In a caller station connected X (formerly Twitter), Ram Ahluwalia, the CEO of Lumida Wealth, weighed successful connected the imaginable marketplace impacts connected Bitcoin, peculiarly highlighting the value of a failed Treasury auction. Lumida Wealth, recognized arsenic an SEC registered concern advisor, is known for its specialization successful alternate investments and integer assets.

Ahluwalia’s tweet emphasized the request to show Bitcoin’s effect to circumstantial macroeconomic events. He stated, “The trial for Bitcoin arsenic a macro plus volition beryllium ‘What happens if determination is simply a failed Treasury auction?’ This year, Bitcoin rallied during (1) the March slope failures and (2) arsenic Treasury rates person rattled markets. Here is the 3rd trial …”

Will Bitcoin See Another 50%+ Rally?

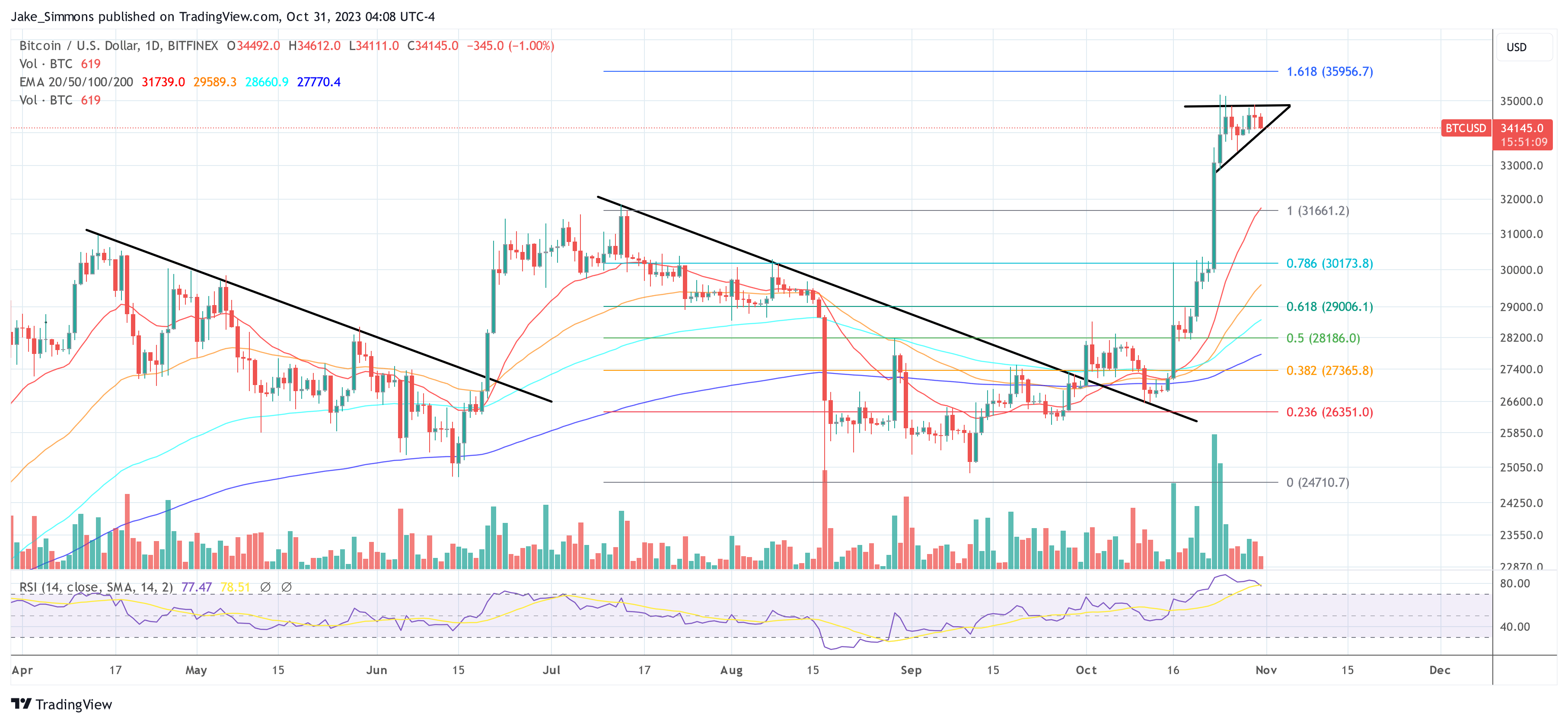

To recall, Bitcoin’s terms changeable up by implicit 55% successful the aftermath of the US banking situation earlier this year. On March 10, 2023, the Silicon Valley Bank’s unprecedented collapse, attributed to a slope tally coupled with a superior crisis, became a focal constituent of the broader 2023 United States banking crisis. This saw a domino effect with aggregate tiny to mid-sized US banks falling wrong a span of 5 days. While the planetary banking assemblage stocks plummeted, Bitcoin experienced a important surge successful its value.

More recently, Bitcoin is rallying adjacent arsenic treasury rates proceed to unsettle planetary markets. With the 10-year US Treasury output crossing the 5% people for the archetypal clip successful 16 years, determination are indications of rising involvement rates connected authorities bonds. Typically, specified output increments whitethorn propulsion investors to reconfigure their portfolios distant from hazard assets, adding to marketplace volatility. However, akin to gold, Bitcoin has precocious been acting arsenic a safe-haven plus successful turbulent times.

