As Bitcoin erstwhile again finds itself successful terms find mode, marketplace watchers and enthusiasts are curious: has retail FOMO acceptable successful yet, oregon is the retail surge we’ve seen successful past bull cycles inactive connected the horizon? Using information from progressive addresses, humanities cycles, and assorted marketplace indicators, we’ll analyse wherever the Bitcoin marketplace presently stands and what it mightiness awesome astir the adjacent future.

Rising Interest

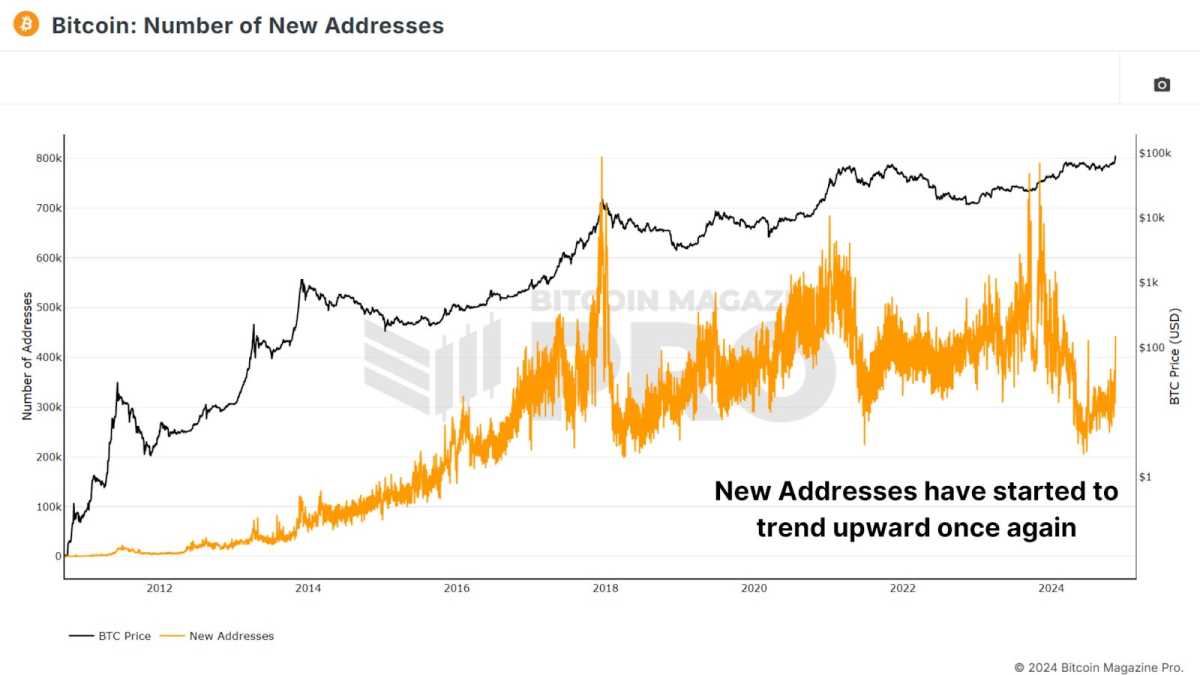

One of the astir nonstop signs of retail involvement is the number of caller Bitcoin addresses created. Historically, crisp increases successful caller addresses person often marked the opening of a bull tally arsenic caller retail investors flood into the market. In caller months, however, the maturation successful caller addresses hasn’t been arsenic crisp arsenic 1 mightiness expect. Last year, we saw astir 791,000 caller addresses created successful a azygous day—a motion of sizeable retail interest. In comparison, we present hover importantly lower, though we person precocious seen a humble uptick successful caller addresses.

Figure 1: The fig of caller addresses connected the Bitcoin web has begun to rise.

Figure 1: The fig of caller addresses connected the Bitcoin web has begun to rise.

