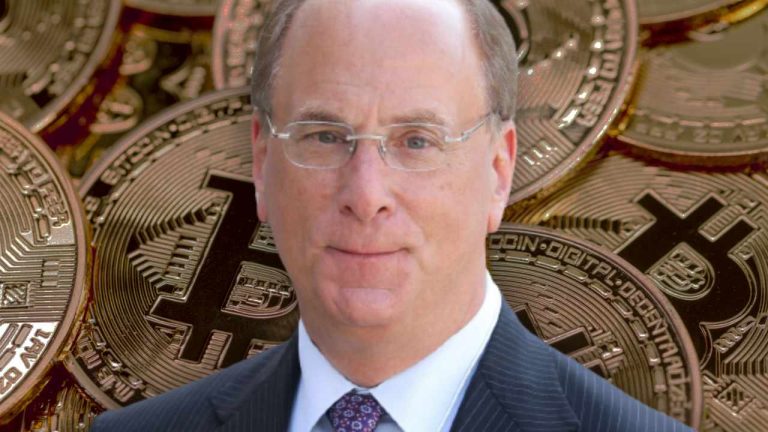

Larry Fink, the CEO of the world’s largest plus manager, Blackrock, sees the caller bitcoin rally arsenic “an illustration of the pent-up involvement successful crypto.” Noting that arsenic the Israel-Hamas warfare rages on, much radical volition beryllium moving to bitcoin arsenic “a formation to quality,” the enforcement emphasized: “We are proceeding from clients astir the satellite astir the request for crypto.”

‘The Rally Today Is About a Flight to Quality’

Blackrock CEO Larry Fink offered his position connected the bitcoin rally Monday pursuing a rumor that the U.S. Securities and Exchange Commission (SEC) had approved his company’s spot bitcoin exchange-traded money (ETF) application.

While emphasizing that helium cannot sermon “the specifics of anything,” Fink said connected Fox Business:

I deliberation it’s conscionable an illustration of the pent-up involvement successful crypto. We are proceeding from clients astir the satellite astir the request for crypto.

The rumor was dispersed by crypto quality outlet Cointelegraph which posted connected societal media level X aboriginal Monday greeting that the SEC had approved Blackrock’s spot bitcoin ETF. The quality outlet aboriginal retracted the story. Bitcoin spiked astir 10% earlier dropping backmost to the $28,000 level aft the fake quality report.

Noting that “Some of this rally is mode beyond the rumor,” the Blackrock CEO stressed:

I deliberation the rally contiguous is astir a formation to quality, with each the issues astir the Israeli warfare now, [and] planetary terrorism. And I deliberation there’s much radical moving to a formation to prime — whether that is successful Treasurys, gold, oregon crypto, depending connected however you deliberation astir it.

Blackrock filed an exertion for Ishares Bitcoin Trust, a spot bitcoin ETF, with the SEC successful June. If approved by the SEC, the spot volition usage Coinbase Custody arsenic its custodian. In July, Fink said crypto volition transcend immoderate 1 currency.

A increasing fig of fiscal institutions person filed for support to motorboat spot bitcoin ETFs with the SEC. However, nary person been approved. Last month, respective U.S. lawmakers urged the SEC to immediately o.k. spot bitcoin ETF applications. Steven Schoenfeld, erstwhile caput of International Equity Product Strategy astatine Barclays Global Investors expects the SEC to o.k. each bitcoin ETF applications wrong three to six months. On Friday, the deadline for the SEC to entreaty the circuit tribunal determination regarding Grayscale Investments’ exertion to person its bitcoin spot (GBTC) to a spot bitcoin ETF expired without the SEC appealing.

What bash you deliberation astir the statements by Blackrock CEO Larry Fink? Let america cognize successful the comments conception below.

1 year ago

227

1 year ago

227

English (US) ·

English (US) ·