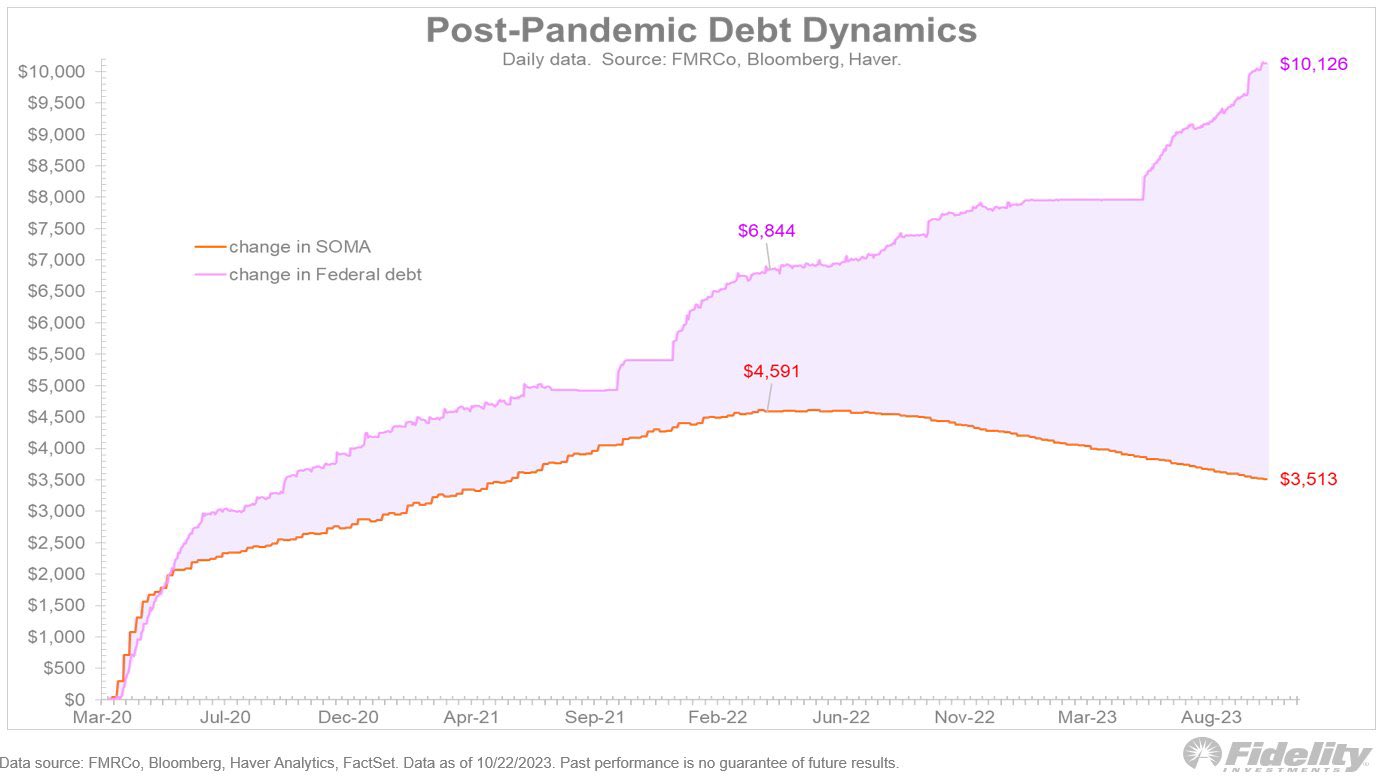

Diving deeper into the topic, Ahluwalia elucidated, “The Bitcoin rally, successful part, is owed to concerns that the Federal Reserve whitethorn request to intervene with Yield Curve Control oregon QE. […] Fidelity makes the lawsuit that the Fed whitethorn request to prosecute successful Japanese benignant Yield Curve Control. If so, that would beryllium powerfully bullish for existent estate, stocks, Bitcoin, bonds, REITs, TIPS and existent assets much generally. It would besides beryllium bearish for the USD. The US has hard choices ahead.” He further emphasized the value of structuring portfolios to withstand imaginable economical shocks and underscored the value of commodities successful weathering inflationary pressures.

Ahluwalia shared his position connected the existent authorities of the Federal Reserve and the Treasury markets, pointing to caller Treasury auctions that displayed softer bid-to-cover ratios. “There is simply a morganatic statement that the Fed whitethorn request to intervene successful Treasury markets. The caller Treasury auctions person weaker bid-to-cover ratios. Japan and American households are the marginal buyer…and they’ve been rewarded with losses,” Ahluwalia remarked.

Three Peat For BTC As Safe-Haven

He added that the Fed’s equilibrium expanse “is already upside down […] it has the equivalent of antagonistic equity (called a Deferred Asset) – an accounting attraction that is not permitted for backstage companies… The Federal Reserve…has $1.5 trillion mark-to-market losses due to the fact that it bought Treasuries & MBS. For the archetypal clip successful 107 years, this slope has antagonistic nett involvement margin. Its losses are poised to transcend its superior base.”

