Bitcoin's caller terms volatility has led galore to wonderment if large-scale bitcoin hodlers are taking vantage of terms dips to accumulate much bitcoin. While immoderate metrics whitethorn initially suggest an summation successful semipermanent holdings, a person introspection reveals a much nuanced story, particularly aft the existent prolonged play of choppy consolidation.

Are Long-Term Holders Accumulating?

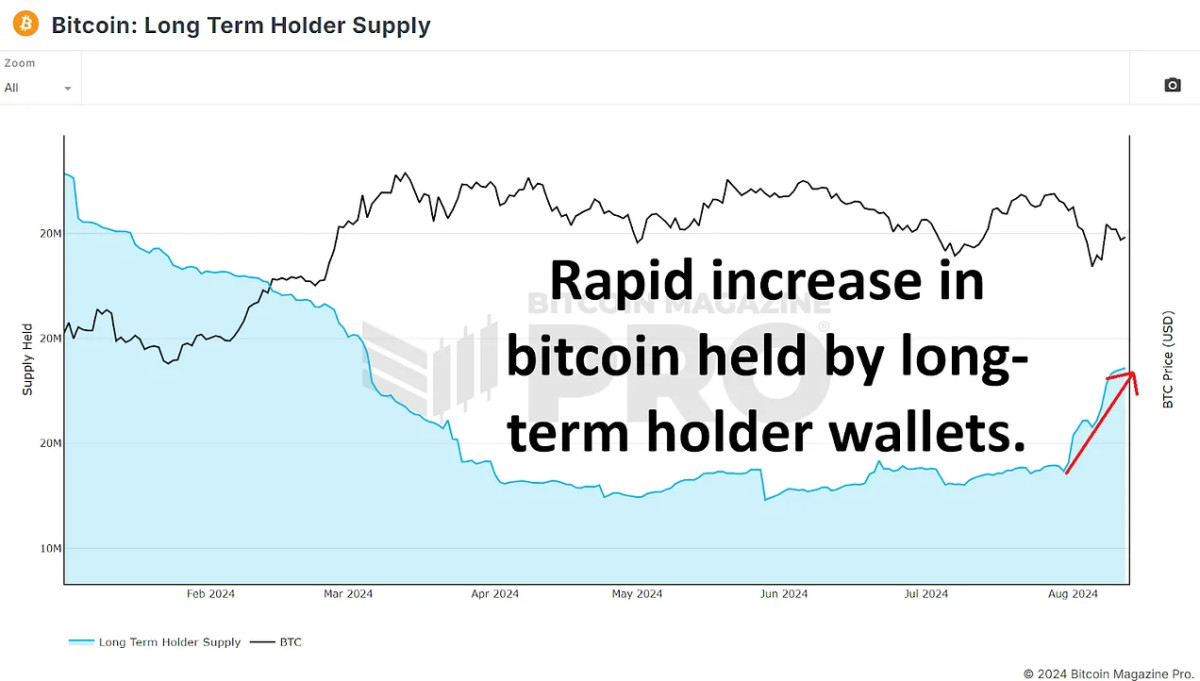

Upon archetypal observation, semipermanent Bitcoin holders are seemingly expanding their holdings. According to the Long Term Holder Supply, since July 30th, the magnitude of BTC held by semipermanent holders has accrued from 14.86 cardinal to 15.36 cardinal BTC. This surge of astir 500,000 BTC has led immoderate to judge that semipermanent holders are aggressively buying the dip, perchance mounting the signifier for the adjacent important terms rally.

Figure 1: Long Term Holder Supply of BTC accrued by 500,000 arsenic the bitcoin terms dipped and rebounded. Access Live Chart 🔍

Figure 1: Long Term Holder Supply of BTC accrued by 500,000 arsenic the bitcoin terms dipped and rebounded. Access Live Chart 🔍However, this mentation mightiness beryllium misleading. Long-term holders are defined arsenic wallets that person held BTC for 155 days oregon more. This week we’ve conscionable surpassed 155 days since our astir caller all-time high. Therefore, it is apt that galore short-term holders from that play person simply transitioned into the semipermanent class without immoderate caller accumulation occurring. These investors are present holding onto their BTC, hoping for higher prices. So successful isolation, this illustration does not needfully bespeak caller buying enactment from established marketplace participants.