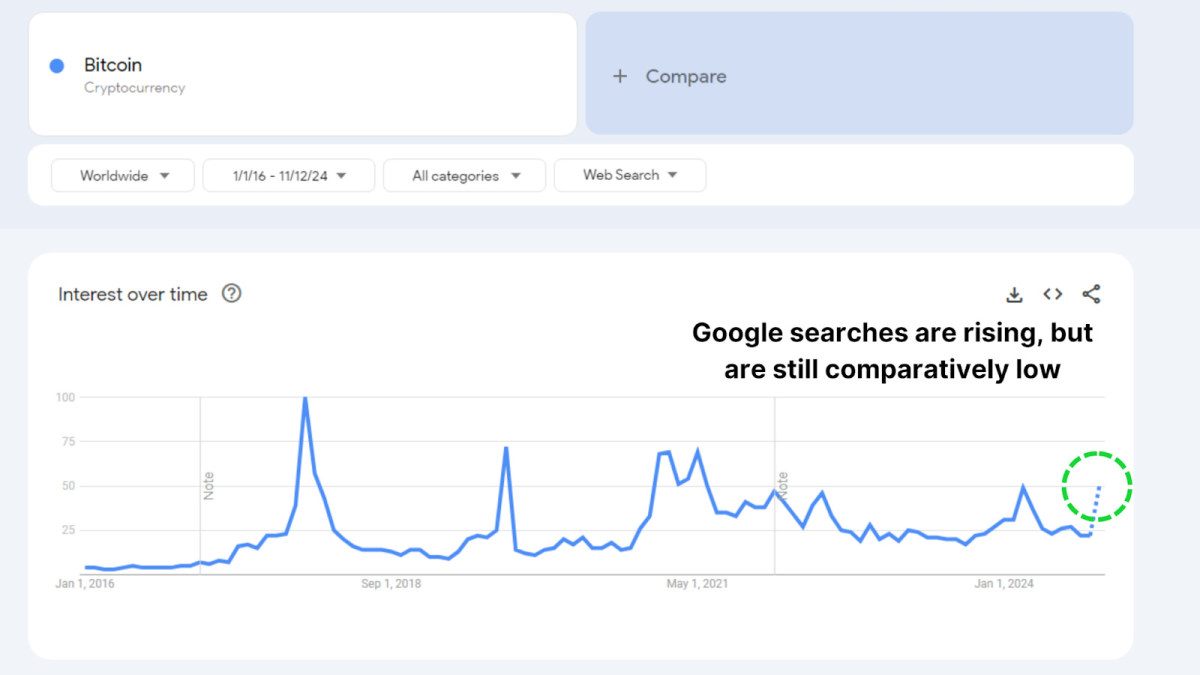

Google Trends besides reflects this tempered interest. Although searches for “Bitcoin” person been expanding successful the past month, they stay acold beneath erstwhile peaks successful 2021 and 2017. It seems that retail investors are showing a renewed curiosity but not yet the fervent excitement emblematic of FOMO-driven markets.

Figure 2: Google searches for ‘Bitcoin’ are besides rising but are inactive comparatively low.

Figure 2: Google searches for ‘Bitcoin’ are besides rising but are inactive comparatively low.

