The nonfiction beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

Bitcoin Market Dynamics

The extremity of this nonfiction is to zoom retired and item immoderate of the latest bitcoin marketplace moves done the lens of on-chain data: realized price, profit-taking behaviour and bitcoin proviso levels.

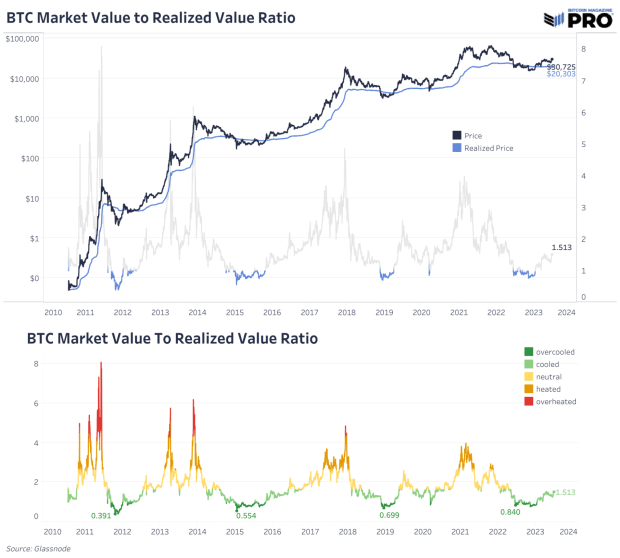

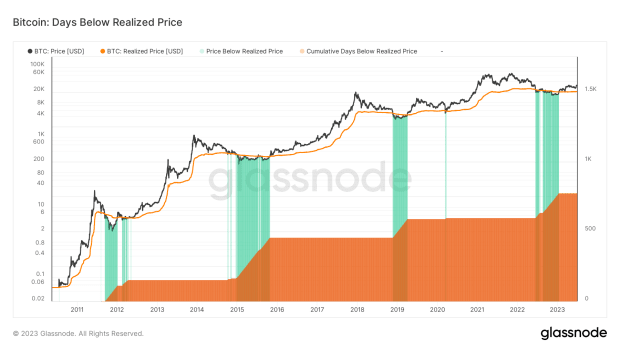

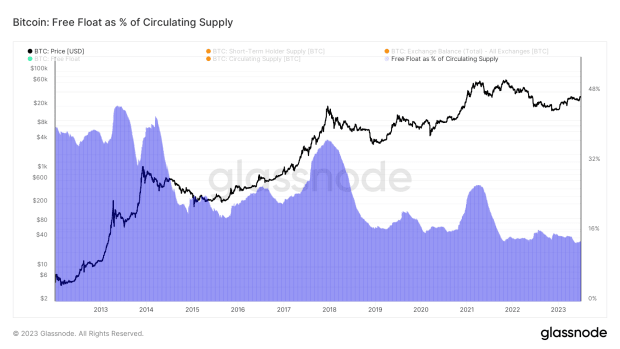

Currently, bitcoin is trading astatine astir 1.5x its realized price, which precocious resurged past the $20,000 mark. This milestone provides an absorbing position and different on-chain information helps america overgarment a much broad picture. Following emblematic bitcoin capitulation events, the proviso often gets constrained by the participants with the astir conviction. We present find ourselves precisely successful specified a phase: A specified 13% of circulating proviso is held connected exchanges and successful the hands of short-term holders.