Coin Days Destroyed: A Contradictory Indicator

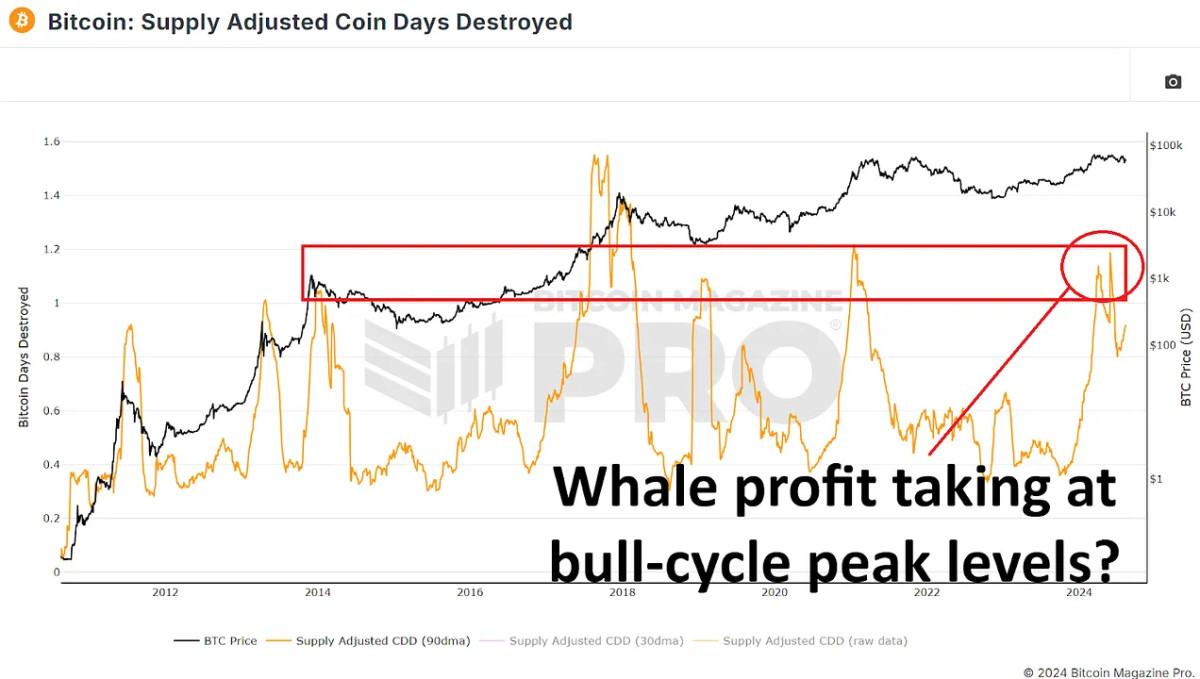

To further research the behaviour of semipermanent holders, we tin analyse the Supply Adjusted Coin Days Destroyed metric implicit the caller 155-day period. This metric measures the velocity of coin movement, giving much value to coins that person been held for extended periods. A spike successful this metric could bespeak that semipermanent holders possessing a important magnitude of bitcoin are moving their coins, apt indicating much selling arsenic opposed to accumulating.

Figure 2: Supply Adjusted CDD (90dma) astatine levels typically reached astatine bull-cycle peaks. Access Live Chart 🔍

Figure 2: Supply Adjusted CDD (90dma) astatine levels typically reached astatine bull-cycle peaks. Access Live Chart 🔍Recently, we person seen a important summation successful this data, suggesting that semipermanent holders mightiness beryllium distributing alternatively than accumulating BTC. However, this spike is chiefly skewed by a azygous monolithic transaction of astir 140,000 BTC from a known Mt. Gox wallet connected May 28, 2024. When we exclude this outlier, the information appears overmuch much emblematic for this signifier successful the marketplace cycle, comparable to periods successful precocious 2016 and aboriginal 2017 oregon mid-2019 to aboriginal 2020.