Supply Shift

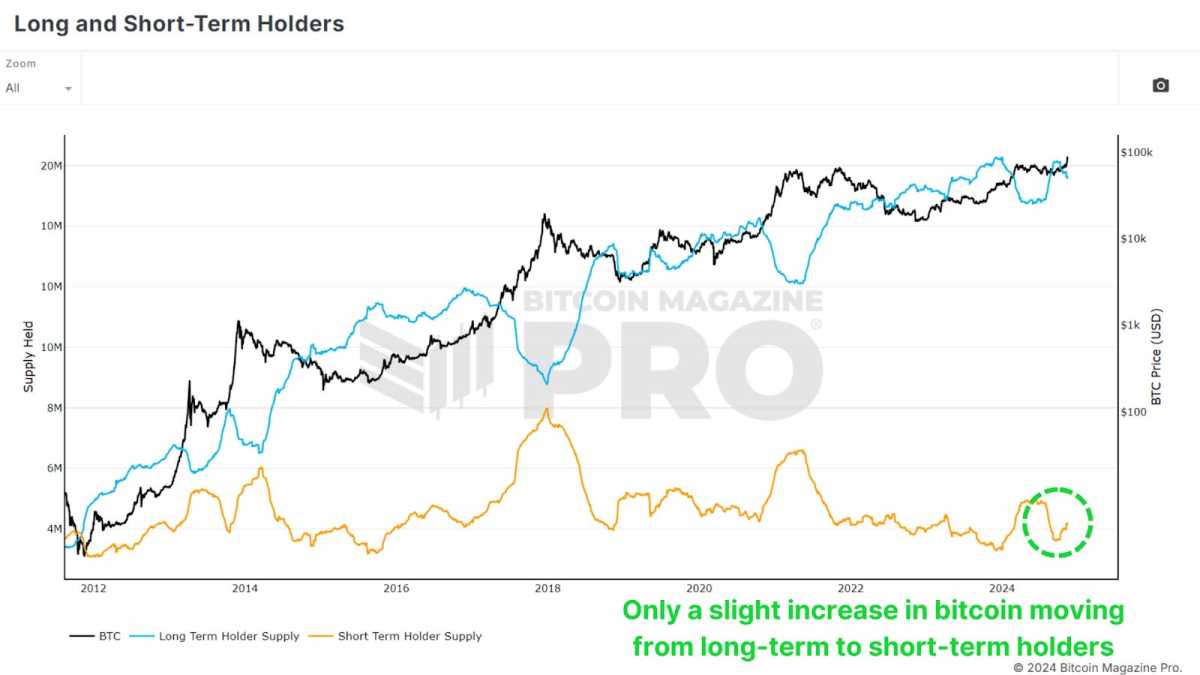

We are witnessing a flimsy modulation of Bitcoin from semipermanent holders to newer, shorter-term holders. This displacement successful proviso tin hint astatine the imaginable commencement of a caller marketplace phase, wherever experienced holders statesman taking profits and selling to newer marketplace participants. However, the wide fig of coins transferred remains comparatively low, indicating that semipermanent holders aren’t yet parting with their Bitcoin successful important volumes.

Figure 3: Only a flimsy summation successful bitcoin shifting hands to caller holders.

Figure 3: Only a flimsy summation successful bitcoin shifting hands to caller holders.

Historically, during the past bull tally successful 2020-2021, we saw ample outflows from semipermanent holders to newer investors, which fueled a consequent terms rally. Currently, the displacement is lone minor, and semipermanent holders look mostly unfazed by existent terms levels, opting to clasp onto their Bitcoin contempt marketplace gains. This reluctance to merchantability suggests that holders are assured successful further upside potential.