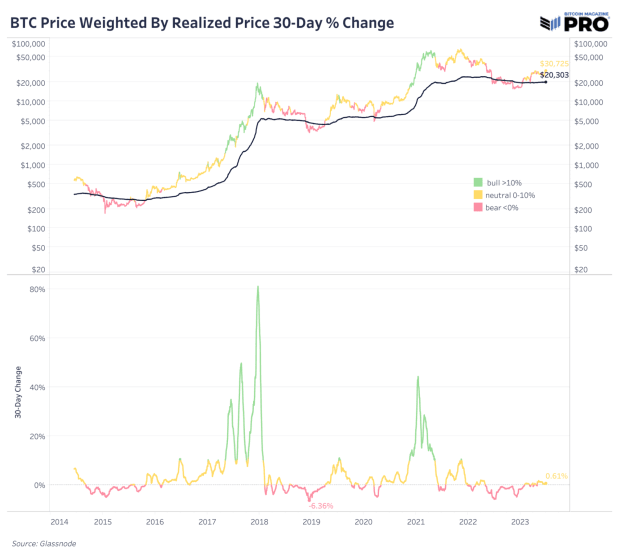

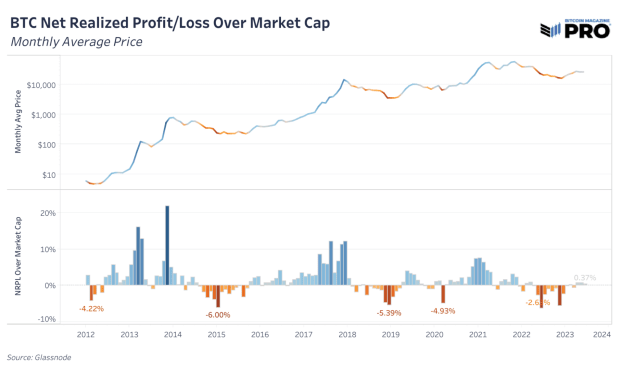

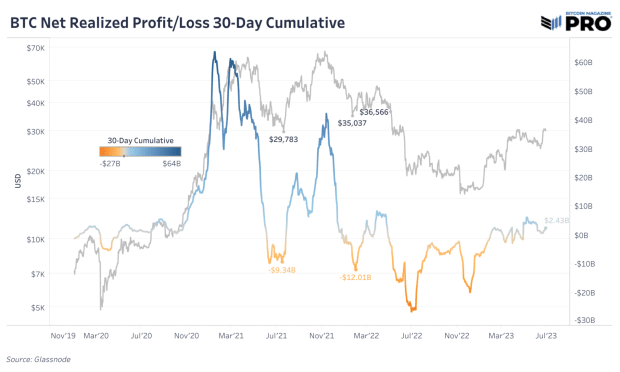

However, it’s important to enactment that portion existent terms enactment and realized profits bash not needfully enactment the conception of a full-fledged bull market, we frankincense acold person witnessed erstwhile realized losses/on-chain capitulation turning into a tiny yet dependable watercourse of profits (old coins moving astatine a higher terms level than they were acquired for).