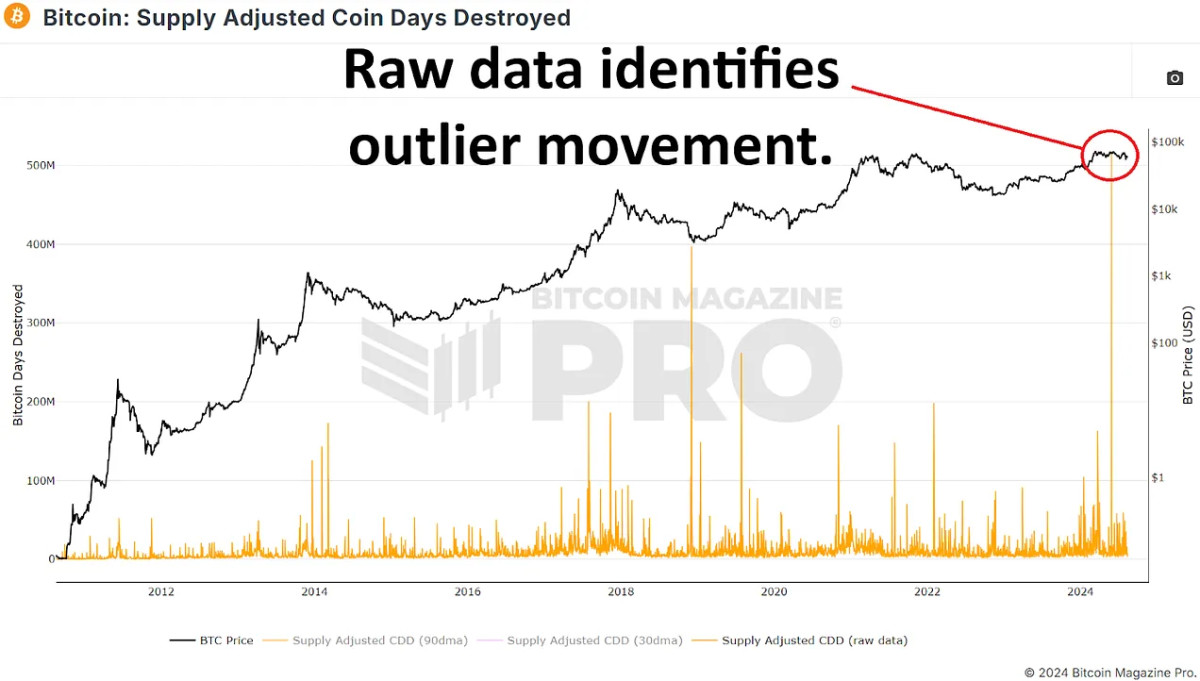

Figure 3: Mt. Gox repayment wallet question has skewed CDD data. Current nett taking is astatine emblematic levels. Access Live Chart 🔍

Figure 3: Mt. Gox repayment wallet question has skewed CDD data. Current nett taking is astatine emblematic levels. Access Live Chart 🔍The Behavior of Whale Wallets

