9.2% QoQ fall.

The gross generated from transaction fees besides decreased by 29.9% QoQ, reflecting a diminution successful idiosyncratic urgency to transact during this period.

Cardano’s Treasury equilibrium grew by 7.2% QoQ to 1.39 cardinal ADA. Although the treasury’s worth successful USD presumption decreased by 3.0% QoQ owed to ADA price depreciation, it demonstrated dependable maturation successful ADA holdings.

Currently, 20% of transaction fees lend to the treasury, providing a imaginable backing root for aboriginal projects.

Moreover, Cardano experienced a diminution successful regular progressive addresses for the 3rd consecutive quarter, down 28.9% QoQ to 41,100. Average regular transactions besides decreased by 12.2% QoQ.

However, the ratio of transactions to progressive addresses indicated that portion the fig of progressive users decreased, those contiguous were powerfulness users, suggesting precocious engagement wrong the network.

Average regular dapp transactions decreased by 14.7% QoQ, but overall, they accrued by 40.0% YTD. Non-fungible token (NFT) transaction enactment declined for the 3rd consecutive quarter, portion NFT trading measurement increased, highlighting the increasing worth of Cardano NFTs.

Cardano’s TVL Demonstrates Stability Despite Market Challenges

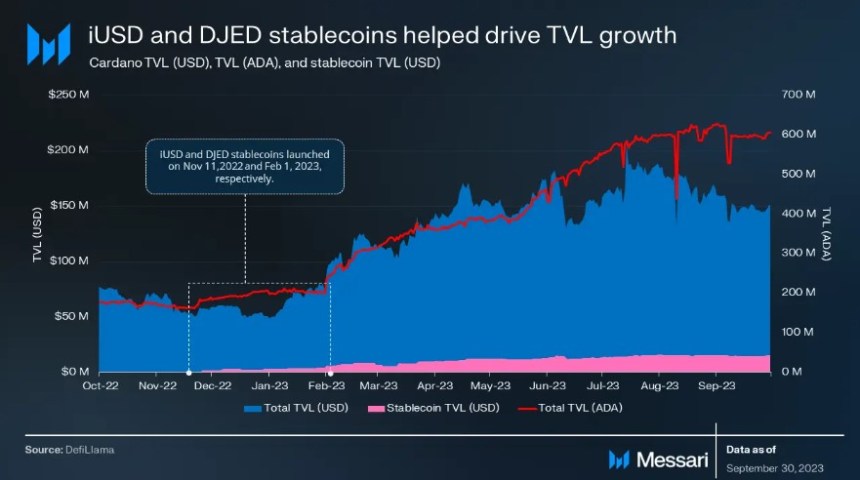

Cardano’s TVL remained steady, declining lone 0.1% QoQ. However, its TVL ranking among each networks improved from 21st to 15th during Q3, indicating comparative maturation compared to different ecosystems.

The motorboat of 2 caller stablecoins, iUSD and DJED, importantly contributed to the wide TVL growth, arsenic the stablecoin marketplace headdress accrued by 16.3% QoQ.

Per the report, Cardano besides made advancement successful interoperability and halfway infrastructure during Q3. Partnerships with networks similar Wanchain and developments successful authorities channels, on-chain governance, and sidechains show the network’s committedness to expanding its capabilities.

Overall, Cardano’s Q3 2023 reflects a play of challenges and maturation for the network. Despite declining ADA’s terms and revenue, the treasury balance, stablecoin marketplace cap, and TVL ranking showcased affirmative trends.

The network’s infrastructure developments and connections to different ecosystems presumption it favorably for aboriginal advancements successful the DeFi sector. As Cardano continues to code challenges and foster innovation, it remains a cardinal subordinate successful the blockchain landscape.

ADA Price Soars By 17% In 30 DaysDespite the sideways question and declines successful assorted indicators of Cardano’s wide ecosystem, ADA has experienced a significant surge of 17% successful the past 30 days.

Currently, ADA is trading astatine $0.2983, continuing its upward inclination betterment implicit the past weeks pursuing a crisp diminution since July 13 and a consequent consolidation phase.

This consolidation signifier led to a breakout of the erstwhile four-month trend, which halted connected October 19, triggering the caller surge successful the token’s price. However, looking astatine the one-year timeframe, ADA’s worth has seen a diminution of 26%.

Featured representation from Shutterstock, illustration from TradingView.com

English (US) ·

English (US) ·