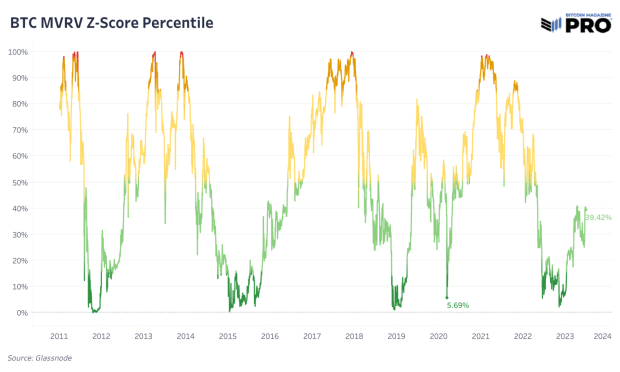

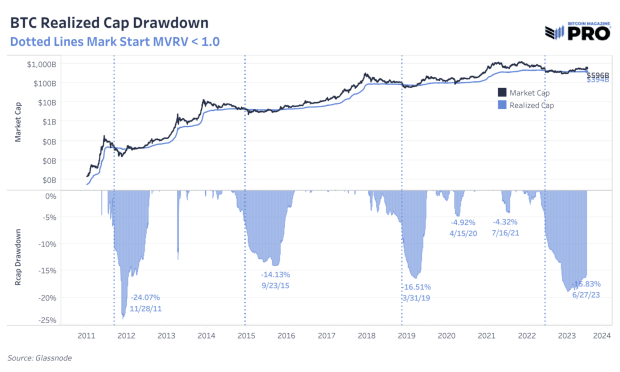

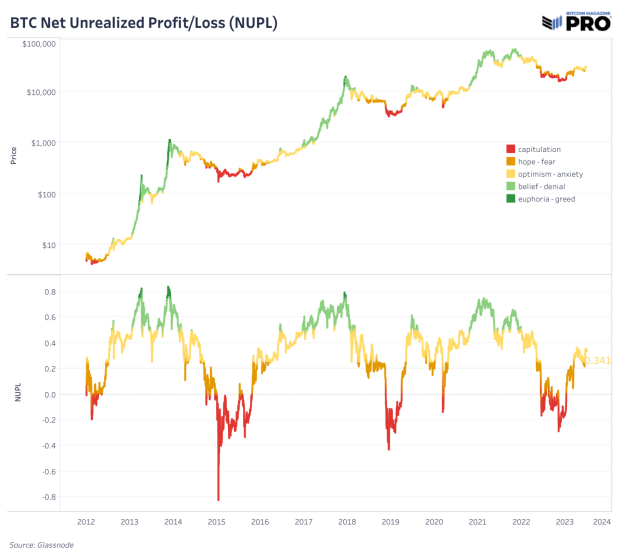

As shown below, the market-value-to-realized-value metric paints a representation of the commencement of a nascent caller bull market, with valuations nary longer astatine bottom-barrel levels but inactive acold from comparatively overpriced, presently ranking successful the 39% of humanities readings.

Looking astatine the complaint of alteration of the realized price, the humanities analog of the existent marketplace look to beryllium the aboriginal months of 2016 and the summertime of 2019, wherever terms had sufficiently rebounded disconnected the lows, with astir of the bleeding yet over, arsenic the marketplace consolidated amid constrained proviso conditions and a increasing web effect of existent satellite adoption.

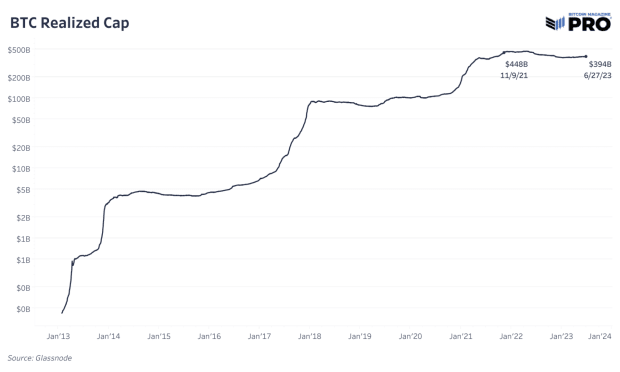

Realized Cap, Not Market Cap

The logarithmic illustration of bitcoin’s realized marketplace capitalization, reflecting the aggregate worth of each bitcoin astatine their past traded price, demonstrates the asset’s resilience. Unlike marketplace cap, which is the merchandise of circulating proviso and existent price, the realized headdress shows the precise worth of each bitcoin UTXO, courtesy of its transparent ledger.

Realized headdress paints a acold antithetic representation regarding bitcoin’s monetization compared to what 1 whitethorn beryllium led to judge erstwhile viewing bitcoin’s hyper-volatile mark-to-market speech rate.

A specified 15% beneath the realized marketplace headdress all-time high, superior inflows person returned, resembling erstwhile carnivore marketplace recoveries. During betterment periods pursuing bitcoin carnivore markets, we person seen a reclaim of the erstwhile all-time precocious successful realized marketplace headdress portion bitcoin was inactive 40%-60% beneath its all-time precocious speech rate. This humanities dynamic demonstrates a mates things:

First, it suggests that superior inflows tin proceed to seep into bitcoin without needfully triggering a raging bull market, alternatively starring to an situation of chop and consolidation. This is often characterized by a tug-of-war betwixt marginal buyers and sellers, wherever terms levels witnesser repeated tests of absorption and support, each portion accumulation from HODLers continues nether the surface.

Second, it shows a humanities world wherever bitcoin’s existent valuation — the terms wherever each its proviso has traded hands — surpasses the all-time precocious agelong earlier the media frenzy and caller question of speculative inflows get again. One tin presumption this arsenic an ode to the “smart money” investors, who don’t request the explicit awesome of a nominal speech complaint all-time precocious to recognize that bitcoin’s fundamentals are stronger than ever.