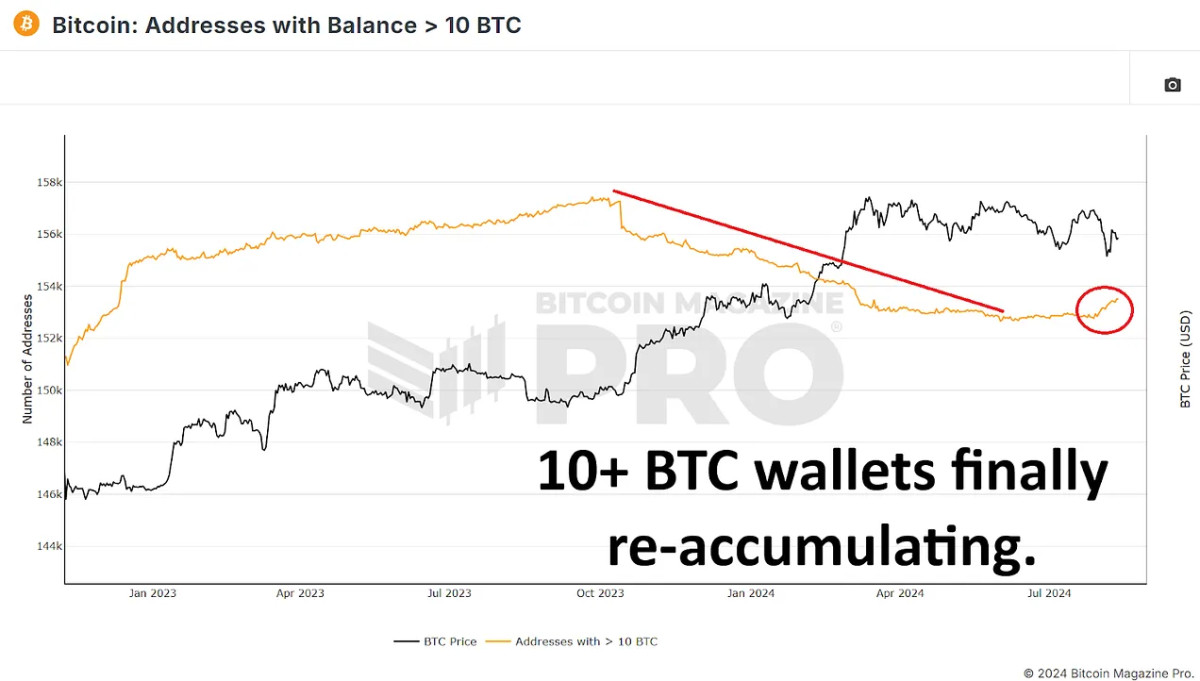

To find whether whales are buying oregon selling bitcoin, analyzing wallets holding important amounts of coins is crucial. By examining wallets with astatine slightest 10 BTC (minimum of ~$600,000 astatine existent prices), we tin gauge the actions of important marketplace participants.

Since Bitcoin's highest earlier this year, the fig of wallets holding astatine slightest 10 BTC has somewhat increased. Similarly, the fig of wallets holding 100 BTC oregon more has besides seen a humble rise. Considering the minimum threshold to beryllium included successful these charts, the magnitude of bitcoin accumulated by wallets holding betwixt 10 and 999 BTC could relationship for tens of thousands of coins bought since our astir caller all-time high.

Figure 4: 10+ BTC wallets person seen a emergence successful the past fewer weeks aft a important alteration connected our run-up to a caller ATH. Access Live Chart 🔍

