Bitcoin has breached backmost supra the $27,000 level during the past day, but if on-chain information is to spell by, this surge whitethorn not past for long.

Bitcoin Investors Are Taking Profits At Highest Rate In 3 Months

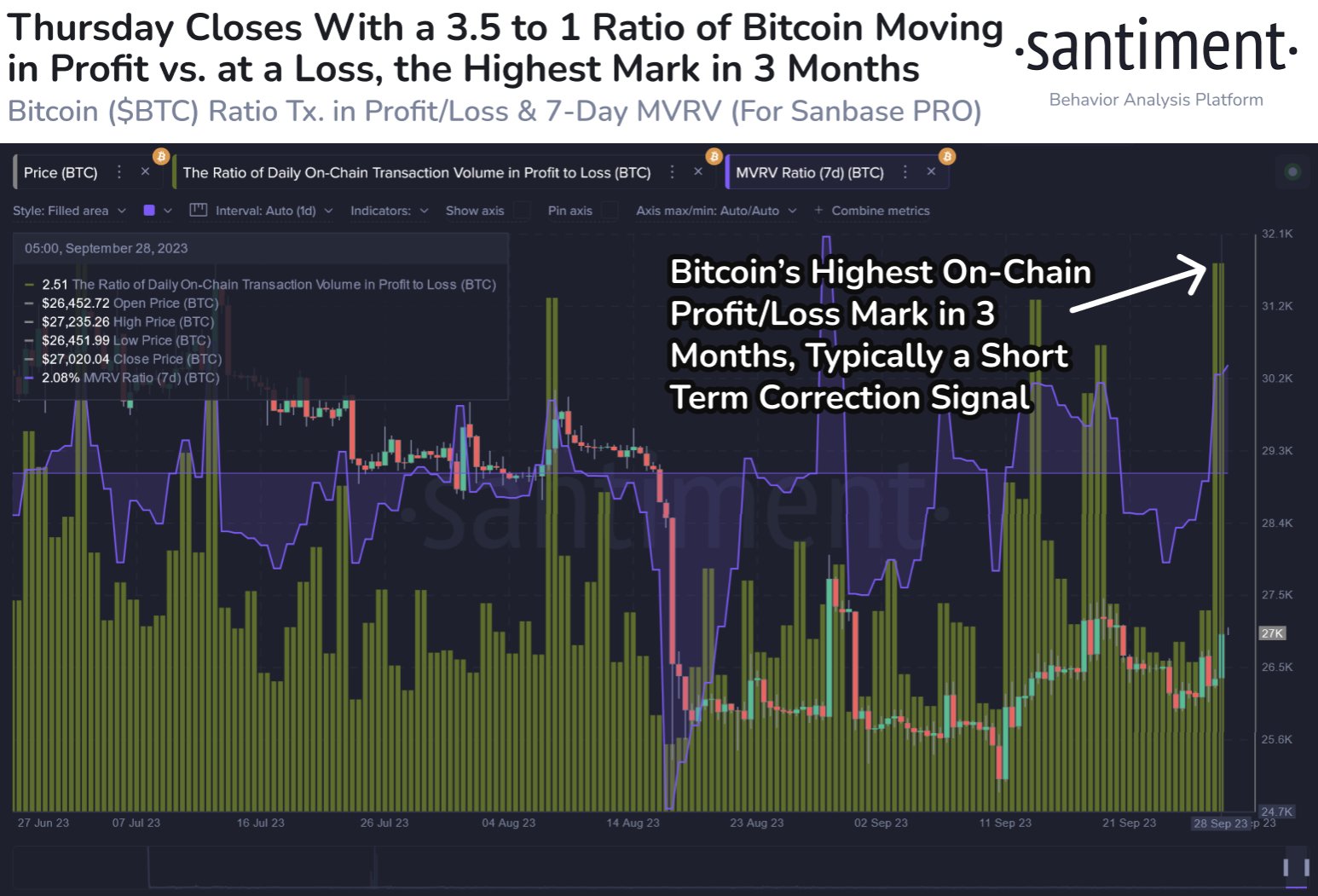

According to information from the on-chain analytics steadfast Santiment, determination is simply a accidental that a short-term correction could hap for the cryptocurrency. The applicable metric present is the “ratio of regular on-chain transaction measurement successful nett to loss,” which, arsenic its sanction suggests, tells america astir however the profit-taking measurement compares against the loss-taking measurement connected the Bitcoin web close now.

This indicator works by going done the transaction past of each coin being sold/transferred connected the blockchain to spot what terms it was moved astatine before. If this erstwhile selling terms for immoderate coin was little than the existent spot price, past that coin is being sold astatine a nett close now.

The merchantability of each specified tokens would lend toward the Bitcoin profit-taking volume, portion coins of the other benignant would adhd towards the loss-taking volume.

Now, present is simply a illustration that shows the inclination successful this BTC metric implicit the past fewer months:

As displayed successful the supra graph, this Bitcoin indicator has observed a ample spike arsenic the cryptocurrency’s terms itself has seen a surge beyond the $27,000 people and has reached a worth of 2.51.

When the metric has a worth greater than zero, it means that the profit-taking measurement is much than the loss-taking volume. On the different hand, values nether this threshold suggest the dominance of loss-taking.

At the existent worth of 2.51, the profit-taking measurement outweighs the loss-taking 1 by 3.51 to 1. This disparity betwixt these 2 volumes is the highest it has been since astir 3 months ago.

Historically, aggravated profit-taking has usually resulted successful astatine slightest a short-term apical for Bitcoin, truthful it’s imaginable that the existent values of the metric would besides effect successful a correction for the price.

In the chart, Santiment has besides attached the information for the “Market Value to Realized Value (MVRV) ratio,” which keeps way of the quality betwixt the Bitcoin marketplace headdress and realized cap.

The second of these is fundamentally a measurement of the full magnitude of superior that the investors arsenic a full person enactment into the cryptocurrency, truthful this metric tells america however the worth that the holders are carrying presently compares with their full investment.

From the graph, it’s disposable that the 7-day Bitcoin MVRV ratio has turned notably affirmative with this rise, which implies that the investors are carrying profits astatine the moment.

The analytics steadfast notes that this metric going backmost beneath zero would beryllium perfect for the adjacent limb up, arsenic the holders being successful nonaccomplishment would pb to an exhaustion of the profit-sellers.

BTC Price

So far, contempt the assertive profit-taking happening successful the market, Bitcoin has managed to clasp supra the $27,000 mark.

English (US) ·

English (US) ·