A objection of this dynamic is the nett realized profits comparative to the bitcoin marketplace cap. Following the worst of a carnivore marketplace capitulation, bitcoin marketplace inflows are distinctly affirmative (but not yet implicit zealous) portion the speech complaint grinds higher to yet flirt with terms all-time highs.

Once the all-time precocious is broken, inflows ramp up dramatically. The setup for this marketplace rhythm is inactive successful the aboriginal stages.

Unrealized Profit/Loss

We’ve examined realized nett and nonaccomplishment cycles, truthful present let's crook to the unrealized broadside of the equation.

Relative Unrealized Profit/Loss (NUPL) is an insightful metric designed to gauge capitalist sentiment successful the bitcoin marketplace by calculating the full unrealized gains oregon losses crossed the existent supply. To cipher the NUPL, subtract the realized headdress (which represents the worth of each bitcoin erstwhile it past moved connected the blockchain) from the marketplace cap, past explicit this quality arsenic a ratio of the marketplace cap. This metric works to standardize the authorities of the unrealized profits/losses held by investors utilizing the marketplace capitalization to relationship for an ever changing marketplace valuation.

- A higher ratio typically suggests a authorities of greed oregon speculative froth among investors, indicative of imaginable marketplace tops oregon overbuying conditions.

- In contrast, a little ratio mostly signals an ambiance of fearfulness oregon capitulation, perchance pointing to marketplace bottoms oregon overselling scenarios.

In the existent climate, NUPL stands astatine 0.37, a level we tin categorize arsenic optimism/anxiety, depending connected the inclination direction.

It's noteworthy that the bitcoin marketplace has ne'er seen a betterment successful NUPL from the capitulation signifier to the optimism signifier without a consequent sojourn to 1 oregon some of the 2 highest tiers of NUPL: content and euphoria.

Translated into simpler terms, this suggests that bitcoin marketplace recoveries, adjacent from the astir terrible conditions, pb to brighter days up owed to the resilience of the bitcoin HODLer basal and a accordant transportation of coins from anemic hands to beardown ones. The ongoing wealthiness transportation underpins marketplace recoveries, reinforcing bitcoin's inherent spot and mounting the signifier for further maturation and imaginable terms appreciation during the adjacent play of superior inflows.

Having conscionable recovered from the depths of the carnivore marketplace successful precocious 2022, the setup present mirrors humanities marketplace recoveries of past cycles, arsenic bitcoin erstwhile again climbs the partition of worry.

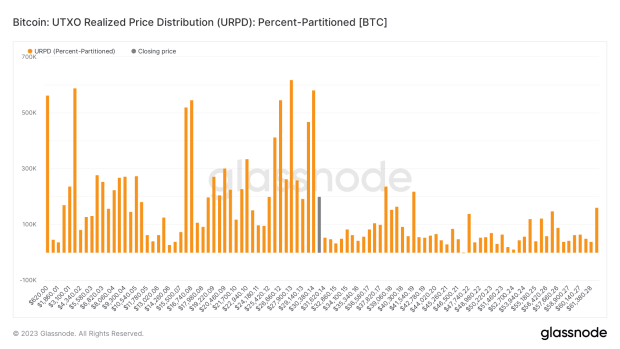

Free Float Constraints And UTXO Distribution

Another metric we tin look astatine to amusement conscionable however sparse the figurative aerial is supra the existent trading scope is the UTXO Realized Price Distribution (URPD).