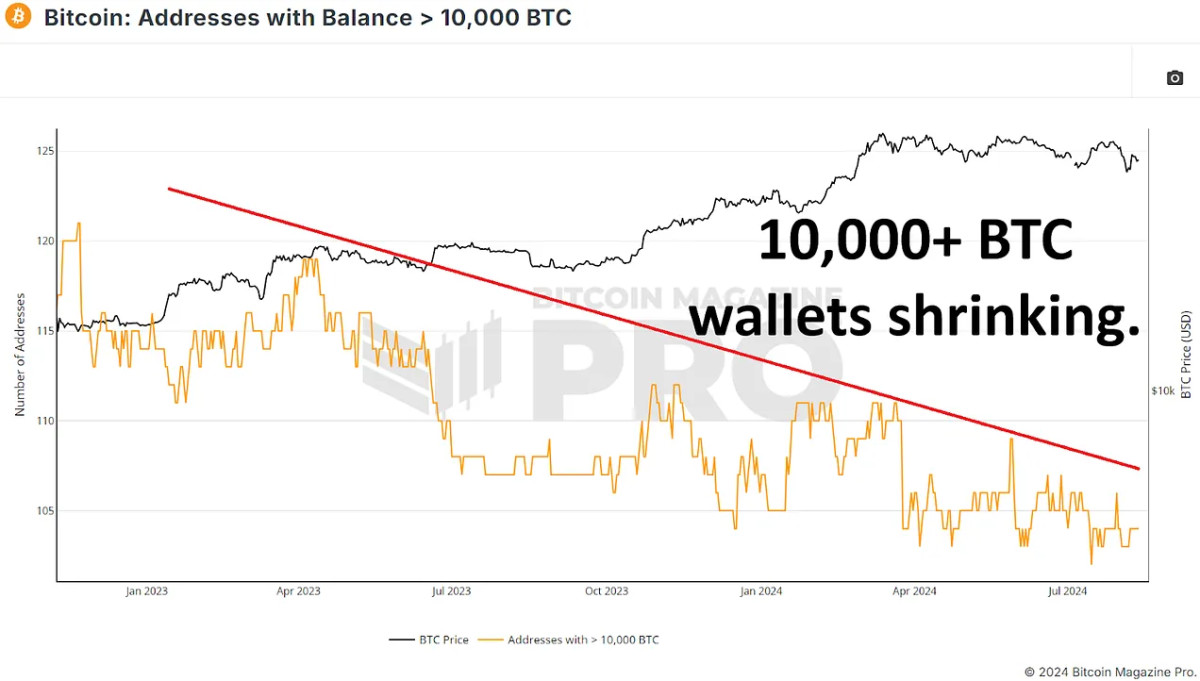

Figure 4: 10+ BTC wallets person seen a emergence successful the past fewer weeks aft a important alteration connected our run-up to a caller ATH. Access Live Chart 🔍However, the inclination reverses erstwhile we look astatine larger wallets holding 1,000 BTC oregon more. The fig of these ample wallets has decreased slightly, indicating that immoderate large holders mightiness beryllium distributing their BTC. The astir notable alteration is successful wallets holding 10,000 BTC oregon more, which person decreased from 109 to 104 successful the past months. This suggests that immoderate of the largest bitcoin holders are apt taking immoderate nett oregon redistributing their holdings crossed smaller wallets. However, considering astir of these highly ample wallets volition typically beryllium exchanges oregon different centralized wallets it’s much apt these are a postulation of trader and capitalist coins arsenic opposed to immoderate 1 idiosyncratic oregon group.

Figure 5: 10,000+ BTC wallets person steadily declined since the carnivore rhythm lows and person not seen sustained buying since. Access Live Chart 🔍

Figure 5: 10,000+ BTC wallets person steadily declined since the carnivore rhythm lows and person not seen sustained buying since. Access Live Chart 🔍The Role of ETFs and Institutional Inflows

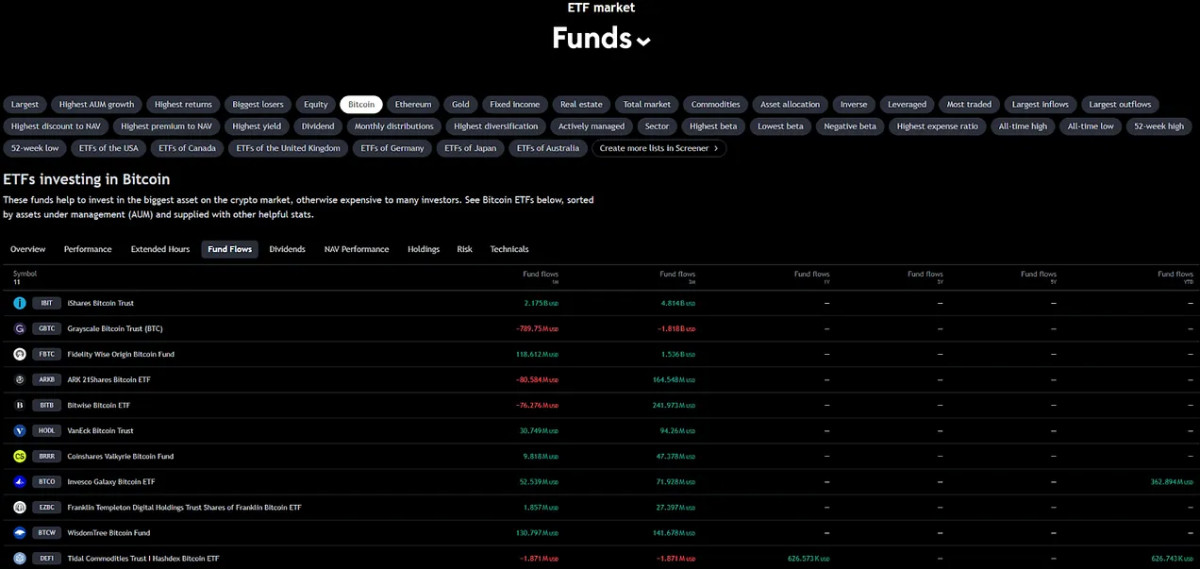

Since reaching a highest of $60.8 cardinal successful assets nether absorption (AUM) connected March 14th, the BTC ETFs person seen an AUM alteration of astir $6 billion, nevertheless erstwhile taking into relationship the terms alteration of bitcoin since our all-time high, this astir equates to an summation of astir 85,000 BTC. While this is positive, the summation has lone negated the magnitude of recently mined Bitcoin during the aforesaid period, besides 85,000 BTC. ETFs person helped trim selling unit from miners and perchance from ample holders but haven't importantly accumulated capable to interaction the terms positively.

Figure 6: BTC ETF’s person lone accrued their bitcoin holdings capable to negate recently minted bitcoin since our all-time high.