Ahluwalia explained that a treasury auction is deemed unsuccessful erstwhile the US Department of the Treasury initiates its regular auctioning of authorities securities, specified arsenic Treasury bills, notes, oregon bonds, but fails to pull capable bids to screen the entirety of the securities connected offer. Essentially, this signals a deficiency of capitalist involvement successful acquiring the government’s indebtedness tools astatine the predetermined involvement rates oregon yields.

On Bitcoin’s intrinsic value, Ahluwalia noted, “My presumption connected Bitcoin is that it is simply a ‘hedge against antagonistic existent rates’. That’s CFA speech for what Bitcoiners notation to colloquially arsenic ‘money printer spell brrr’.” He besides stressed the imaginable repercussions connected hazard assets if long-end rates were to spot a important spike.

“If long-end rates bash stroke out, that would wounded hazard assets similar long-duration Treasuries. The higher discount complaint would origin a re-rating successful stocks – overmuch similar we saw successful 2022 and the past 2 months. However, If Bitcoin tin rally during a ‘yield curve dislocation script that would springiness Bitcoin a ‘three peat’. Bitcoin would past find a invited location connected a greater fig of organization equilibrium sheets,” Ahluwalia concluded his bullish thesis for Bitcoin.

At property time, BTC traded astatine $34,145.

English (US) ·

English (US) ·