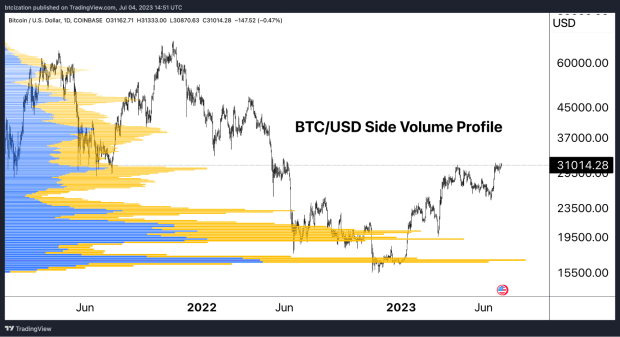

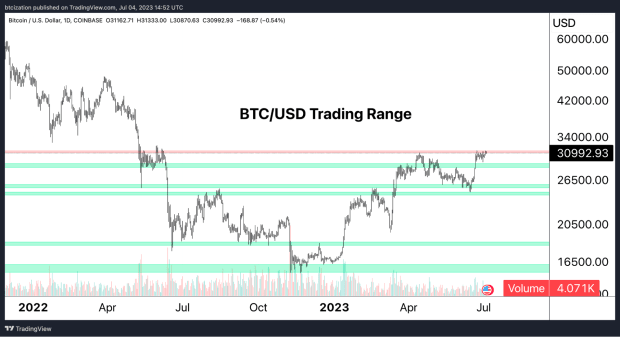

The URPD reveals that supra $31,000, lone a constricted proviso has exchanged hands, with the bulk of transactions occurring successful the $15,000-$30,000 range. The archetypal large absorption constituent from a proviso organisation level is astir $40,000. This besides aligns with the spot measurement trading distribution, arsenic good arsenic the method breakdown of the chart.

With bitcoin looking to outpouring past the levels past visited astir the clip of the LUNA/UST-induced crypto contagion, demise of aggregate exchanges and the industry’s largest hedge fund, Three Arrows Capital, what tin crook the bullish setup into a reality?

Capital inflows and a primed proviso broadside that is constrained to historical levels.

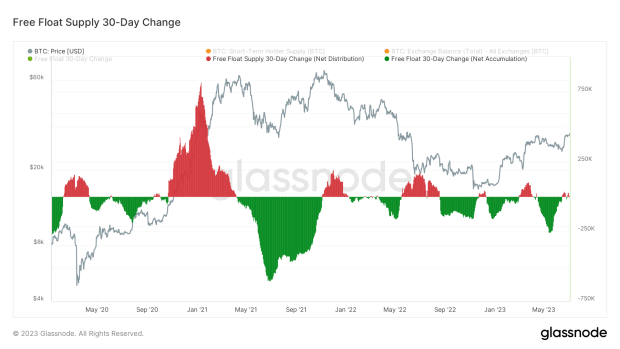

Looking astatine the escaped interval proviso of bitcoin, what we specify arsenic exchanges’ balances successful summation to short-term holder supply, the existent setup points to the tightest proviso conditions bitcoin has ever experienced.

While it is existent that proviso has been sufficiently constrained from a humanities discourse since aboriginal 2022, we presumption the dynamic a spot otherwise today, with the nascent bitcoin marketplace having endured its largest capitulation play ever.

Relatedly, we tin spot a dependable dose of accumulation occurring passim the people of the 2 years, with contagion events being the lone things to temporarily reverse the trend.

We expect the abundance of affirmative quality stories related to bitcoin spot ETF filings to materialize successful continued affirmative inflows, with plentifulness of opportunistic investors and speculators looking to beforehand tally the support and motorboat of spot bitcoin ETFs by bequest institutions.

While we expect that the support of an ETF to travel determination successful the precocious months of 2023 oregon aboriginal months of 2024, the rhythm reset coupled with primed supply-side conditions could pb to continued affirmative terms enactment done year’s end.

In our view, macro correlations and marketplace conditions inactive clasp value successful the bitcoin market, but the idiosyncratic catalysts of a imaginable spot ETF support and the halving arriving adjacent the aforesaid clip — positive complaint cuts apt to get successful 2024 — has america leaning bullish.

In the short-term, bitcoin ranging from anyplace betwixt $20,000-$40,000 wouldn’t beryllium astonishing with specified an illiquid market.

However, taking a longer view, the supply-side dynamics and imaginable for accrued request flows is eerily akin to the setups that led to erstwhile raging bull markets.

That concludes the excerpt from a caller variation of Bitcoin Magazine PRO. Subscribe now to person PRO articles straight successful your inbox.

2 years ago

226

2 years ago

226

English (US) ·

English (US) ·