Figure 6: BTC ETF’s person lone accrued their bitcoin holdings capable to negate recently minted bitcoin since our all-time high.Retail Interest connected the Rise

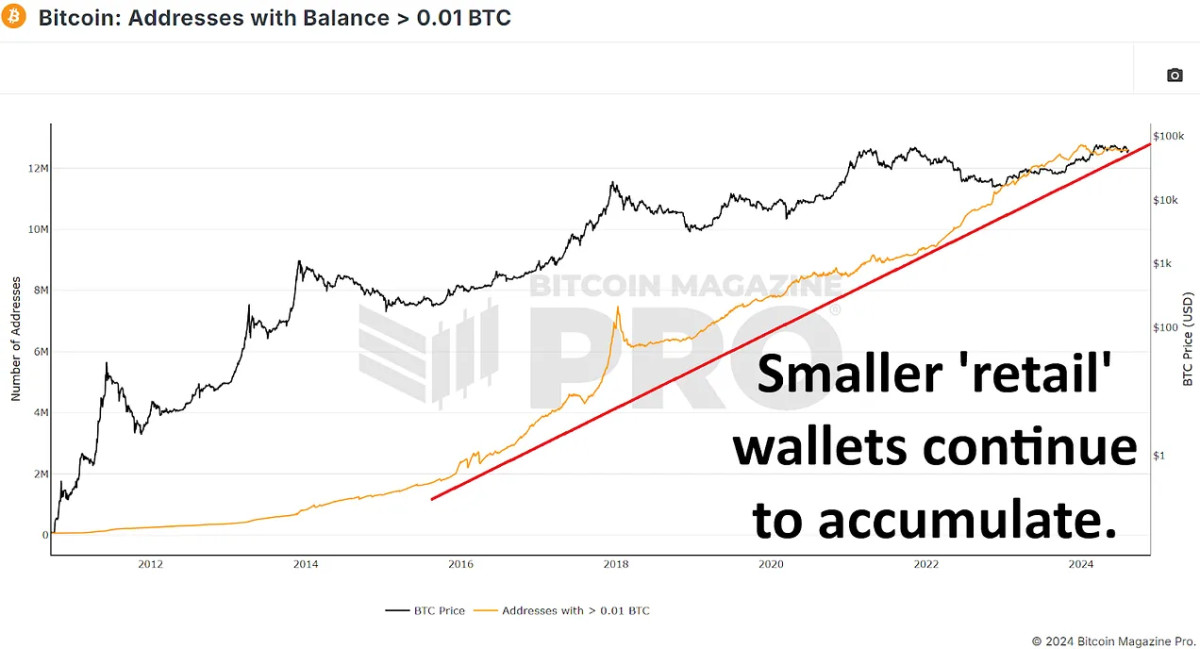

Interestingly, portion large holders look to beryllium selling BTC, determination has been a important summation successful smaller wallets – those holding betwixt 0.01 and 10 BTC. These smaller wallets person added tens of thousands of BTC, showing accrued involvement from retail investors. There’s been a nett alteration of astir 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This whitethorn look alarming, but considering we typically spot millions of bitcoin power from ample and semipermanent holders to caller marketplace participants passim an full bull cycle, this is not presently immoderate origin for concern.

Figure 7: Wallets betwixt 0.01 BTC and 10 BTC person accumulated each larger wallet selling, astir 60,000 BTC. Access Live Chart 🔍

Figure 7: Wallets betwixt 0.01 BTC and 10 BTC person accumulated each larger wallet selling, astir 60,000 BTC. Access Live Chart 🔍Conclusion

The communicative that whales person been accumulating bitcoin connected dips and passim this play of chopsolidation does not look to beryllium the case. While semipermanent holder proviso metrics initially look bullish, they mostly bespeak the modulation of short-term holders into the semipermanent class alternatively than caller accumulation.

The summation successful retail holdings and the stabilizing power of ETFs could supply a beardown instauration for aboriginal terms appreciation, particularly if we spot renewed organization involvement and continued retail inflows station halving, but is presently contributing small to immoderate Bitcoin terms appreciation.

The existent question is whether the existent organisation signifier seizes and sets the signifier for a caller circular of accumulation, which could propel Bitcoin to caller highs successful the coming months, oregon if this travel of aged coins to newer participants continues and apt suppresses the imaginable upside for the remainder of our bull cycle.

🎥 For a much in-depth look into this topic, cheque retired our caller YouTube video here: Are Bitcoin Whales Still Buying?

And don’t hide to cheque retired our different astir caller YouTube video here, discussing however we tin perchance amended 1 of the champion bitcoin metrics:

1 year ago

186

1 year ago

186

English (US) ·

English (US) ·