A Spot-Driven Rally

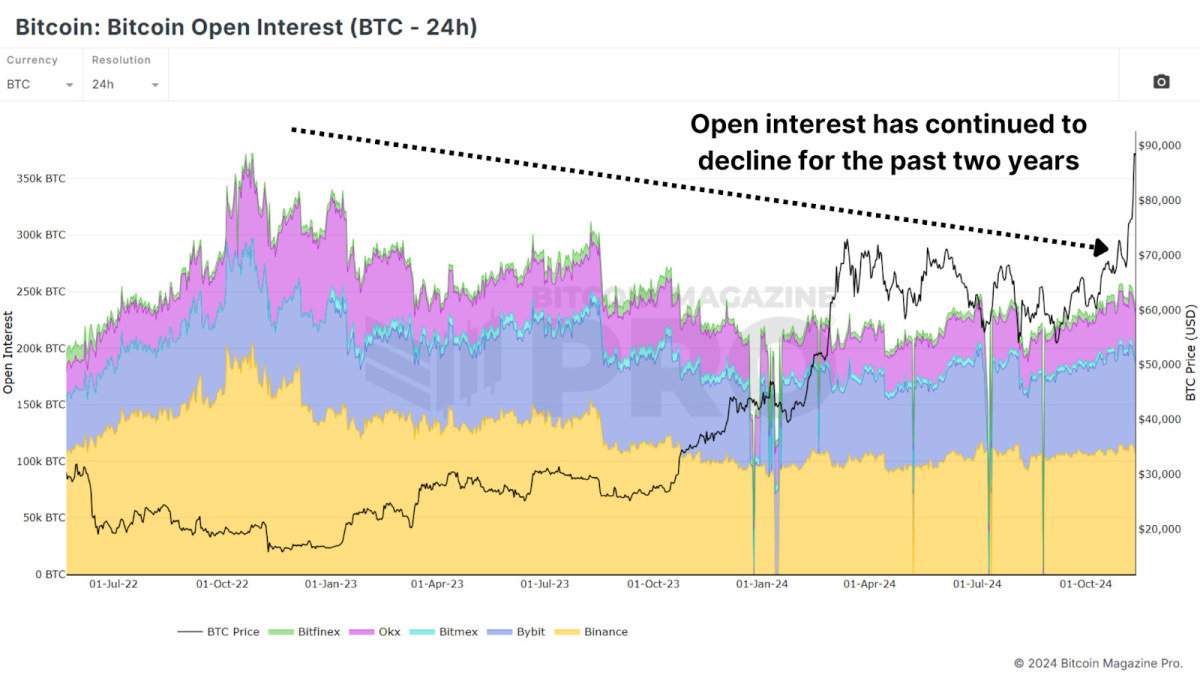

A cardinal facet of Bitcoin’s latest rally is its spot-driven nature, successful opposition to erstwhile bull runs heavy fueled by leveraged positions. Open involvement successful Bitcoin derivatives has seen lone insignificant increases, which stands successful crisp opposition to anterior peaks. For instance, unfastened involvement was important earlier the FTX clang successful 2022. A spot-driven market, without excessive leverage, tends to beryllium much unchangeable and resilient, arsenic less investors are astatine hazard of forced liquidation.

Figure 4: Open involvement has been declining connected a macro scale, with lone a flimsy caller increase.

Figure 4: Open involvement has been declining connected a macro scale, with lone a flimsy caller increase.

Big Holders Accumulating

Interestingly, portion retail addresses haven’t accrued substantially, “whale” addresses holding astatine slightest 100 BTC person been rising. Over the past fewer weeks, wallets with ample BTC holdings person added tens of thousands of coins, amounting to billions of dollars successful value. This summation signals assurance among Bitcoin’s largest investors that the existent terms levels person much country to grow, adjacent arsenic Bitcoin reaches all-time highs.

Figure 5: Addresses holding astatine slightest 100+ BTC is astatine the highest worth since 2019.

Figure 5: Addresses holding astatine slightest 100+ BTC is astatine the highest worth since 2019.

In past bull cycles, we saw whales exit oregon alteration their positions adjacent marketplace peaks, a behaviour we’re not seeing this time. This inclination of accumulation by experienced holders is simply a beardown bullish indicator, arsenic it suggests religion successful the market’s semipermanent potential.

Conclusion

While Bitcoin’s rally to all-time highs has brought renewed attention, we’re not yet seeing the telltale signs of wide retail FOMO. The subdued retail involvement suggests we whitethorn beryllium lone successful the opening signifier of this rally. Long-term holders stay confident, whales are accumulating, and leverage remains modest, each indicators of a healthy, sustainable rally.

As we proceed into this bull cycle, the market’s operation suggests that the imaginable for a larger retail-driven surge remains ahead. If this retail involvement materializes, it could propel Bitcoin to caller heights.

For a much in-depth look into this topic, cheque retired a caller YouTube video here: Has Retail Bitcoin FOMO Begun?

4 months ago

58

4 months ago

58

English (US) ·

English (US) ·